Mexicos Economy

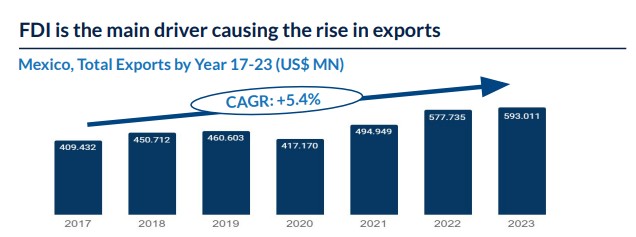

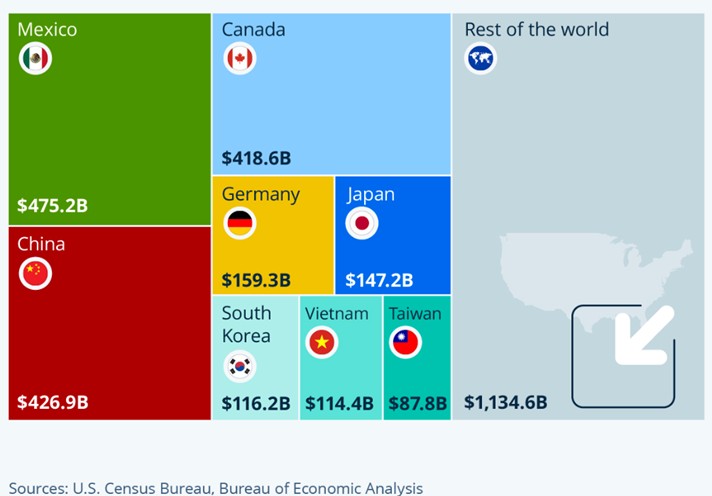

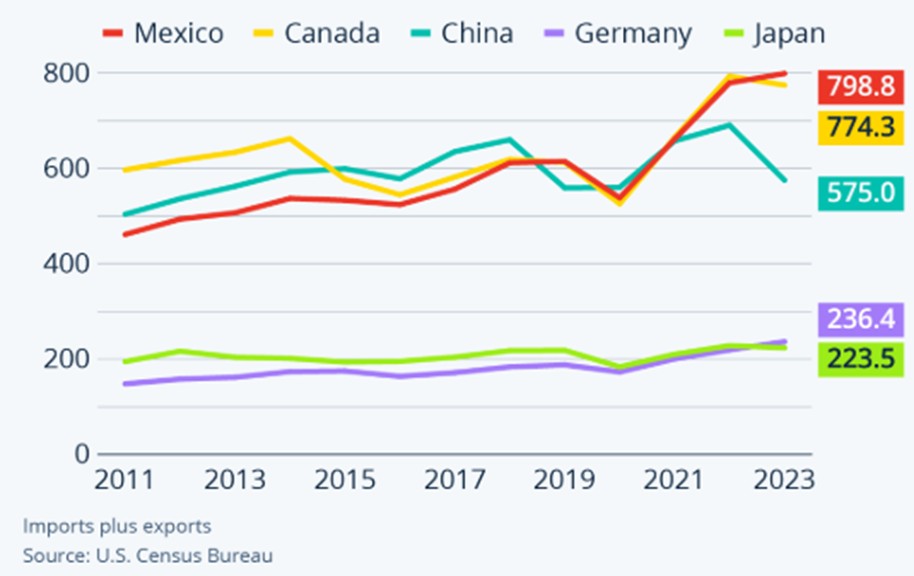

Mexico has one of the largest economies and is a global leader in Growth Domestic Product and to start a business. In 2023, there was a trade deficit with Exports $593B and of Imports $621B. The country overtook China as the largest exporter to the US with 15%, bolstering economic ties and stimulating investment, job creation, and economic stability.

