How the “Houthi Attacks” Disrupt the European Supply-Chain – and Why Mexico Could Be an Interesting Alternative

Introduction: A Shifting Global Supply-Chain Landscape

Houthi rebels have targeted cargo ships in the Red Sea—one of the world’s most critical trade corridors through the Suez Canal—using drone and missile attacks backed by Iran. These aggressive moves, linked to the Israel-Hamas conflict in Gaza, have disrupted global supply-chains by forcing shipping companies to reexamine traditional routes.

While the Houthis originally claimed their intent was to target Israeli-bound vessels, the broader impact has been felt across a wide range of commercial shipments, pushing logistics operators to seek more secure and efficient alternatives.

Disruption of the Suez Canal and Its Supply-Chain Impact

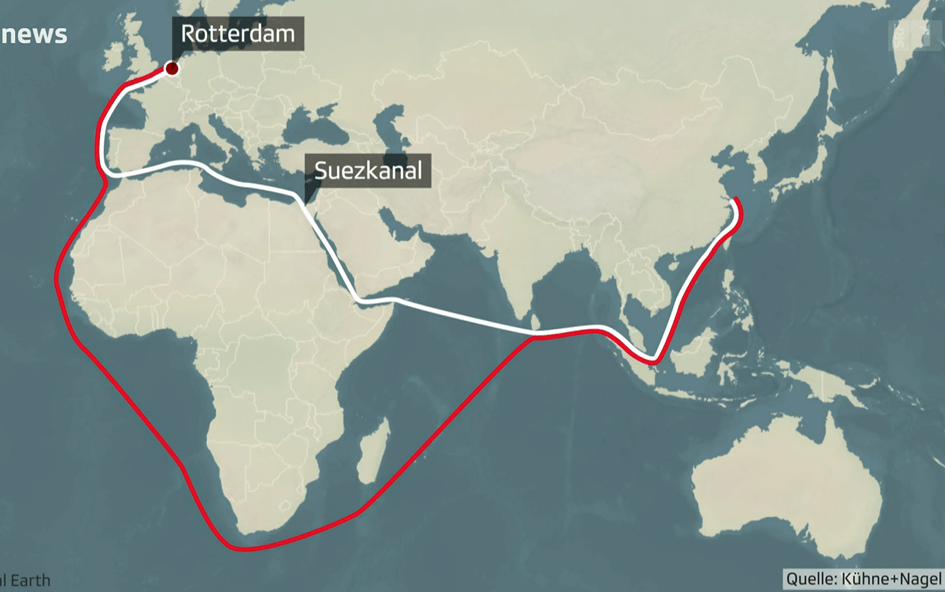

Normally, around 13% of global trade passes through the Suez Canal, facilitating billions of dollars in commerce and handling roughly 30% of the world’s container shipping. However, since the onset of these attacks, traffic through the canal has plummeted by 75%, as shipping companies avoid the risk of exposing their vessels and crews.

Instead, many major operators—including seven of the ten largest companies such as Maersk and BP—have opted for an alternative route around Africa via the Cape of Good Hope. This detour not only extends delivery times by up to two weeks but also increases transportation costs by more than $1 million per shipment due to higher fuel and operational expenses.

Rising Shipping Costs and the Ripple Effects on Consumers

The forced rerouting around the Cape of Good Hope means that goods destined for Europe now face delays of an additional 10–12 days beyond the typical 30–45-day transit time from China via the Suez Canal. Vincent Clerc, CEO of Maersk Lines, has observed that shipping costs have more than tripled since these disruptions began.

Data from the Shanghai Shipping Exchange confirms that freight rates have surged—with the Shanghai Containerized Freight Index reaching record levels—resulting in increased costs that are ultimately passed on to importers and, eventually, to end-consumers. Although transportation expenses are only a part of overall product costs, their rise contributes to higher consumer prices over time.

Mexico as a Strategic Alternative in the Global Supply-Chain

The challenges arising from the Houthi attacks underscore the need for alternative production and shipping hubs. Mexico is emerging as a prime candidate not only as a nearshoring destination for the United States but also as an offshoring alternative for European markets.

