Location & Infrastructure

Mexico's strategic position as a central hub linking the South and North Pacific regions, along with its proximity to the U.S. and Panama borders, enhances its appeal and drives the rapid expansion of its transportation industry. This growth is fueled by rising manufacturing activity, expanding distribution operations, increasing trade with the U.S., and the growing impact of e-commerce.

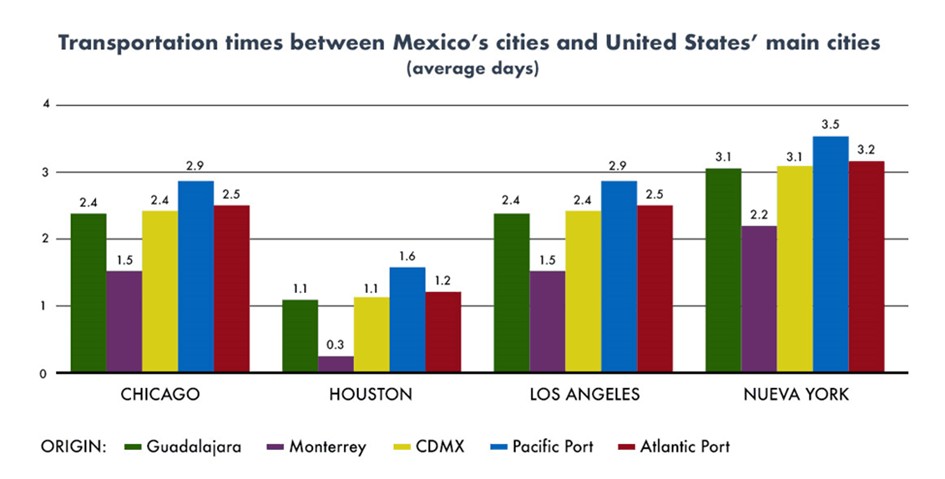

In addition, Mexico's efficient transportation infrastructure, including modern highway systems and railways, allows for significantly shorter shipment times compared to those from China or the United States or European Union. This not only enhances logistical efficiency but also reduces supply chain risks.

Some Hard Facts

- 6,500,000 trucks passing the border Mexico – USA every year

- 220,000 km of Highways15 days shipment to Europe

- 17,000 km Railway

- 11,000 trains pass the border every year

- 117 Seaports

- 77 (international) airports

- 54 border crossings to the United States

- 14 Intermodal Terminals

Border Crossings Mexico - USA

Selecting the most suitable manufacturing facilities and locations poses significant challenges and represents a critical decision for foreign companies, particularly in light of the profound impact of the coronavirus pandemic on the manufacturing industry. To overcome those challenges, companies must innovate flexible supply chain solutions.

