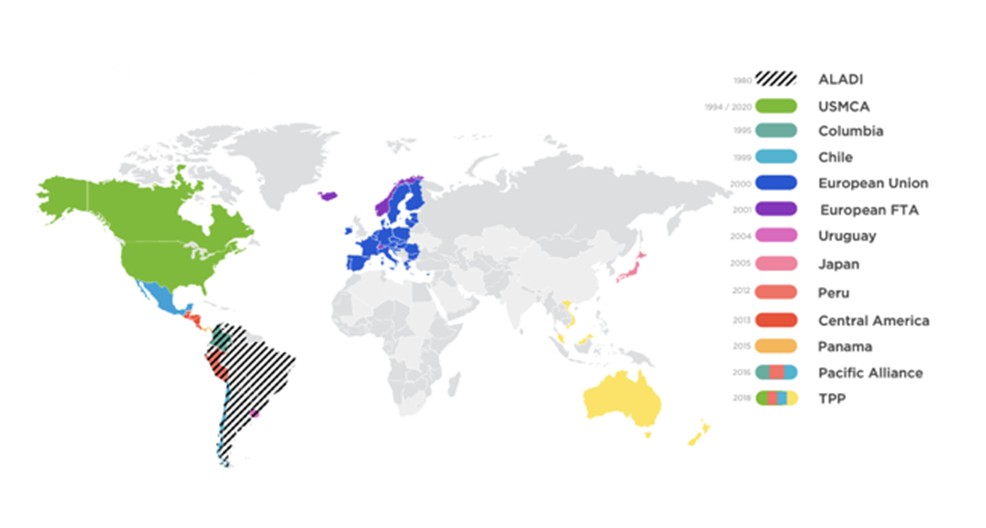

50+ Trade Agreements

Mexico, a member of the WTO, has 13 free trade agreements covering 50 countries, including the USMCA (USA-Mexico-Canada, formerly NAFTA), EFTA (Europe), or the CPTPP. And thanks to its strategic location, especially its proximity to the United States, has fueled economic growth, notably in manufacturing, food production, and professional services. Bordering both the Atlantic and Pacific Oceans, Mexico serves as a vital hub for global trade, enabling seamless distribution throughout the Americas. This favorable geographic position has drawn substantial investment and deepened supply chain integration with the United States.

The mentioned agreements as well as Mexico’s advantages as a long-experienced manufacturing hub are key to attracting foreign direct investment (FDI), as they provide foreign investors with preferential market access, tariff advantages, and alignment with international, predictable regulations. As a result, Mexico is attracting significant manufacturing investment, making it one of the most competitive and open markets globally.