Some Hard Facts

- Mexico belongs to the Top 10 export countries worldwide

- Nr. 1 Exporter to USA, before China

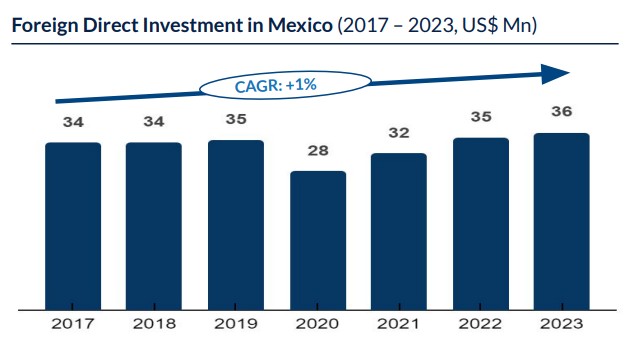

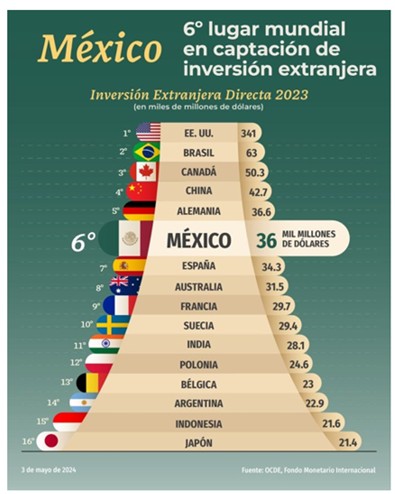

- 2023: $36 billion USD in FDI

- Main FDI are USA 38%, Spain 10%, Canada 10%, Japan 8%, and Germany 7%

- 2024: US $617 billion Exports

- 2nd Rank in Top 50 Global Competitive Report 2022

Main Trading Partners

Mexico entered 2024 with remarkable trade momentum, posting a historic export record of more than US $617 billion — up 4.1% from the previous year and outpacing official forecasts. Manufacturing remained the engine of growth, contributing nearly 90% of total exports, led by the automotive sector with close to US $200 billion in overseas sales.

Imports also advanced, rising 4.5% to US $625 billion and resulting in a modest trade deficit as industry demand for intermediate goods remained strong. While overall economic expansion stayed below 2%, Mexico’s export performance underscored its role as a strategic global production hub and key supply-chain partner to the United States, even as policy uncertainty around potential U.S. tariffs begins to shape the outlook for 2025.

USA as main Investor

Mexico's key trading partners are the United States, China, Germany, USA, Brazil, Japan, and South Korea. In 2023, there was a trade deficit with Exports $593B and of Imports $621B.The top 10 countries account for more than 90% of total FDI in Q1 2024, a similar trend to 2023 when the top ten countries represented 87% of total FDI.

State Engines Behind Mexico’s U.S. Trade and Investment Boom

Main FDI United States into In 2024, Mexico’s largest export to the U.S. was passenger vehicles, reflecting the country’s role as a major automotive manufacturing hub. Mexico City, Chihuahua, and Nuevo León led national export activity, while petroleum products remained a top U.S. export to Mexico. Foreign investment flows also reinforced bilateral ties, with U.S. companies channeling over US$16 billion into Mexico, primarily into Mexico City and northern border states. This economic partnership is complemented by strong social linkages — Mexico remains the top recipient of U.S. remittances and hosts a sizable American community, reinforcing the long-term economic and cultural integration between both nations.

Global Foreign Direct Investment

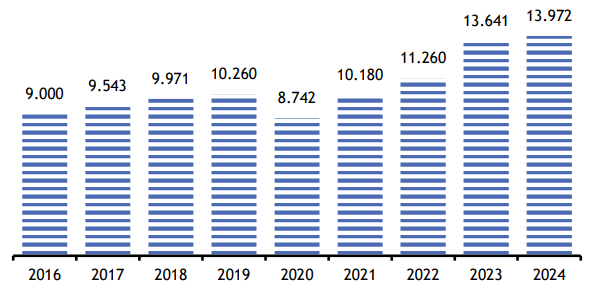

Worldwide, Mexico hit two consecutive records of Foreign Direct Investment (FDI) with $36.3 billion USD in 2022 and $36.1in 2023, with the manufacturing sector accounting for 42% of the total. Hence, Mexico secured the 6th position globally for Foreign Direct Investment (FDI), reflecting its growing appeal as a top destination for international investors. In Latin America, the country is even the second-largest recipient of foreign direct investment (FDI), contributing to North America’s 30% share of global FDI.