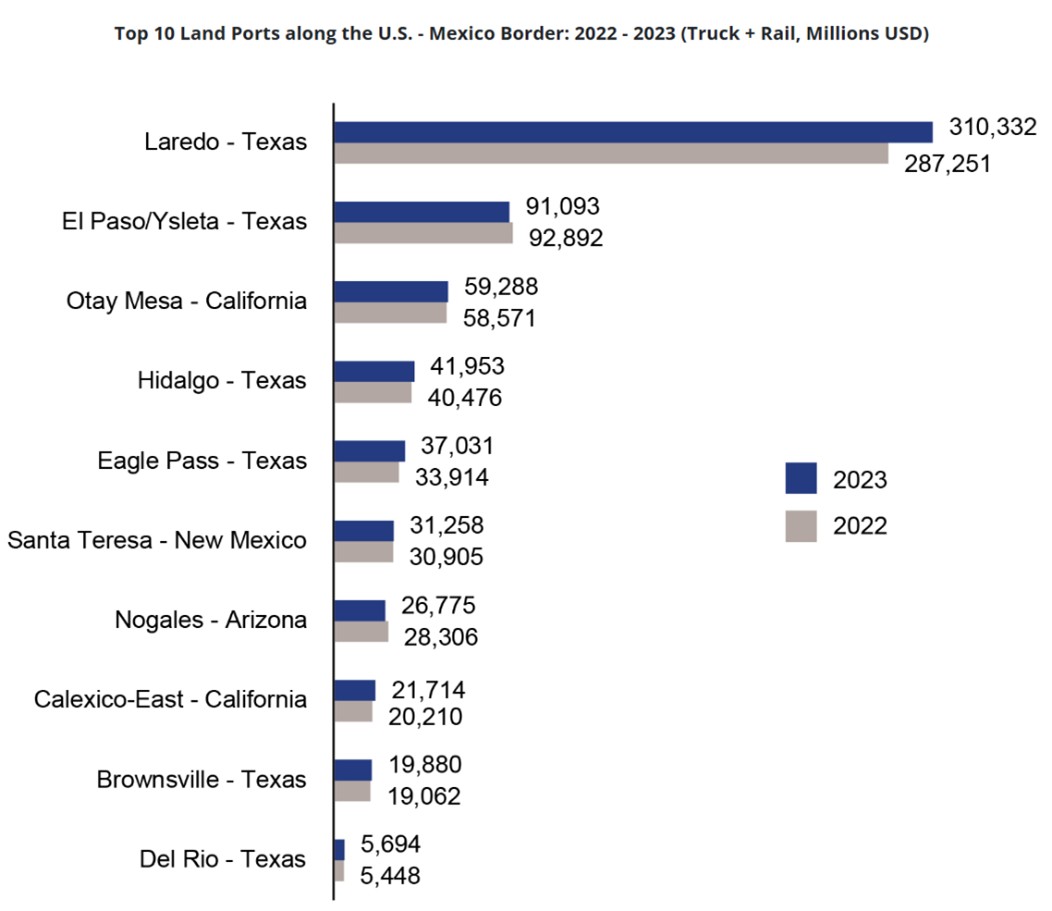

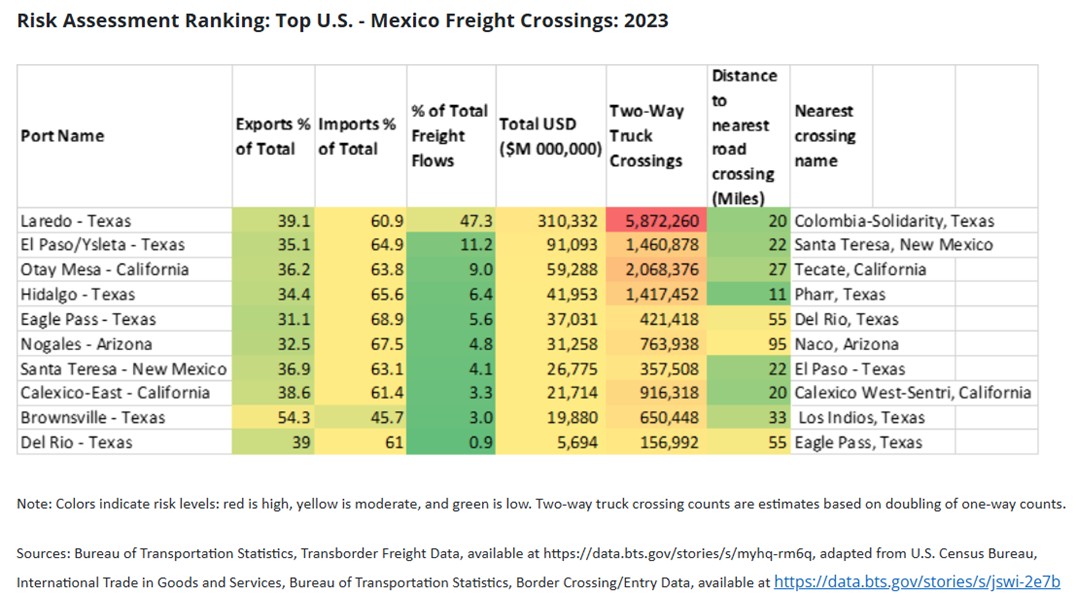

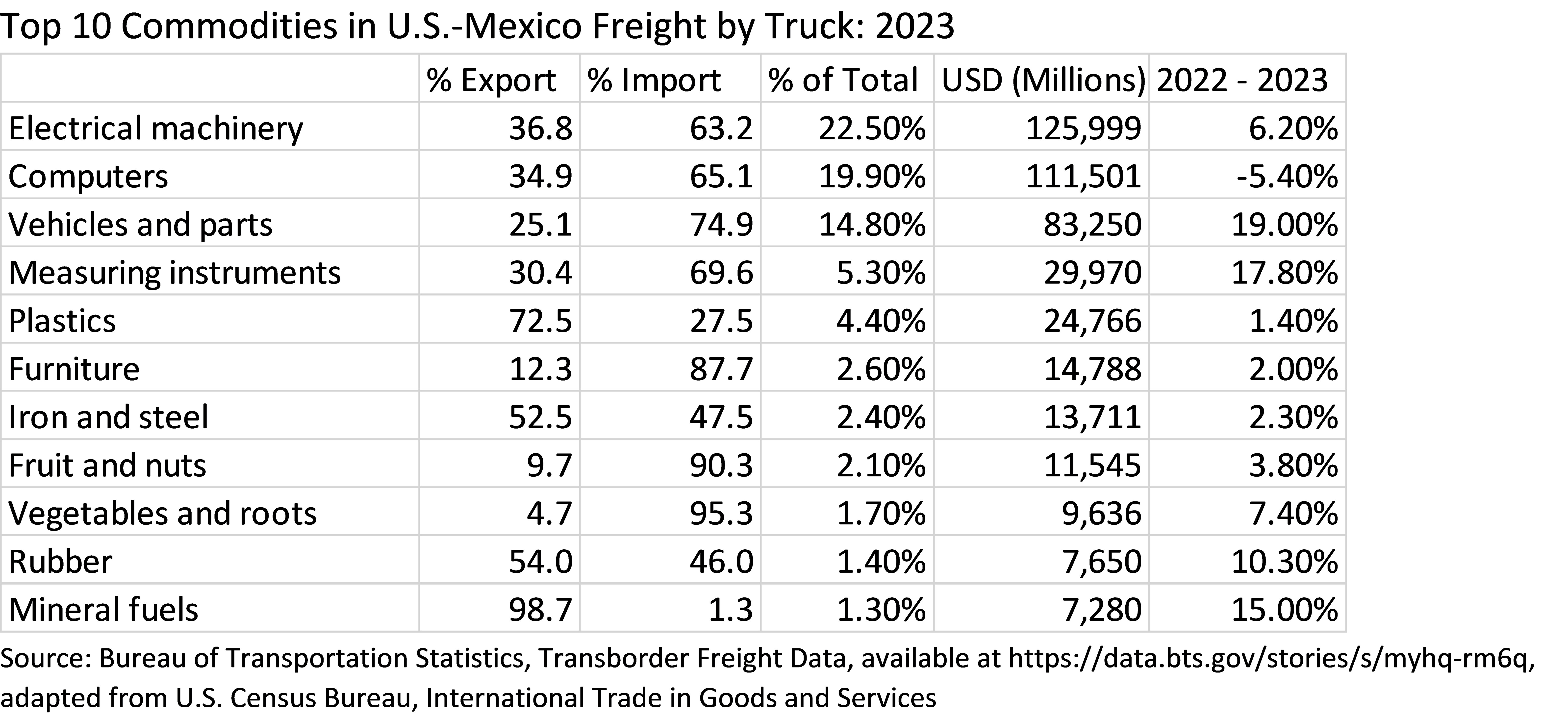

In 2023, U.S.-Mexico freight flows reached $798.8 billion, surpassing U.S.-Canada trade and highlighting Mexico’s growing role as the U.S.'s top trade partner. The Bureau of Transportation Statistics (BTS) expanded fits border freight analysis to assess vulnerabilities and ensure transportation resiliency, identifying key land ports where trade bottlenecks could occur. Trucking dominated U.S.-Mexico trade, accounting for 70.2% ($560.6 billion) of total freight, followed by rail at 11.9% ($95.4 billion).

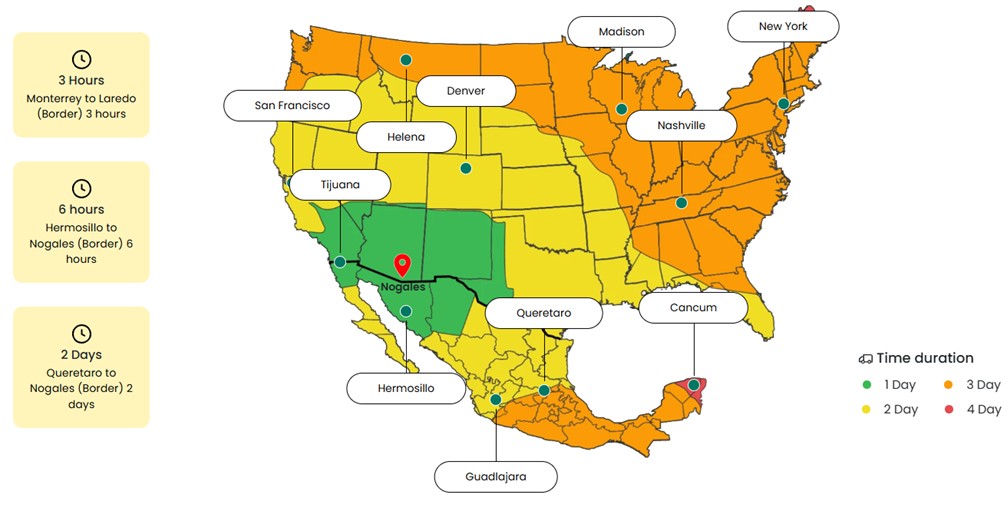

Distances Border Crossings

Due to the reason that Mexico is with its 1,972,550 km 2 five times bigger is than Germany, the different driving hours depend where are you