Tax & Government Incentives

Mexico maintains a corporate tax rate of approximately 30%. However, the country offers a tax advantage to foreign companies through the "IMMEX" program, also known as the Maquiladora Program in which international companies can deduct the import taxes if you export the processed products.

Furthermore, certain states within Mexico provide attractive tax incentives to encourage companies to establish their production facilities within their jurisdictions. These incentives serve as additional benefits for companies seeking to initiate manufacturing operations in specific cities or regions of Mexico.

Some Hard Facts

- Tax Incentives with the program “Immex”

- Imported machinery and equipment are tax free

- Various tax incentives from states for international companies

IMMEX Program

In the late 1960s, the Mexican Government introduced the Maquiladora Export Program, now known as the IMMEX Program, which served as the cornerstone for this industry.

This program played a key role in driving industrial growth, creating employment opportunities, and, most importantly, providing companies with the ability to temporarily import goods for industrial or service processes. These processes may involve manufacturing, transformation, repair, or the provision of export services, offering significant tax benefits, such as the deferral of General Import Tax, Value Added Tax (VAT), and, where applicable, countervailing duties.

The primary objective of the IMMEX program is to boost the Mexican economy by allowing foreign companies to import raw materials and components into Mexico for manufacturing products destined for export.

Benefits of the Immex Program

- Import goods under a temporary regime

- Defer payment of the General Import Tax

- Defer payment of Value Added Tax

Process of Immex Program

In other words, international companies are allowed to import raw materials and components with zero free tax – as long as it is processed there and the final good exported to other countries.Additionally, imported machinery and equipment which will be used to process goods can also enjoy tax exemptions.

Given the various global crises, such as the COVID-19 pandemic, the Ukraine conflict, and the strained relations between the United States and China, many foreign companies are leveraging the advantages offered by the IMMEX program by expanding their operations in Mexico and engaging in nearshoring activities. Hence, by relocating to Mexico, you not only manufacture more competitively and closer to your clients but also benefit from import tax savings under the IMMEX program.

Requirements to enter the IMMEX program

The IMMEX program in Mexico is aimed exclusively at legal persons, which is an individual with rights and obligations that exists, not as a natural person, but as an institution that has been created by one or more natural persons. To participate in the IMMEX program, manufacturers must meet certain requirements:

- Temporary stay: Raw materials, components, and products imported by foreign companies into Mexico are allowed to remain in the country for a limited period. They must be incorporated into an end product and exported from Mexican national territory.

- Specification and incorporation: Companies must clearly state the items they will receive from abroad and how they will be incorporated into the end product intended for overseas shipment.

- Registration with the Mexican Tax Authority (SAT) and the Official Register of Importers.

- Minimum Export: At least $500k worth of finished products on an annual basis or must have exports that account for a minimum of 10% of yearly sales

- Customs compliance with all relevant import and export regulations.

- Annual reports to demonstrate compliance with production and export commitments.

- Operational controls for tracking inventory and production processes.

- Control and verification of consumptionof temporarily imported fuels and lubricants

Why using Immex Program

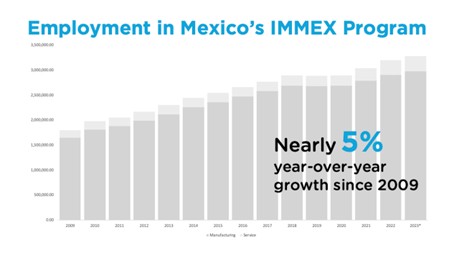

Since its inception, the IMMEX Program has expanded beyond the U.S.-Mexico border, now employing over 3 million workers across more than 5,000 certified operations in Mexico. It plays a vital role in global supply chains, with Mexico emerging as a preferred destination for both manufacturing and administrative talent.

Key Advantages of IMMEX in Mexico:

- Highly skilled, bilingual workforce familiar with international systems and software

- Time zones that align with real-time business operations

- Strong endorsements from global corporations expanding their presence in Mexico

- Cultural and business alignment supported by technology and travel

Who is IMMEX in Mexico aimed at

Today, IMMEX is applied to most industries in which foreign companies manufacture in Mexico to export products from the country to global markets. Among the most important users of the IMMEX program in Mexico are companies that produce parts for the country’s automotive, medical device and aerospace industries as well as textiles, and electronics.

