Industrial Real Estate Mexico: A Macroeconomic Primer for Nearshoring Decisions

Executive Introduction: Why the Macro Context Matters Now

Nearshoring Mexico continues to attract executive attention, but the decision environment has changed. After the post-pandemic rebound and the surge of announcements in 2022–2023, companies now face a more complex backdrop: slower global growth, persistent trade friction, and tighter financial conditions. Against this backdrop, Mexico’s macroeconomic balance of risks becomes a critical input for industrial real estate Mexico decisions—from site selection to capacity planning.

Based on the latest available macro analysis (2024–2025) from BBVA Research, this article explains what the data says about growth, inflation, public finances, external accounts, and financial stability—and how these factors translate into nearshoring Mexico outcomes through 2026.

Global Backdrop: Slower Growth, Higher Uncertainty

Global activity has moderated since 2024. Advanced economies are expanding below long-term averages, while emerging markets show uneven momentum. The defining features of the current cycle are policy uncertainty, trade fragmentation, and selective capital allocation rather than a synchronized downturn.

For companies considering invest in Mexico, the implication is straightforward: capital is still available, but it is more discriminating. Projects with clear supply-chain logic, regional integration, and execution readiness continue to advance; speculative expansion slows.

Mexico’s Growth Profile: Moderation, Not Breakdown

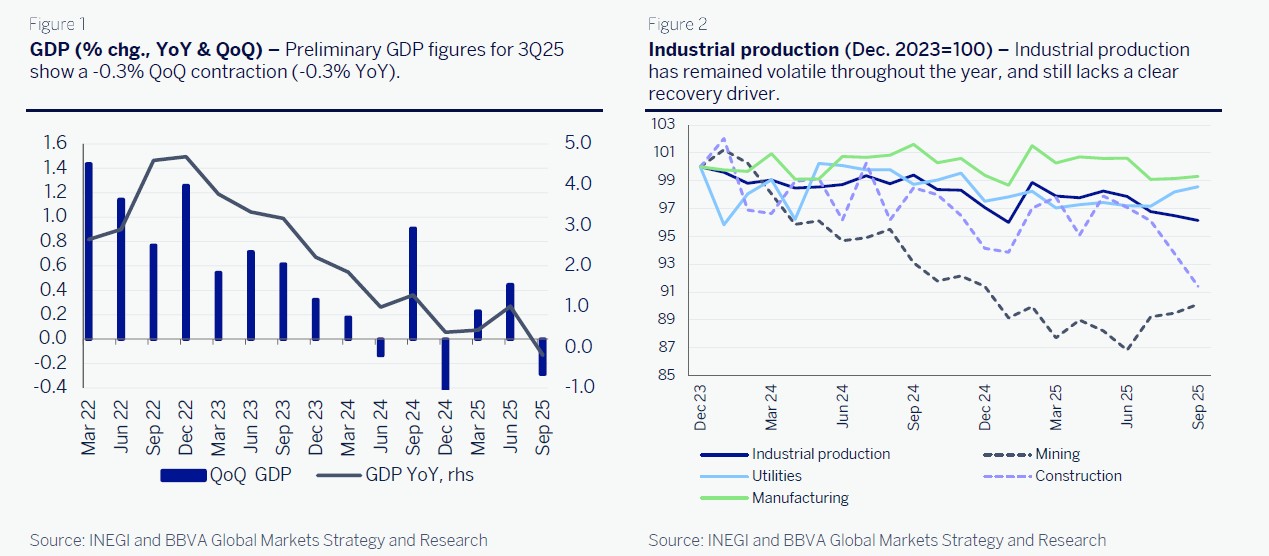

Mexico’s GDP growth decelerated through 2024–2025 as domestic demand softened. Investment paused amid higher interest rates and policy uncertainty, while consumption normalized after earlier strength. Externally, exports showed volatility driven by front-loaded shipments ahead of tariff changes.

Interpretation: The slowdown reflects cyclical adjustment, not a structural reversal. Mexico manufacturing remains tightly linked to U.S. industrial cycles—an anchor that supports baseline demand even as domestic drivers cool.

Inflation and Monetary Policy: Anchors Are Holding

Inflation eased from earlier peaks as global supply pressures normalized and domestic demand cooled. Core inflation proved stickier than headline, but expectations remained broadly anchored. The central bank maintained a cautious stance, signaling data dependence rather than abrupt easing.

Why this matters for industrial real estate Mexico:

- More predictable inflation reduces construction-cost volatility.

- A cautious but credible monetary framework supports longer planning horizons for warehouses and industrial buildings in Mexico.

Fiscal Position: Manageable, With Trade-Offs

Mexico’s fiscal accounts show contained deficits and a stable debt profile relative to peers. Revenue performance benefited from resilient exports and tax administration, while spending pressures increased due to social programs and public investment priorities.

Decision insight: Fiscal space is not unlimited, but neither is it constrained to crisis levels. For nearshoring Mexico, this means public support (permits, infrastructure coordination) is selective and regionally differentiated—reinforcing the need for careful site selection.

Financial System: Stability With Selective Risk

Mexico’s banking system remains well capitalized and liquid. Credit growth slowed as rates stayed elevated, particularly for SMEs, while large corporates retained market access. Asset quality metrics stayed within historical ranges.

Translation for manufacturing investment risk in Mexico:

Large, well-structured projects proceed.

Smaller suppliers face tighter financing—reinforcing the value of locations embedded in established industrial parks with shared services.

Exchange Rate Dynamics: Strength Has Two Sides

The peso’s relative strength reflected global dollar movements and investor positioning as much as domestic fundamentals. While currency stability reduces import costs for equipment and inputs, excessive appreciation can compress cost advantages.

Practical takeaway: Currency is a second-order variable for industrial real estate decisions. Proximity, throughput, and supplier density dominate long-term outcomes.

Sectoral Signals: What Expands, What Waits

Transportation equipment & machinery: Continue to anchor Mexico manufacturing competitiveness.

Electronics & data infrastructure: Advance selectively where power and permitting are secured.

Pharma & medical devices: Policy clarity determines timing; execution favors regions with regulatory experience.

These sectoral differences matter for warehouses and industrial buildings in Mexico: specifications (power density, ceiling height, docks) increasingly diverge by use case.

Risks to Watch: What Could Change the Equation

Trade rules and enforcement: Headline tariffs vs. effective tariffs remain a gap; changes to rules of origin would matter more than rates.

Infrastructure bottlenecks: Power and water constraints can delay otherwise viable projects.

Institutional execution: Permitting timelines and local coordination differentiate outcomes region by region.

Outlook: Decision Takeaways for 2025–2026

Nearshoring Mexico remains viable, but capital is selective.

Industrial real estate Mexico benefits where clusters already exist.

Macroeconomic stability supports planning; execution risk determines speed.

Expect fewer announcements, more completions—and tighter location criteria.

FAQ (How Decision-Makers Ask)

Is nearshoring in Mexico still attractive in 2025–2026?Yes. Momentum has shifted from volume to selectivity, favoring established corridors.

Does slower GDP growth reduce industrial demand?Not necessarily. Export-linked manufacturing remains supported by U.S. integration.

How important is currency stability for site decisions?Secondary. Logistics, utilities, and supplier density matter more.

Are financing conditions a constraint?For SMEs, yes. Larger projects with clear execution paths proceed.

Where does industrial real estate benefit most?In regions aligned with existing clusters, infrastructure, and permitting capacity.