This record high of FDI led by the automotive industry. Major companies such as BMW, General Motors, Volkswagen, and Nissan invested heavily in northern states like Chihuahua, Nuevo Leon, and Coahuila, as well as in the Bajo region, which includes Guanajuato, San Luis Potosi, and Aguascalientes. Other key industries benefiting from FDI include machinery, electrical equipment, optical apparatus, mineral fuels, and plastic articles.

High reinvestments by established companies

Reinvested earnings in Mexico accounted for 97% of the FDI in the first half of 2024, highlighting the potential for growth within the country. This trend is supported by government incentives, a skilled workforce, and Mexico’s strategic position as a prime destination for investment. The consistent reinvestment of earnings reflects businesses’ confidence in Mexico’s long-term economic prospects. This is also the main driver for the rise in exports over the last years.

Manufacturing Export Sectors to the United States

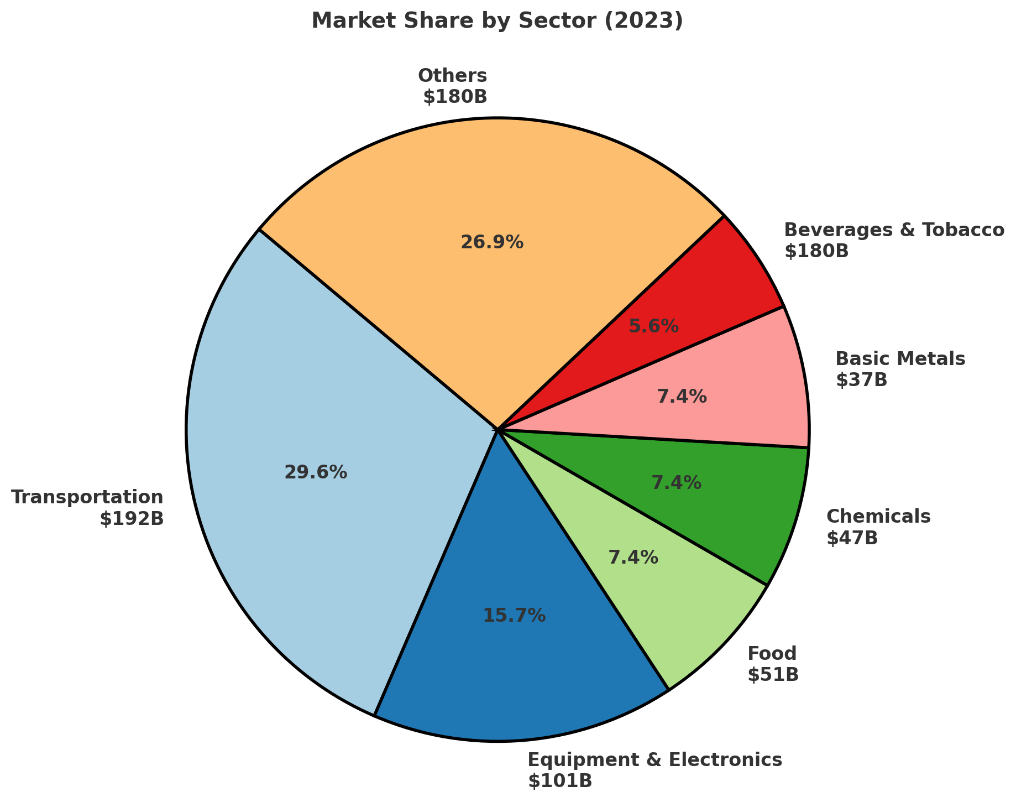

In 2023, the transportation sector led with a significant revenue of $192 billion, accounting for 32% of the total market share. The food sector followed with $101 billion, representing 17%. Other notable sectors included chemicals ($51 billion), basic metals ($47 billion), and beverages & tobacco ($37 billion), each contributing around 6-8% of the total market share. Across the board, the sectors showed steady growth, with transportation, food, and basic metals leading the way in terms of compound annual growth rates (CAGR).

Outlook Future Growth in FDI

With the whole nearshoring trend, it can be expected, that Japan will increase its FDI as well as China will appear within the top 10 foreign investors. The FDI flows in the last 5 years have remained between $30 million and $35 million and more than 36% has been channeled to advanced manufacturing industries, such as automotive, spare parts, electronics, aerospace, pharmaceuticals, e-commerce and medical devices, among others.