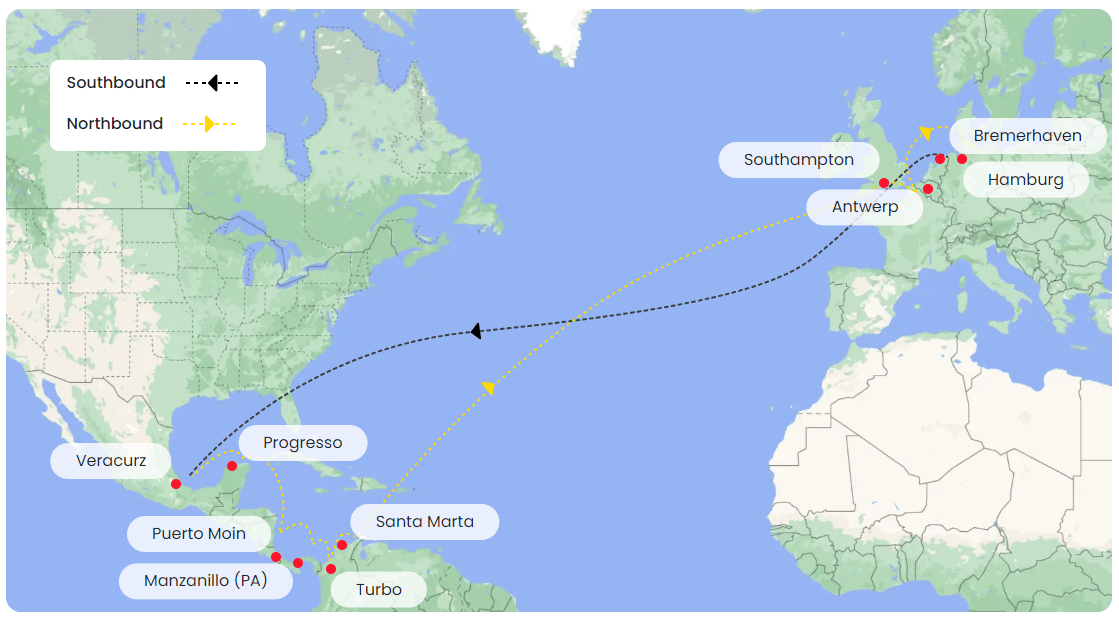

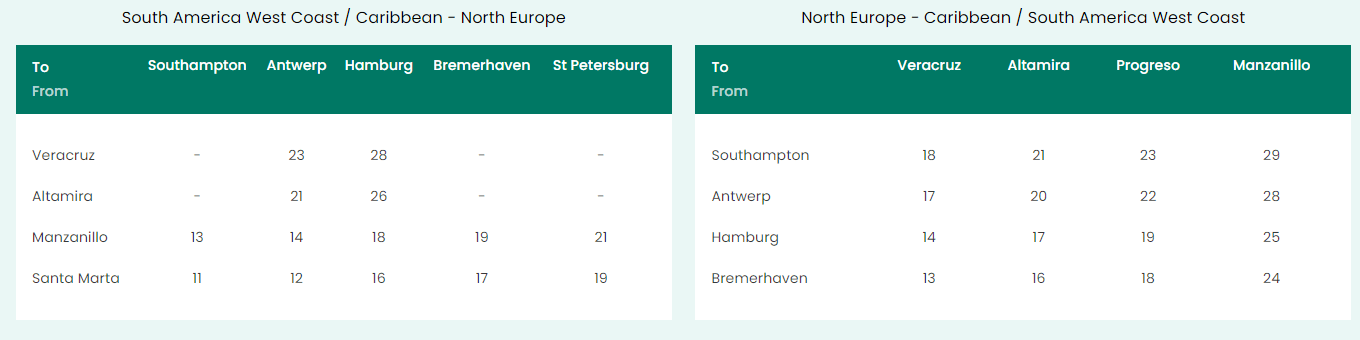

Thanks to its advantageous geopolitical positioning and cost-effective sea freight connectivity to both Europe and Asia, Mexico offers significant benefits. Its strategically located ports, such as Manzanillo and Veracruz, provide efficient, reliable logistics solutions that can help companies avoid the prolonged and expensive routes currently in use.