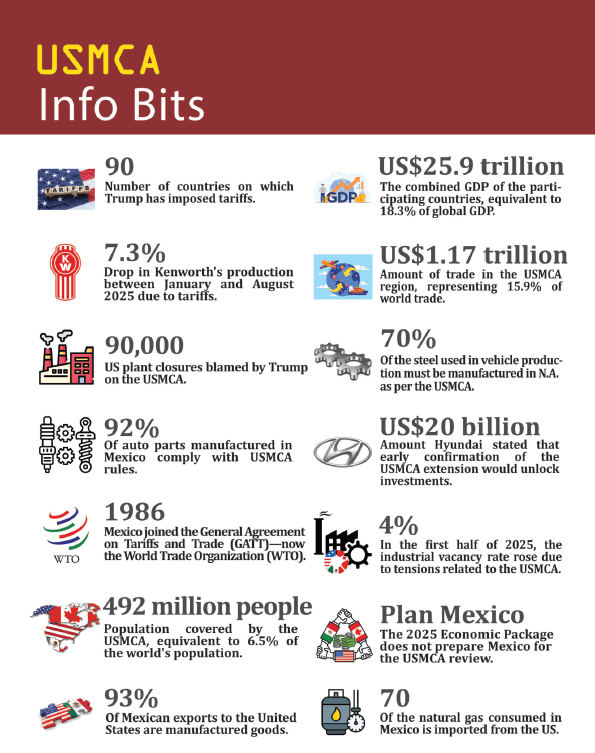

Some Hard Facts

- Over 50 trade agreements

- No other country has more trade agreements

- USMCA Agreement is key for Nearshoring

- Asian companies take advantage of USMCA agreement

- International Standards must be followed with the USMCA agreement

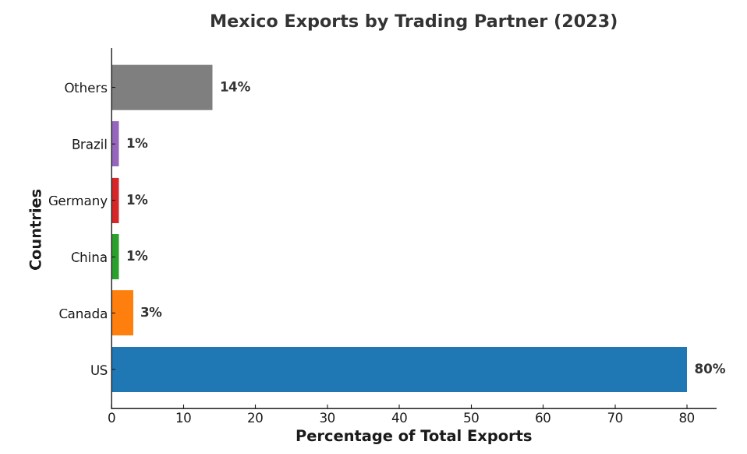

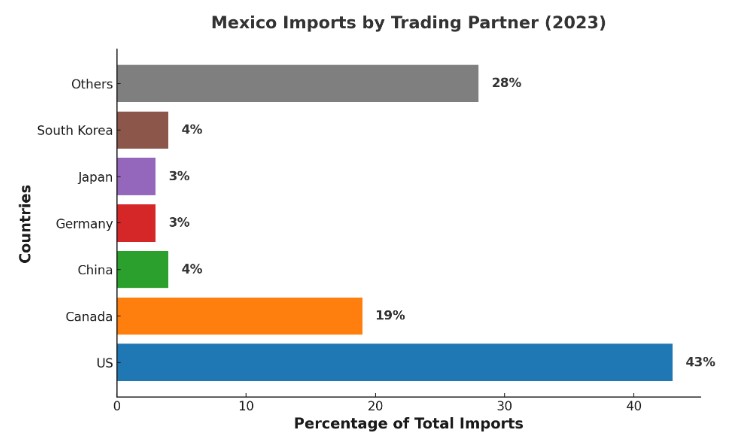

Main Trading Partners of Mexico

In 2023, Mexico's total exports amounted to $593 billion USD, while total imports reached $621 billion USD, resulting in a trade deficit. The US was the dominant partner in both areas, accounting for 80% of Mexico's exports ($474 billion USD) and 43% of Mexico's imports ($267 billion USD). Other key partners included Canada, China, Germany, and Brazil, each contributing smaller shares to both exports and imports. Despite the deficit, Mexico's exports are expected to continue growing, fueled by rising demand from both the US and other global markets.

However, Mexico's heavy reliance on the US for both exports and imports underscores the country's vulnerability to changes in US economic conditions and trade policies. This dependency represents a significant aspect of Mexico's trade dynamics, where the imbalance between exports and imports is likely to persist unless diversification efforts are further strengthened.