This nearshoring boom will be continuously driven by several key factors such as the country’s strategic geographic location, combined with an extensive network of free trade agreements. It is for various industries interesting investing into Mexico who are seeking to diversify their manufacturing bases.

United States key for Nearshoring Boom

Mexico overtook China as the largest exporter to the US with 15%, bolstering economic ties and stimulating investment, job creation, and economic stability. The strong economic relationship between Mexico and the US is evident, as the majority of Mexico's exports are directed northward. Although relying on a single market carries certain risks, businesses gain advantages from engaging with a stable and predictable market while fostering robust economic and political ties.

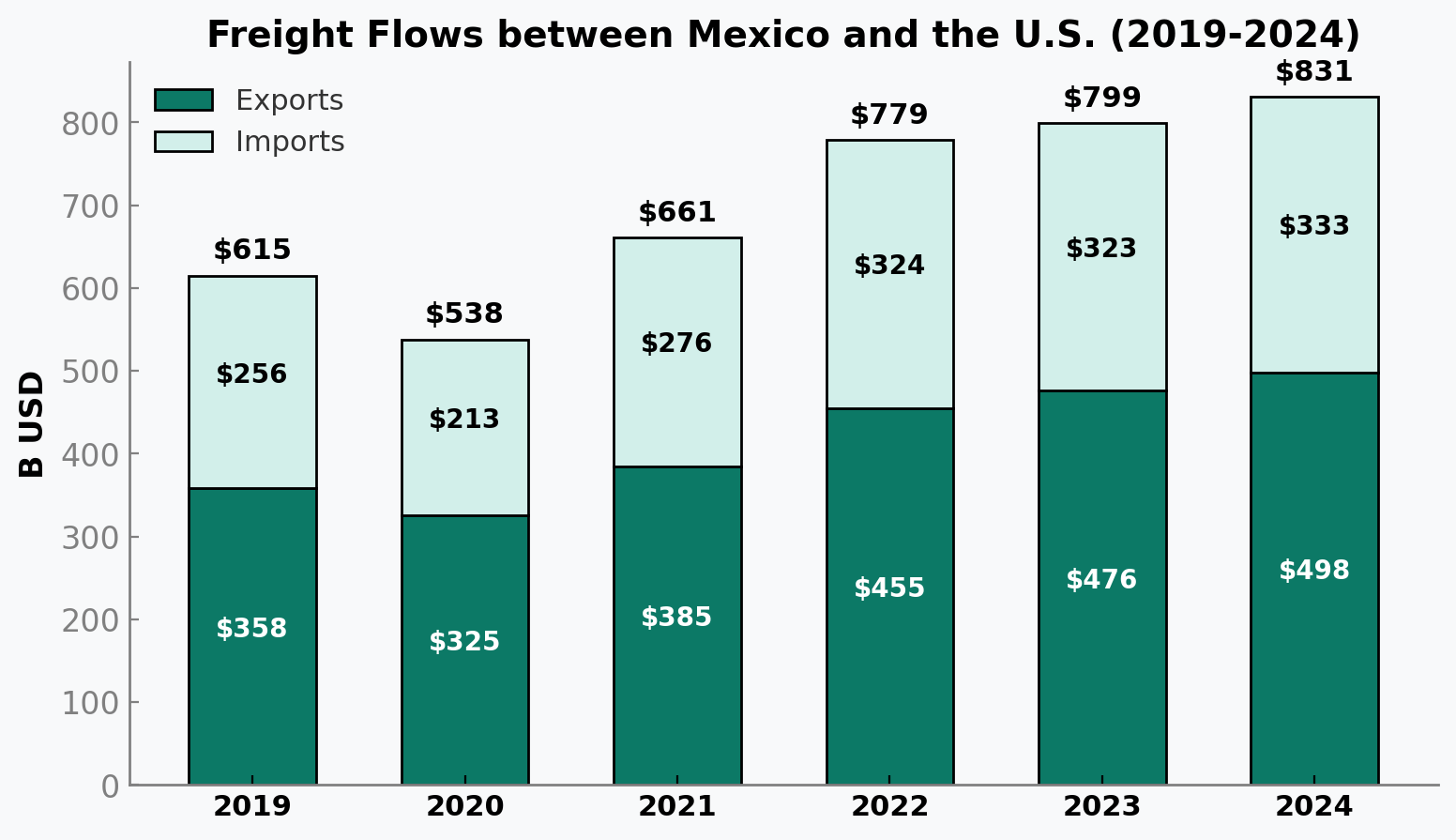

Compared to the numbers before Covid (360 billion USD in 2019), it is an outstanding increasement of almost 32% in the year 2023. However, due to the huge market and proximity of the United States, Mexico is with over 80% very dependent on that market.