located. Whereas it takes 3 hours from Monterrey to the border United States, it can take up to 9 hours from Mexico City respective 7 hours from Guadalajara.

Main Borders

Mexico and the United States are connected by 50 land border crossings and six rail connections, whereas four of them are the most frequent used for camions,

Mexico has a total of over 55 customs crossings, enabling seamless trade between Mexican manufacturing hubs and key U.S. economic regions. However, not all of them are suitable for trucks. The six most used border crossings between Mexico and the United States in the eastern part are Laredo (over 2 million trucks), in the north, El Paso (1 million trucks), Hidalgo and Nogales as well as Calexico and Otay, which belong to Tijuana. Remarkably, 70% of the trade value flows through just five of these crossings. Accordingly, these customs corridors have the largest and most efficient facilities. Every day, over 500,000 vehicles cross the border, and 40,000 of them are cargo trucks.

Laredo Texas USA / Nuevo Laredo, Tamaulipas Mexico

Laredo, stands out with an average of around3 million truck crossings in 2023and accounts for approximately40% of the truck volumeon the U.S. Border, significantly surpassing other land ports.

- Trade Value$310 Billion USD

- Exports to USA:60%

- Imports to Mexico:40%

El Paso/Ysleta Texas & Santa Teresa New Mexico / Ciudad Juarez, Chihuahua Mexico

Ciudad Juarez, StateChihuahua, facilitated approximately640,000 truckcrossings at the El Paso and and Santa Terea Border in 2023and accounts for approximately10% of the truck volumeon the U.S. Border. TheTrade Value of the two borders togetherwas around$122 Billion USD.