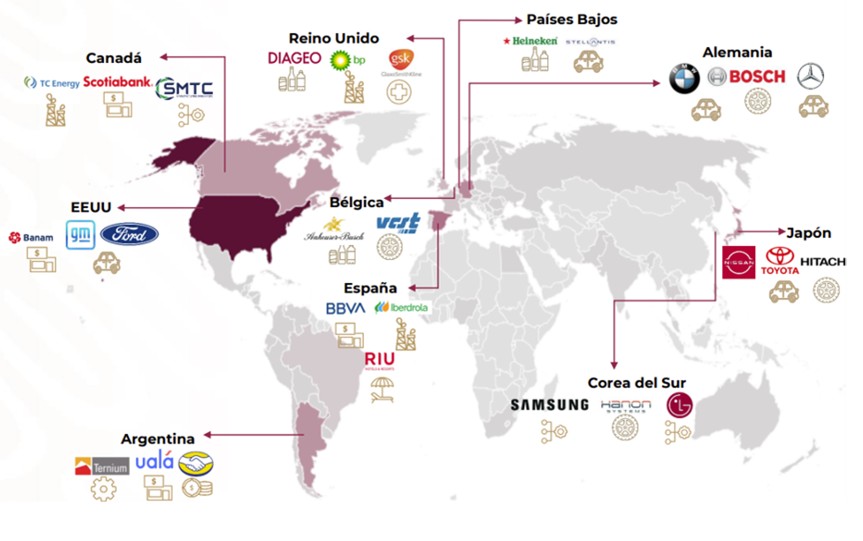

Foreign Direct Investments 2023

Thanks to the attractive Trade Agreements, the FDI in Mexico reached in 2023 a record high of $36 billion USD, with the manufacturing sector receiving 42% of the total investment. 87% of Mexico's total foreign direct investment (FDI) came from just 10 countries. The United States remained the top investor, contributing 38% of total FDI, or $13.64 billion, although its investment declined by 9% compared to 2022.

Prominent U.S. investors included Citigroup, General Motors, and Ford. Spain ranked second with $3.77 billion (10% of the total), driven by companies like Iberdrola and BBVA, followed closely by Canada with $3.47 billion (10%) from firms such as TC Energy and Scotiabank.

Prominent U.S. investors included Citigroup, General Motors, and Ford. Spain ranked second with $3.77 billion (10% of the total), driven by companies like Iberdrola and BBVA, followed closely by Canada with $3.47 billion (10%) from firms such as TC Energy and Scotiabank.

Other key investors included Japan ($2.9 billion), Germany ($2.4 billion), Argentina ($2.2 billion), the United Kingdom ($936 million), the Netherlands ($892 million), Belgium ($759 million), and South Korea ($497 million).

Which sectors and states did the money go to?

In 2023, over 50% of Mexico's total foreign direct investment (FDI), amounting to $18.08 billion, was directed towards the manufacturing sector. The transport equipment industry, including automakers, received the largest share, accounting for 41% of manufacturing investment, while the remaining funds were spread across other sectors such as beverages and tobacco, metals, computer equipment, and chemicals.

The other half of FDI went to industries like financial services, mining, and temporary accommodation. Geographically, 31% of FDI was concentrated in Mexico City, followed by Sonora (8%), Nuevo León (7%), Jalisco (6%), and Chihuahua (5%).

Just looking at the manufacturing sector, it received 42% of the total investments. The automotive sector, including major companies like General Motors, Volkswagen, and Nissan, was the largest beneficiary, with investments in states such as Chihuahua, Nuevo León, Coahuila, as well as the Bajío region, including Guanajuato, San Luis Potosí, and Aguascalientes.

Just looking at the manufacturing sector, it received 42% of the total investments. The automotive sector, including major companies like General Motors, Volkswagen, and Nissan, was the largest beneficiary, with investments in states such as Chihuahua, Nuevo León, Coahuila, as well as the Bajío region, including Guanajuato, San Luis Potosí, and Aguascalientes.

Despite heavy federal investments in the southern and southeastern states, none of these regions ranked among the top 10 FDI recipients. However, the development of the Interoceanic Corridor of the Isthmus of Tehuantepec, including 10 new industrial parks, could help boost FDI in Oaxaca and Veracruz in the future.

Foreign Direct Investments 2024

The Ministry of Economy (SE) reported that Mexico attracted $31.1 billion USD in foreign direct investment (FDI) during the first half of 2024, marking a 7% increase compared to the same period last year. A significant portion of FDI in Mexico, 97% in the first half of 2024, was driven by reinvested earnings. This highlights the country’s growth potential, supported by government initiatives, a skilled workforce, and its strategic position as an investment destination and underscores strong investor confidence, despite global uncertainties, including election cycles in both Mexico and the US.