Freight flows between Mexico and United States

The freight flows between Mexico and the United States have shown consistent growth from 2019 to 2024. Exports increased steadily from $358 billion in 2019 to $498 billion in 2024, highlighting Mexico's expanding role in trade. Similarly, imports grew from $256 billion in 2019 to $333 billion in 2024, reflecting the strengthening bilateral relationship.

The total trade value rose from $615 billion in 2019 to $831 billion in 2024, marking a 35% growth over five years and a positive trade balance with the U.S. of over US $171 billion in 2024, an increasement from 12.5% vs. 2023. This upward trend underscores the importance of trade between the two nations and their deepening economic integration.

Germany as EU Top Investor

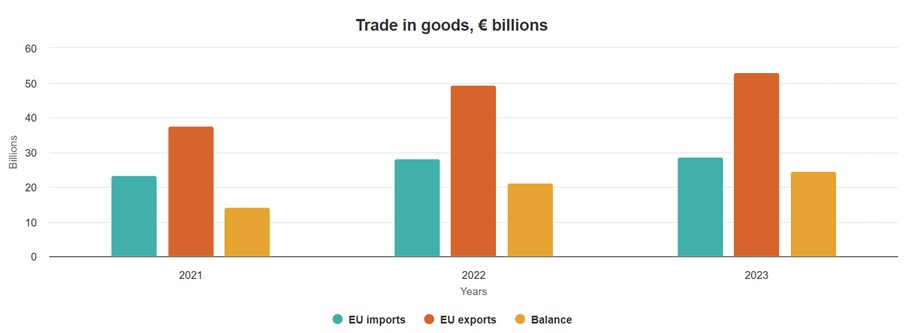

Although geographic distance has historically kept Europe from closely following Mexican affairs, it is now essential for the EU to pay greater attention to Mexico's transformation. This distant nation holds valuable insights into the future of globalization. While Europe widely recognizes the benefits of strengthening transatlantic ties, Mexico is often overlooked as a key player in that relationship.

In 2023, the EU was Mexico’s third-largest trading partner (€81.7 billion in bilateral trade), following the US and China. It ranked as Mexico’s second-biggest export market (€28.6 billion) and third-largest import source. Key traded goods included machinery, transport equipment, and chemical products.

The EU maintained a trade surplus with Mexico, increasing from €21.1 billion in 2022 to €24.6 billion in 2023. In services, EU imports from Mexico were led by travel and transport, while exports focused on business, transport, and ICT services. The EU remained Mexico’s second-largest foreign investor after the US.