- Trade Value$122 Billion USD

- Exports to USA:64%

- Imports to Mexico:36%

Otay Mesa California USA / Tijuana, Baja California, Mexico

At the border from Tijuana to San Diego (Otay Mesa Cross-Border), there were around1 Mio. truckcrossings at the in 2023and accounts for approximately8% of the truckvolume on the U.S. Border.

- Trade Value$59 Billion USD

- Exports to USA:64%

- Imports to Mexico:36%

Eagle Pass, Texas USA / Piedras Negras, Coahuila Mexico

The border from Piedras Negras (Eagle Pass Cross-Border) accounts for approximately 6% of the truck volume on the U.S. Border.

- Trade Value$37 Billion USD

- Exports to USA:69%

- Imports to Mexico:31%

Hidalgo Texas USA / Reynosa, Tamaulipas Mexico

At the border from Reynosa (Hidalgo Cross-Border), there were around 700'000 trucks crossings at the in 2023 and accounts for approximately 10% of the truck volume on the U.S. Border.

- Trade Value$42 Billion USD

- Exports to USA:66%

- Imports to Mexico: 34%

Means of transport

Mexico has an extensive and well-developed transportation network, particularly along routes connecting the central region with coastal ports, the northern region, and the United States via highways and railways. Key border crossings such as Nogales, Eagle Pass, Laredo, and Tijuana facilitate this connectivity. In 2023, there was a cargo movement of more than 1 billion tons.

Transport by Truck

Trucks are essential for linking Mexico's manufacturing hubs to the United States, enabling just-in-time delivery and ensuring a seamless flow of goods, with the country's favorable geography providing direct, flexible, and cost-effective routes for both domestic and cross-border logistics.

Hence, it doesn’t surprise that road transport by truck is the dominant mode of cargo movement in Mexico, accounting for more than 55% of the total freight transported. This is largely due to Mexico's extensive and well-maintained road network, which spans the country and connects key industrial regions to ports, border crossings, and urban centers.

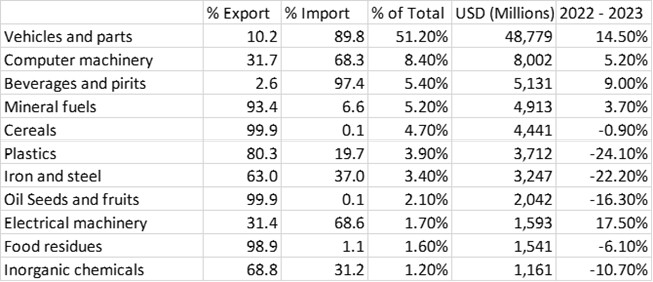

Transport by Train

Rail transport accounts for around 11% of the total cargo moved in Mexico and holds significant potential for growth. With Grupo México and CPKC controlling 75% of the country’s rail network, the infrastructure is well-positioned to support large-scale freight movement, particularly for heavy or bulk goods.

However, many companies continue to favor road transportation due to its greater efficiency, flexibility, and shorter transit times, as rail can sometimes involve delays and less direct routes. Despite these challenges, rail remains a crucial component of Mexico’s logistics system, especially for connecting key industrial regions and facilitating trade with the United States.

Large Railway Tracks

The railway network of Mexico consist of 17,360 kilometers trail tracks and includes 5 U.S.-Mexico gateways in San Diego, El Paso, Eagle Pass, Laredo and Brownsville. This gives the companies the ability to reach key markets throughout North America. There are various cargo transportations whereas the most well-known are Kansas City Southern de Mexico and Ferrocarril Mexicano.