USMCA Agreement

The United States, Mexico and Canada build together theUSMCA-Agreement (which replaced NAFTA), making North America one of the world’s largest free trade zones. The USMCA agreement ensures an import-export of goods and services without difficulties. This strong trade ties with both the United States and Canada helps to mitigate some of the risks associated with doing business in the Mexico (security & corruption).

How has USMCA benefited Mexico?

As Mexico's largest trading partner, the US has leveraged efficient trade routes, leading to a steady increase in freight value over the years. USMCA plays an essential role in transforming Mexico's economy and positioning it as an important player in North America's economic and political landscape and boosts manufacturing investments by enabling free trade across North America. Indeed, this agreement is the key to the success why Mexico has experienced a Nearshoring boom over the last three years as well as it will keep a significant role for the future.

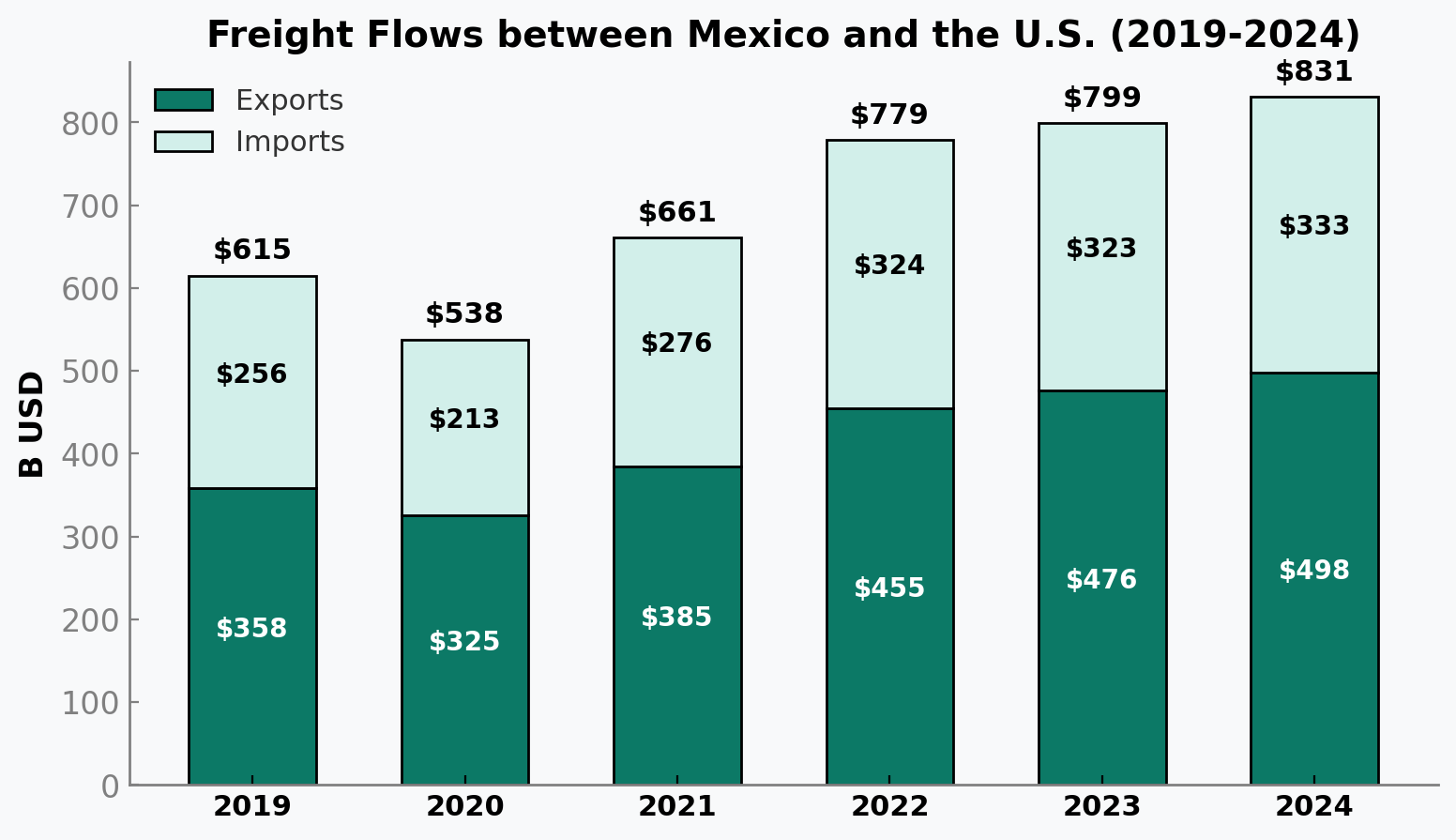

Freight flows between Mexico and United States

The freight flows between Mexico and the United States have shown consistent growth from 2019 to 2024. Exports increased steadily from $358 billion in 2019 to $498 billion in 2024, highlighting Mexico's expanding role in trade. Similarly, imports grew from $256 billion in 2019 to $333 billion in 2024, reflecting the strengthening bilateral relationship.