Strategic Advantages of Mexican Ports

Mexico’s port infrastructure plays a pivotal role in its supply-chain appeal. For example, the port of Veracruz—Mexico's oldest and largest commercial hub on the Gulf of Mexico—operates 18 berths and offers over 600,000 m² of storage space. This facility manages a diverse range of cargo, including containers, agricultural and mineral bulks, general cargo, and automobiles. Key highlights include:

- Over 2,500 ships call at Veracruz annually.

- It processes more than 700,000 vehicles each year, making it the largest vehicle-handling port in the continent.

- Daily container capacities reach up to 4,400, with peaks of approximately 8,000 during high-demand periods.

Mexico - Europe Supply-Chain Connections

Such robust infrastructure ensures competitive transit times, with shipments from Mexico to Europe averaging around 15 days—a significant improvement over the extended routes now in use.

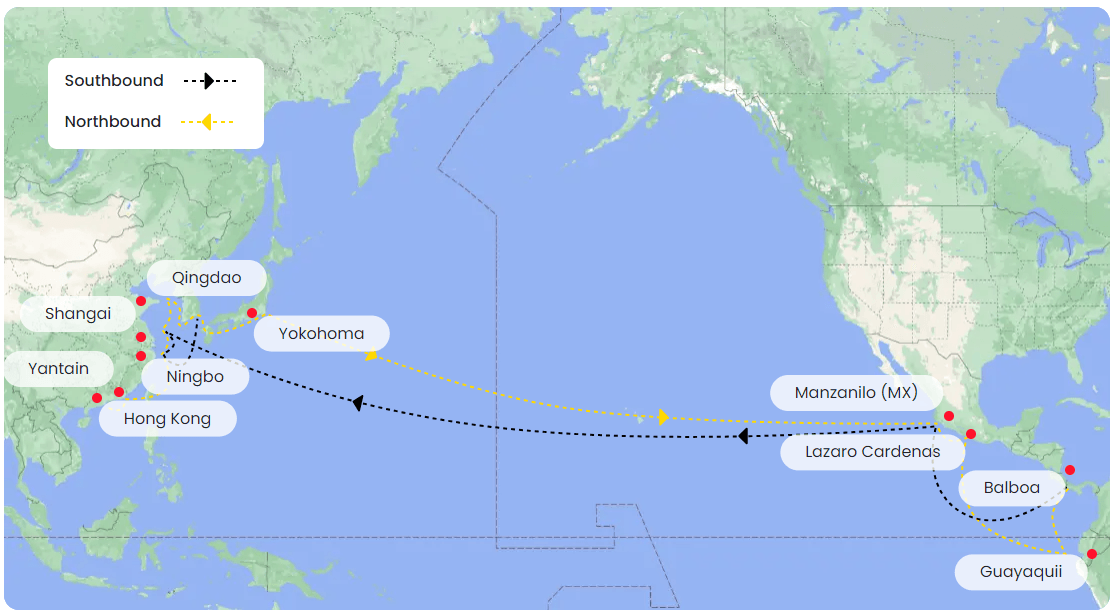

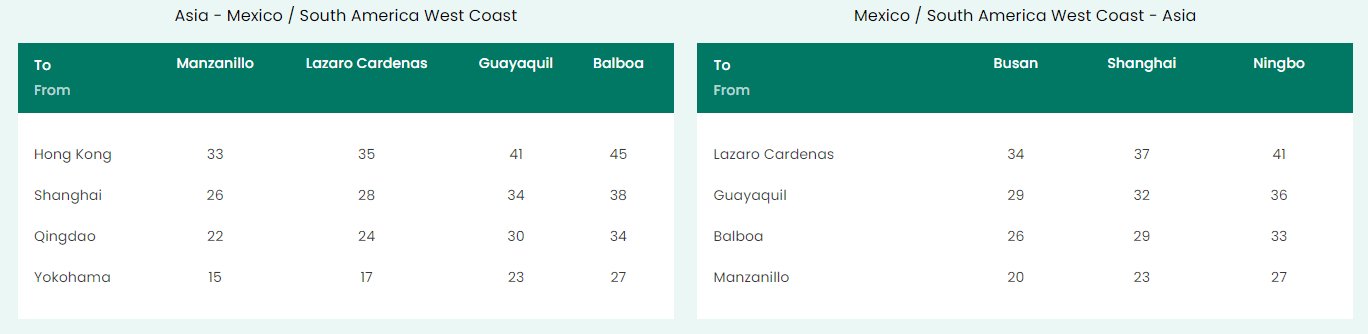

Mexico - Asia Supply-Chain Connections

Mexico’s geopolitical positioning ensures excellent sea freight connectivity not only to Europe but also to key markets in Asia, making it a versatile hub for global supply-chain operations.