The largest commodities by volume transported by rail are manufactured goods (47.6%), agricultural grains (25.1%), minerals (12.9%), and oil and its derivatives (8.1%). Broken down, the top products to be transported by rails are Corn (12%), Cement (8%), Steel Sheet (7%), Iron Ore, Vehicles, Wheat, Soya beans and Coal.

Top 10 Commodities in U.S.-Mexico by Train

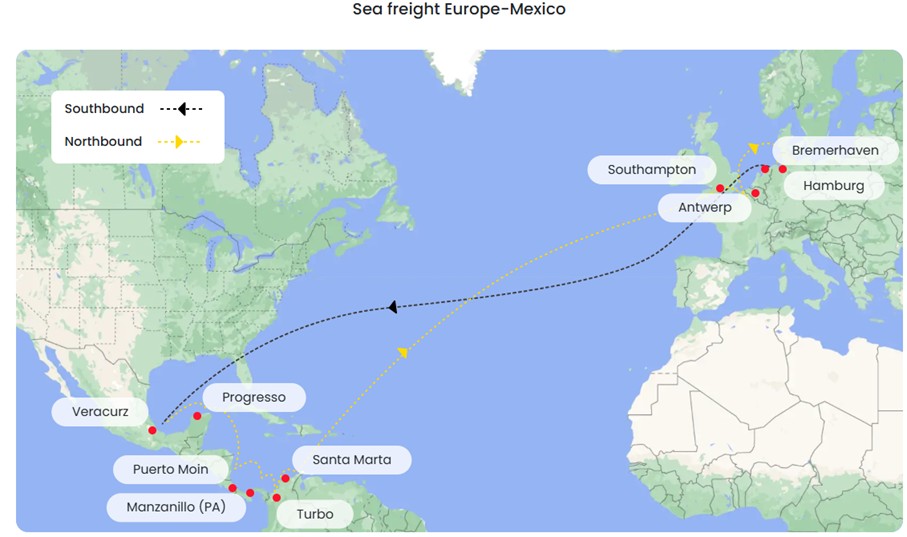

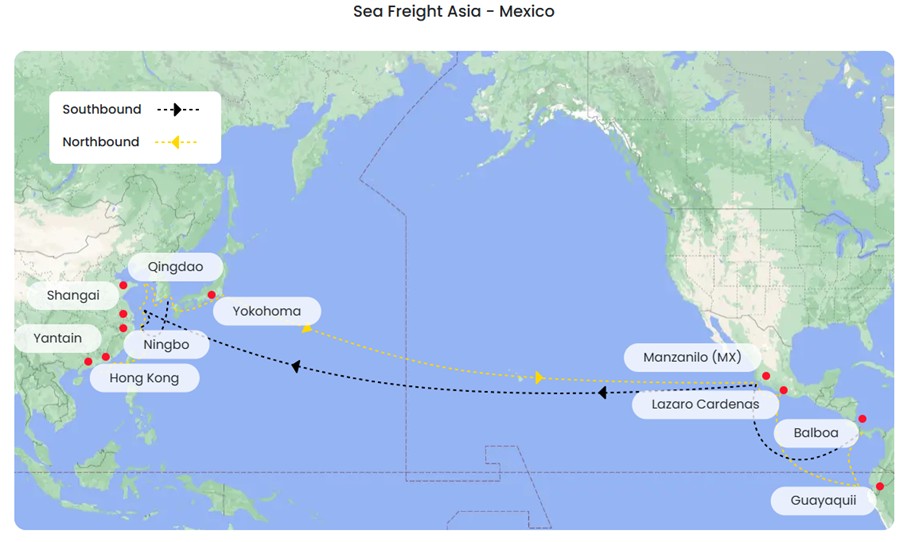

Sea Freight

Mexico's maritime infrastructure is equally robust. The ports of Manzanillo and Lázaro Cárdenas serve as vital gateways for raw materials from Asia, which are transported to manufacturing hubs and then to the United States. Additionally, the ports of Altamira, Tamaulipas, and Veracruz handle goods from the West, linking them to Mexico's major automotive and industrial centers.