The total trade value rose from $615 billion in 2019 to $831 billion in 2024, marking a 35% growth over five years. This upward trend underscores the importance of trade between the two nations and their deepening economic integration.

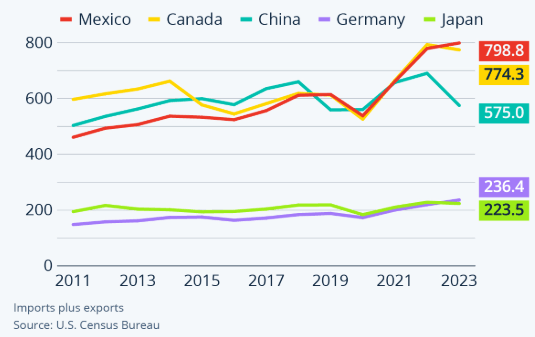

Largest Trading Partner of USA

In 2023, Mexico surpassed China as the largest exporter to the United States, a shift driven by several key factors. While both countries saw growth in exports to the US, Mexico’s more predictable regulations, strong international relations, political stability, and proximity to the US made it a more reliable partner. Additionally, lower labor costs, favorable trade agreements, and a large, integrated manufacturing base further contributed to this shift.

As seen in the graph, the last five years marked a significant change in U.S. imports, with Mexico and Canada surpassing China as leading sources. China's share of U.S. imports fell to 13.35%, while Mexico and Canada accounted for 16% and 15%, respectively. In 2023, Mexico exported nearly $799 billion USD, followed by Canada at $774 billion and China at $575 billion USD. Mexico also serves as the second-largest agricultural export market for the US, importing $19.5 billion worth of US agricultural products in 2018.

This development, fueled by the Trump Administration’s tariffs on Chinese imports and the COVID-19 pandemic, highlighted the risks of relying on a single source for raw materials and finished products. This shift has not only strengthened Mexico’s economic stability but also reinforced its political and economic ties with the US.