The Interoceanic Corridor: Enhancing Supply-Chain Connectivity

In addition to its established ports, Mexico is pioneering the Interoceanic Corridor—a multifaceted infrastructure project designed to connect the Pacific and Atlantic Oceans. This corridor integrates 309 km of railway for freight trains, dedicated highway sections, and two key ports, primarily benefiting southern regions like Veracruz and Oaxaca.

By reducing transit times to less than six hours from port to port, the corridor streamlines trade flows between Asia, Europe, and the Americas. Projections suggest that by 2050, the corridor could contribute 1.6% to Mexico’s GDP, mobilize over $50 billion in investment, and create more than 500,000 direct jobs, making it a significant asset in global supply-chain optimization.

Exploring Alternative Routes and Future Strategies

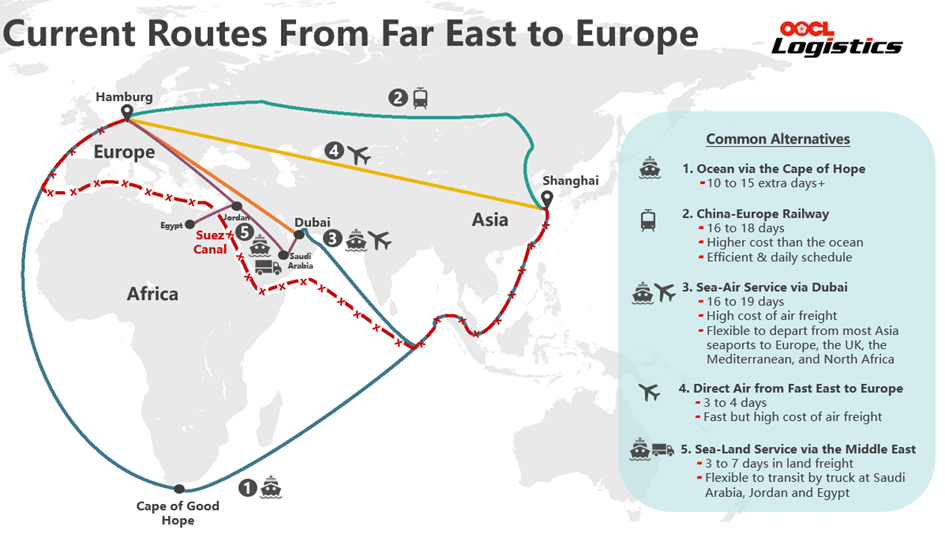

In response to the current challenges, businesses are evaluating other transport options to complement traditional sea freight. Rail freight, for instance, is gaining appeal with transit times between 13 and 20 days via the Northern and Western Corridors, offering a faster alternative to ocean routes.

Similarly, intermodal solutions—such as combining sea and air freight—present a balanced approach by reducing transit times while keeping costs manageable, though these methods involve greater complexity in handling and customs. Additionally, sea-land transportation in the Middle East, where goods are moved from a seaport by truck to final destinations, is also being explored as a flexible alternative to longer maritime detours.

Conclusion: Rethinking the Global Supply-Chain

The ongoing Houthi attacks have highlighted critical vulnerabilities in the global supply-chain, particularly along the Suez Canal. With rising shipping costs and extended transit times impacting both businesses and consumers, companies are increasingly forced to rethink their logistics strategies.

Mexico, with its robust port infrastructure, strategic geographical advantages, and innovative projects like the Interoceanic Corridor, stands out as a promising alternative. As global trade continues to evolve, reexamining the supply-chain and shifting production closer to key markets will be essential for reducing costs and ensuring reliable transportation.

Links

https://www.usip.org/publications/2023/12/houthi-attacks-red-sea-disrupt-global-supply-chains

https://trans.info/en/asia-europe-freight-options-red-sea-375852

The Report; Redefining trade; Prolstmo & Mexico's Interoceanic Corridor