Maritime transport handles around 30% of Mexico's total cargo tonnage, leveraging the high capacity of ships to move large volumes efficiently. It plays a critical role in imports, as approximately 50% of Mexico’s imported goods cannot be transported via land routes.

International Shipping

Mexico has over 100 ports and 15 terminals; 59 on the Gulf of Mexico and the Caribbean coast, and 58 on the Pacific coast. The most strategic ports for commercial cargo are Altamira, Veracruz for Europe, and Manzanillo, and Lázaro Cárdenas, for the Asian Market. Together, they account for 95% of containerized cargo.

There are 182 shipping lines operating in Mexican ports, and about 15 percent of all cargo is handled in containers. Those ports are connected to the logistic infrastructure on which the logistics and supply chains are deployed in the area.

Shipping Europe to Mexico

There are typically 2-4 shipments per month to Germany, with an average transit time of approximately 15 days. At Veracruz, container loading occurs daily, with capacities reaching up to 4,400 containers and peaking at approximately 8,000 containers during high-demand periods.

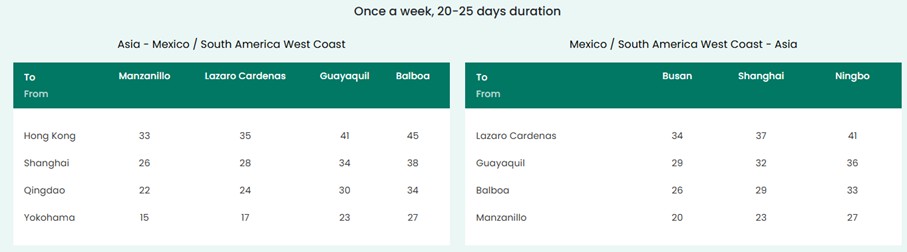

Shipping Asia to Mexico

The ports of Manzanillo and Lázaro Cárdenas receive raw materials from Asia. There are 1-2 sea freights to Hong Kong, which typically take between 23 and 30 days to reach their destination., which are then transported to manufacturing sites and ultimately to the US.

Industrial Real Estate in Mexico

Industrial parks are a cornerstone of Mexico’s industrial sector, driving foreign investment and fostering sustainable growth. As of 2023, there are 425 industrial parks across 27 states, with three-quarters of occupants being foreign companies. High demand, fueled by nearshoring trends and international firms relocating supply chains to Mexico, has pushed nationwide availability rates to just 2.1% in 2022. In Monterrey, for example, leasing often requires a 10-year commitment. Notably, one in five companies establishing a presence in Mexico is of Chinese origin, reflecting strategic shifts to navigate U.S. tariffs.

Northern Regions with most Industrial Parks

Mexico's industrial parks are predominantly located in the northern states near the US border, which include Nuevo León, which leads with 80 industrial parks, followed by Estado de México (47), Guanajuato (44), Coahuila (34), Chihuahua (32), and Jalisco (25). Border states collectively host 63% of the country’s industrial parks, offering superior connectivity to the U.S. for importing materials and exporting goods.

Collectively, the border states account for 63% of Mexico's industrial parks, offering excellent connectivity for importing materials and exporting finished goods to the US.

Government Investments in new Industrial Parks

Since 2021, demand for industrial parks has surged, reducing available space to just 2.1%. For companies looking to expand near established supply chain clusters, partnering with local experts is critical. These partners offer valuable guidance on site selection, pre-leasing opportunities, and flexible lease terms.

To meet rising demand, the Chamber of Mexican Industrial Parks plans to invest $6.2 to $13 billion between 2024 and 2030 to develop 128 new parks, expanding industrial capacity by 32% from 65 to 86 million square meters. However, with construction taking around two years per park, the challenge remains to accommodate the immediate needs of investors seeking productive spaces.