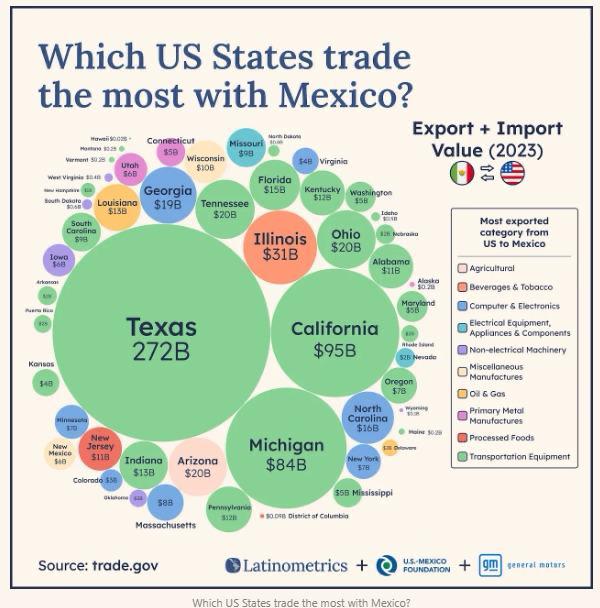

Manufacturing Export Sectors to the United States

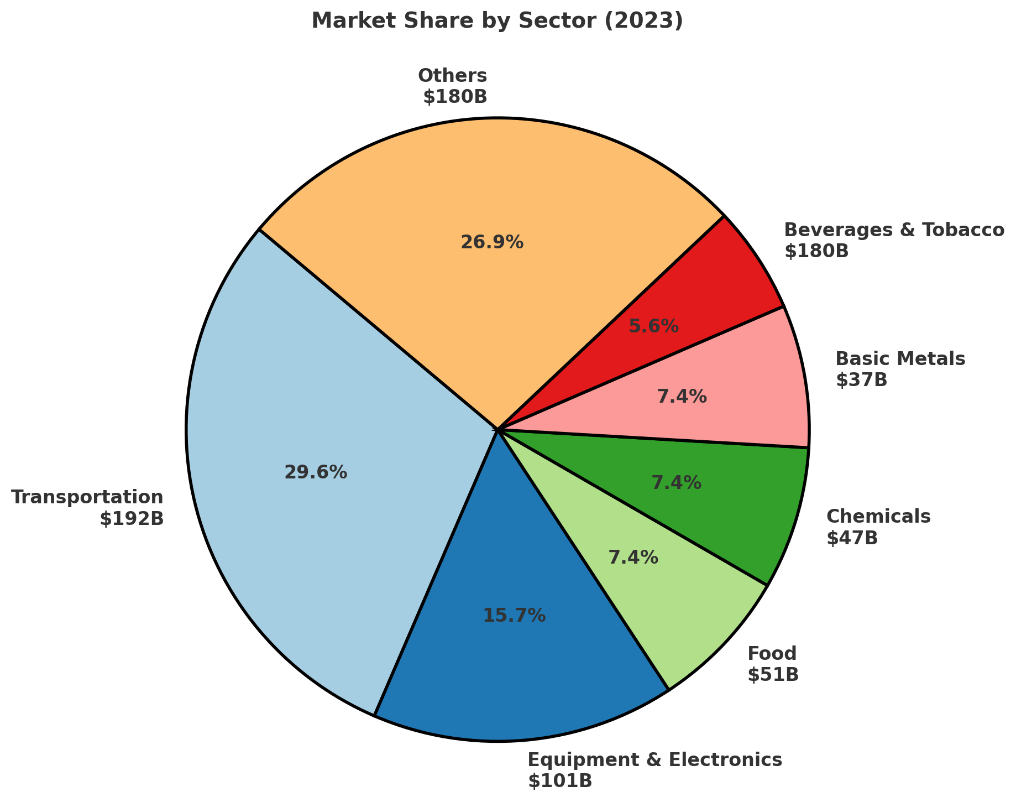

In 2023, the transportation sector led with a significant revenue of $192 billion, accounting for 32% of the total market share. The food sector followed with $101 billion, representing 17%. Other notable sectors included chemicals ($51 billion), basic metals ($47 billion), and beverages & tobacco ($37 billion), each contributing around 6-8% of the total market share. Across the board, the sectors showed steady growth, with transportation, food, and basic metals leading the way in terms of compound annual growth rates (CAGR).

E.U. Trade Agreements

No other countries than Mexico has signed more free trade agreements and it was the first country in Latin America to sign a partnership agreement with the European Union (1997). At least 47 in North, Latin America, Europe and Asia allows free flow of goods and services and is therefore very attractive to start your production, your service or distribution center. They have removed several non-tariff barriers and reduced import duties on exports.