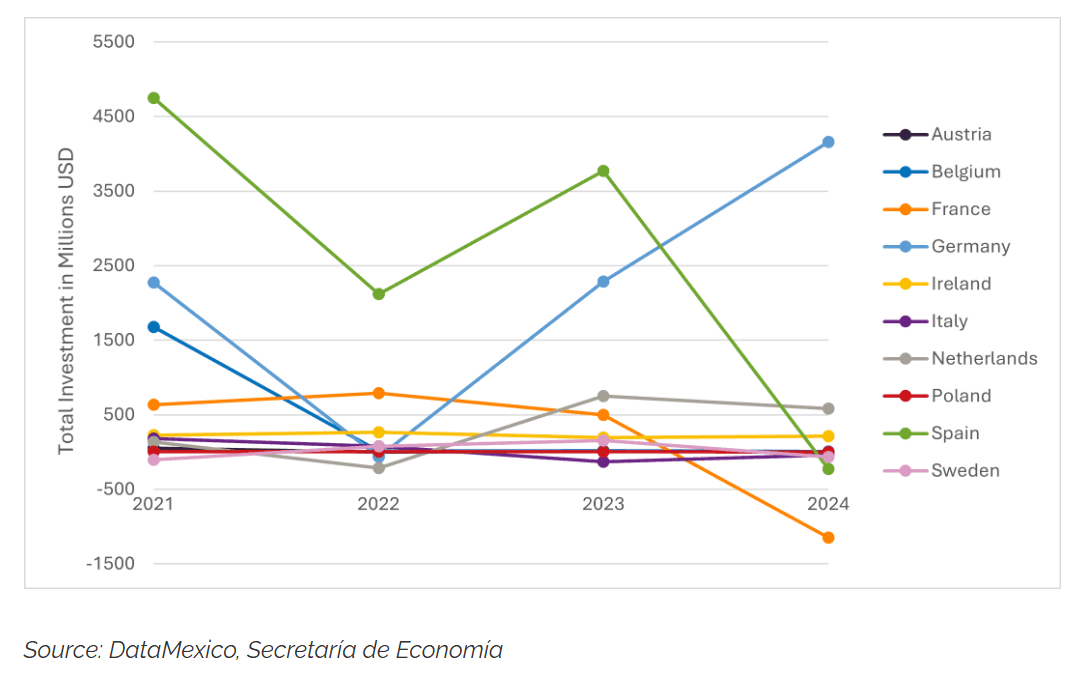

Germany has overtaken Spain as Mexico’s top European investor, driven by automotive and manufacturing expansion. However, FDI from other key European players like France, Italy, and Spain showed negative trends in early 2024, raising concerns about long-term investment stability.

Hence, Mexico is not long term not only attractive for Nearshoring to the United; thanks to Mexico's strategic location, maintaining a variety of import partners enhances supply chain resilience and provides companies with alternative sources for materials in case of disruptions.

Investments by Asian

Even though Mexico City is the top recipients of FDI, Nuevo Leon will thanks to many Asian as well as Tesla(?) investment make a significant increasement in FDI. As of 2018, many Asian countries began to increase their investments in Mexico, probably looking for an alternative to avoid the tariffs that former president Donald Trump was imposing at that time. if we analyze the pre and post 2018 data, the foreign direct investment from China increased 162% and from Hong Kong 269%.

Due to the tense relation between United States and Asia, there is an astonishing waiting list of over 400 companies in the most important corridors of the country.

Additionally, the government’s focus on infrastructure development and innovation in sectors such as technology and renewable energy creates new opportunities for foreign investors. Al these factors collectively reinforce a positive outlook for sustained FDI growth in the coming years.

GDP of Mexico

The GDP in Mexico reached USD 10,046 per capita, or 1.273 trillion USD for the whole country. Mexico is therefore one of the world's largest economies and is currently at rank 12. Mexico has globally the 12thlargest economy in terms of Growth Domestic Product GDP and after Brazil the second largest in Latin America.

In 2022, Mexico’s economy grew by 3% the gross domestic product, which indicates a recovers after the global drop in growth due to Covid since 2020. In that, the industrial sector grew the most with 3.2%, followed by agricultural with 2.8% and services 2.7% compared to the previous year.

Over the last 40 years, the GDP per head between 1980 and 2018 had an increase at certain stages of over 300%, which is a strong indicator of a strong development of the country itself as well as the globalization. The Corona pandemic hit them, as every other country, very hard, however the forecast promises a recovery in the next years.

Global Competitive Report

Mexico ranks 55th in the Global Competitiveness Index 2022 and is second in all of South America after Chile (45rd). Mexico have been able to stay stable over the past 5 years with the Ranks 51, 50, 53, 55 and again 55 in 2022. Looking only at the economy performance factor, Mexico made the largest gains with 22 places better than to previous year and ranks now on positions 27th.This thanks to the areas of infrastructure, trained specialists, and also due to the good relationships with the NAFTA regions US & Canada as well as the European Union. Thus, Mexico is one of the most attractive countries in South America to produce commodities.

Ranking of other production locations:

Hong-Kong 3rd

United States 10th

China 17th

Indien 37th

Brasil 59th

Top 20 countries to start a business

Accordingto the news magazine U.S. News from 2020, Mexico is ranked on place 7in the category "Start a Business" – before many other large countries like USA, Great Britain, Germany, France or Japan. Around 6,000 business decision-makers assessed the attractiveness of a country for starting a company on the basis of five characteristics. The following properties were equally included in the evaluation:

- Financing is affordable

- Bureaucracy

- favorable manufacturing costs

- Connection to the rest of the world

- easy access to capital