Indeed, 89 of the top 100 automotive parts manufacturers have an established presence in Mexico. IMMEX is also utilized by many other industries such as assembly, food or general manufacturing.

The types of legal entities that can access the IMMEX program in Mexico are several. Among them are the following:

- Industrial: For processes of transformation and manufacturing of goods intended for export

- Services: or companies that provide services to export goods or offer export services

- Parent company: when the manufacturing operation of a SAT-certified company (“parent company”) and one or more controlled subsidiaries are integrated into the same program

- Shelter: When foreign companies provide technology and productive material without directly operating the program

- Outsourcing: When a third party is used to perform manufacturing processes, and the third party is registered in the program

Other advantages of the IMMEX Program

The program also aims to modernize the globalization of Mexico’s manufacturing infrastructure by bringing new, specialized technologies and knowledge to the region and creating jobs as well as to attract foreign direct investment. This also provides companies to be cost-efficient while still focusing on the quality of the goods produced and manufactured.

From the following advantages will a company benefit:

- Exemption from import/export tax: Deferred payment of import duties on processed goods, as long as they comply with the legal stay duration in Mexico.

- Reduced or no corporate tax: Foreign-owned IMMEX companies can benefit from a special tax regime, provided they meet the "maquiladora" definition for tax law purposes.

- Exemption from VAT: Eligibility to apply for a VAT/IEPS Certification granted by SAT. / VAT/IEPS Certification allows IMMEX companies to receive a "tax credit" equivalent to the applicable VAT and/or IEPS tax on temporary imports.

Other tax incentives

Beside the immex program, Mexico offers various tax incentives at federal and state levels to attract investment, support specific industries and promote economic development. Though it’s important to note that the availability and specific details of tax incentives can vary by location and industry.

Some federal and/or state incentives may include:

The Prosec Program (Sectoral Promotion Program) helps reduce import costs for companies operating in specific industries by offering reduced tariffs on imported raw materials, machinery, and equipment. These tariffs, which range from 0% to 5%, apply even if the final products are sold domestically.

The Value Added Tax (VAT) Refunds program enhances cash flow for export-oriented companies by providing quick reimbursements of VAT paid on goods and services related to export activities. Refunds are typically processed within 30-40 days of filing, helping businesses maintain liquidity.

Research and Development (R&D) Tax Credits are aimed at fostering innovation and technological advancement. Companies can benefit from tax credits or deductions for investments in R&D activities, though these incentives are subject to approval and specific eligibility criteria.

Mexico’s Double Taxation Agreements (DTAs) help international companies avoid being taxed twice on the same income. By offsetting taxes paid in Mexico against those owed in the company’s home country, these agreements provide significant tax relief. Mexico has established DTAs with over 50 countries.

The Corporate Income Tax Incentives are designed to encourage long-term investments. Companies can take advantage of accelerated depreciation on fixed assets, deductions for employee training and benefits, and tax credits for hiring vulnerable groups such as disabled workers or senior citizens.

Energy and Renewable Sector Incentives aim to promote sustainable energy projects. Businesses investing in renewable energy equipment, such as solar panels or wind turbines, can benefit from tax deductions and credits, supporting Mexico’s transition to cleaner energy sources.

The Employment Subsidies program encourages job creation by offering payroll tax reductions or subsidies to companies generating significant employment. These incentives are particularly beneficial for businesses operating in underdeveloped regions of Mexico.

The Regional or State-Level Incentives are designed to attract investment to specific areas within Mexico. These incentives, which vary by state or municipality, can include benefits such as land grants, property tax reductions, and lower payroll taxes, making local investments more appealing to international companies.

These incentives make Mexico a competitive destination for international companies, especially those in manufacturing, technology, energy, and export-focused industries. By leveraging these programs, businesses can significantly reduce costs and enhance profitability while gaining access to Mexico’s skilled workforce and strategic location.