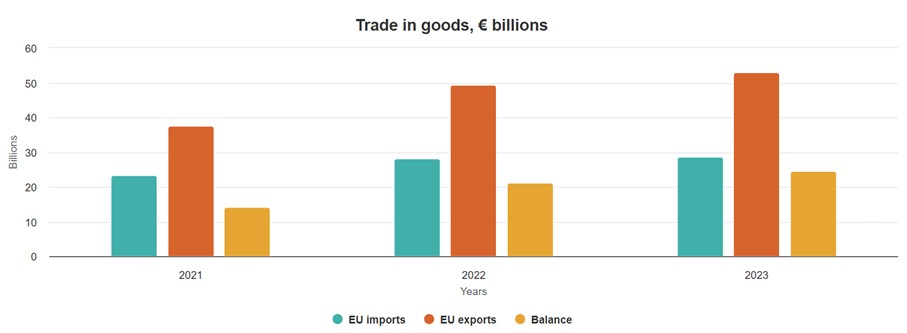

In 2023, trade between Mexico and the European Union remained robust, with bilateral trade in goods reaching €82 billion. The EU exported goods worth €53.1 billion to Mexico, while importing €28.6 billion from Mexico, resulting in a trade surplus of €24.6 billion for the EU. Key EU exports included machinery, appliances, transport equipment, and chemical products, whereas major imports from Mexico comprised machinery, transport equipment, mineral products, and optical instruments.

The EU's key imports from Mexico are machinery and appliances, transport equipment, optical/photographic instruments, and mineral products. As a foreign direct investment, the EU is the second largest investor in Mexico after the US.

These figures underscore the strong economic ties between Mexico and the EU, highlighting the importance of their trade relationship in fostering mutual growth and prosperity.

Exports to the European Union have grown by nearly 30% over the past decade, reflecting strong confidence in Mexico’s leading manufacturing industry. Despite a drop during the pandemic, exports rebounded by 17% from 2020 to 2021, rising from $23 billion to $27 billion, and reached nearly $30 billion in 2022, driven by the nearshoring trend. Forecasts predict further growth to $32–35 billion in the coming years. Key exports include vehicles, electronics, minerals, fuels, machinery, and medical apparatus.

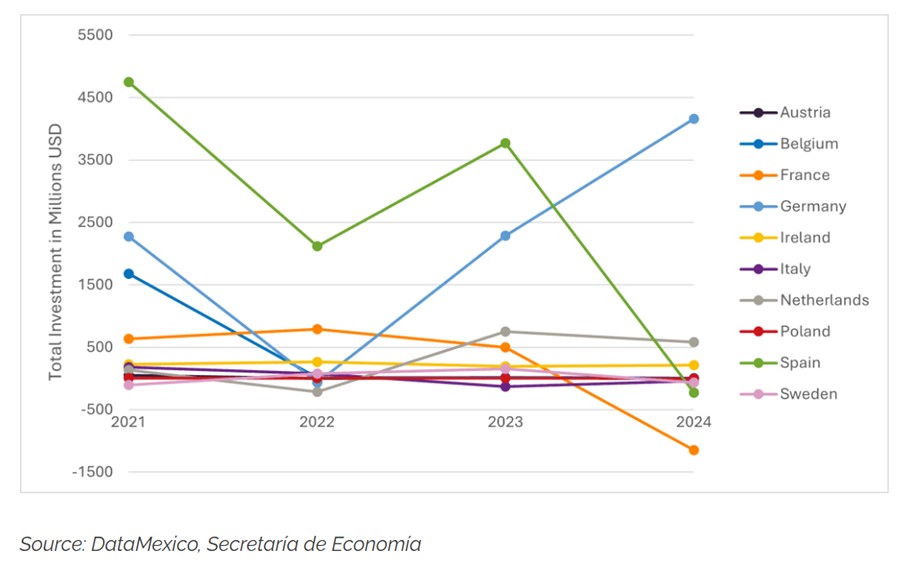

Germany as Top Investor in 2024

Germany has overtaken Spain as Mexico’s top European investor, driven by automotive and manufacturing expansion. However, FDI from other key European players like France, Italy, and Spain showed negative trends in early 2024, raising concerns about long-term investment stability.

Tarriffs threat by Trump

In 2016, during Trump’s legislation, the three countries announced that they had come to terms on a newtrade agreementthat preserved much of NAFTA but introduced a number of significant changes, which was branded theUnited States-Mexico Canada Agreement(USMCA).Some of the most significant terms of the new agreement related to automobile manufacturers. Despite of that, there was a continuosly investment due to the Pandemic, Panama Scandal, or the Ukraine War.

Can the USMCA be cancelled?

Trump’s potential 25% tariff on Mexico has sparked concerns, but there are strong reasons to believe these threats may not materialize. Below are the key points outlining why this move could be more of a political bluff than an economic reality:

- Contradicts USMCA: Imposing tariffs would undermine the trade agreement Trump negotiated, which is crucial for economic stability in North America.

- Renegotiation Likely: Adjusting the USMCA before its 2026 review is a more practical approach than disrupting trade with tariffs.

- Economic Interdependence: The U.S. and Mexico rely heavily on each other for raw materials, finished goods, and integrated supply chains.

- Harm to U.S. Companies: Major American investors in Mexico, such as GM and John Deere, would be negatively impacted, harming the U.S. economy.

- Supply Chain Disruption: Tariffs would increase costs for U.S. consumers and slow economic growth by creating supply chain chaos.

- Focus on China: Trump’s trade priorities historically target China, making tariffs on Mexico less likely.

- Political Strategy: The tariff threats appear aimed at appealing to extremist voters rather than serving sound economic logic.

- Nearshoring Trend: The growing shift of production to Mexico due to nearshoring makes maintaining strong trade ties more beneficial.

- Industry Warnings: Economists and industries, especially autos, caution that tariffs would hurt U.S. businesses more than they would benefit.

Other Facts about USMCA

To sum up, thanks to the USMCA agreement, Mexico has a stronger investment framework and more transparency, clarity and protections for businesses operating in the country. The agreement’s biggest shift will take place at the macroeconomic level, as the USMCA solidifies trade rules and provides greater certainty for North American businesses operating across the continent. The agreement not only provides planning certainty and stability for Asian and American companies, but also for European countries which want to enter new markets and produce in Central America.

Asians take advantage of the USMCA

Due to the shipping chaos and geopolitical fractures caused by the pandemic and the supply chain crisis, many Asian companies do not want to lose one of the main market United States. In addition, when Trump became president and forced to put tariffs on hundreds of billions of dollars in Chinese imports, they realized that they cannot be dependent on their own manufacturing but also need to diverse their portfolio.

Thus Asian companies establishing factories that allow them to label their goods such as electronic, apparel, clothing or furniture “Made in Mexico,” then trucking their products into the United States duty-free. Indeed, more than 400 North American companies have the intention to carry out a relocation process from Asia to Mexico – and over 400 Asian companies announced the do the same.

USMCA enforces Labor Rights

The transformation of labor conditions in Mexico will be a crucial aspect due to the requirements of the United States-Mexico-Canada Agreement (USMCA), which mandates the enforcement of domestic labor laws along with adherence to international standards. Mexico took significant steps towards achieving these changes by enacting labor reforms on May 1, 2019, which granted workers enhanced rights and increased the power of labor unions to organize. While these reforms hold the potential for long-term success in Mexico's labor movements, successful implementation will be pivotal.

Mexican companies will need to make adjustments to their internal structures to comply with the new labor provisions and establish effective relationships with labor unions. These changes are expected to empower Mexican labor unions with greater negotiating power; however, they may also lead to increased friction and labor disputes as the dynamics between employers and unions evolve.

Despite the changes and uncertainty of NAFTA being re-negotiated as the new United States-Mexico-Canada Agreement, the major manufacturing industries in Mexico are expected to see continual growth. Respective governments have streamlined certain regulations which allow businesses to establish operations in Mexico with little difficulty.

Pros and Cons of the USMCA Agreement

While NAFTA brought numerous benefits to Mexico, it also had some disadvantages and negative consequences for the country. After reaching a deal on the final version of the new United States-Mexico-Canada Agreement (USMCA), President Donald Trump tweeted that it “will be the best and most important trade deal ever made by the USA”.

There are various other Cons of the USMCA agreement such as what happens if the United States should cancel the agreement or what negative environmental impacts has the increased industrial activity in some regions, leading to pollution and deforestation, raising concerns about sustainable development.