Mexico at a Crossroads in 2026: Nearshoring, Risk, and the Next Phase of North American Manufacturing

Introduction: 2026 Will Decide Mexico’s Nearshoring Trajectory

As Mexico approaches 2026, the country stands at one of the most decisive crossroads of its modern economic history. Nearshoring remains one of the most powerful forces reshaping global manufacturing—but it is colliding with slowing investment, rising security costs, institutional uncertainty, and the upcoming USMCA review in 2026.

For international manufacturers, the key question is no longer whether nearshoring to Mexico makes sense—but whether Mexico is structurally prepared to capture Nearshoring 2.0 while managing rising risks.

This article answers one clear question:

Is Mexico ready to convert nearshoring momentum into sustainable industrial growth beyond 2026?

The Strategic Context: Why 2026 Is a Turning Point

Nearshoring accelerated between 2021 and 2023 as companies diversified supply chains away from China. Mexico benefited from:

- Proximity to the U.S. market

- Competitive labor costs

- Deep manufacturing integration under USMCA

However, the environment entering 2026 is fundamentally different. Global demand is cooling, trade policy is becoming more protectionist, and scrutiny on supply-chain compliance is intensifying.

The result: nearshoring remains attractive—but execution risk has increased.

Economic & Trade Pressure Points (2024–2025)

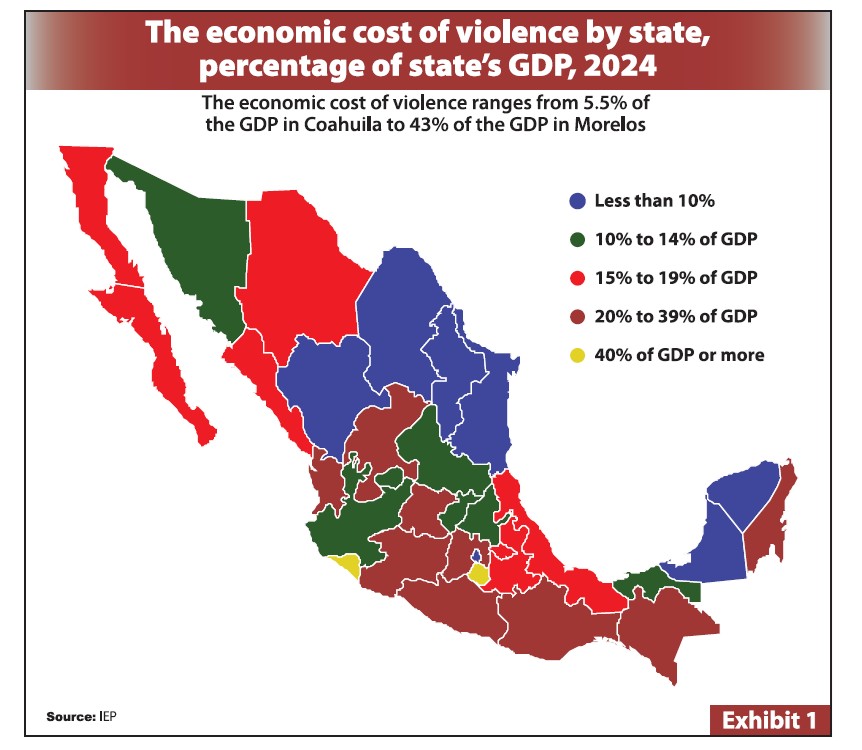

Violence continues to impose a significant economic burden. In 2024, its cost reached nearly 15 % of Mexico’s GDP, with several central and southern states exceeding 20–39 % of local economic output. For manufacturers, this translates into higher operating costs, security spending, and location-specific risk premiums.

Northern Nearshoring States with lower violence

Exhibit #1 shows that the economic cost of violence varied widely across Mexico in 2024. While several northern and southeastern states recorded impacts below 10% of GDP, large parts of central and Pacific Mexico faced significantly higher costs, ranging between 20% and 39% of local economic output.

High indirect costs for security

According to INEGI, Mexico recorded a homicide rate of 25.6 per 100,000 inhabitants in 2024—more than four times the OECD average of approximately 5.6 per 100,000.

The economic impact is substantial. The Mexico Peace Index 2025 estimates that violence generated direct and indirect costs of roughly US$273 billion, equivalent to 14.7% of GDP in 2024. Although marginally lower than in 2023, this burden still represents six times national public health spending and five times the education budget.

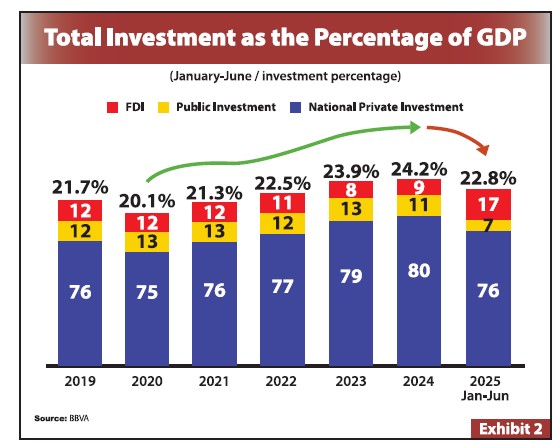

Investment Is Slowing—Except Where Nearshoring Is Strongest

While foreign direct investment (FDI) linked to nearshoring remains positive, domestic private investment and public investment have declined. This imbalance matters.

Nearshoring projects continue—but they are becoming more selective, favoring regions with:

- Proven industrial ecosystems

- Energy and logistics capacity

- Regulatory clarity

This explains why nearshoring demand is concentrating rather than spreading evenly across the country.

Manufacturing and Exports: Slower Demand, Not Structural Collapse

Mexico’s manufacturing sector remains deeply tied to U.S. demand. While exports and industrial output slowed through 2025, this reflects:

- High interest rates in the U.S.

- Cautious consumer demand

- Delayed capital expenditures

Importantly, this is not a de-industrialization trend. Analysts expect gradual recovery through 2026 as monetary conditions normalize and supply-chain relocation resumes.

Nearshoring is evolving—not reversing.

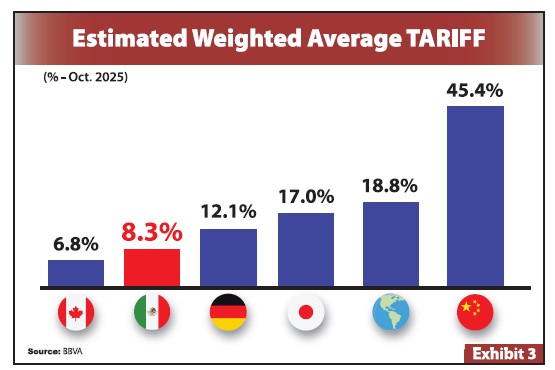

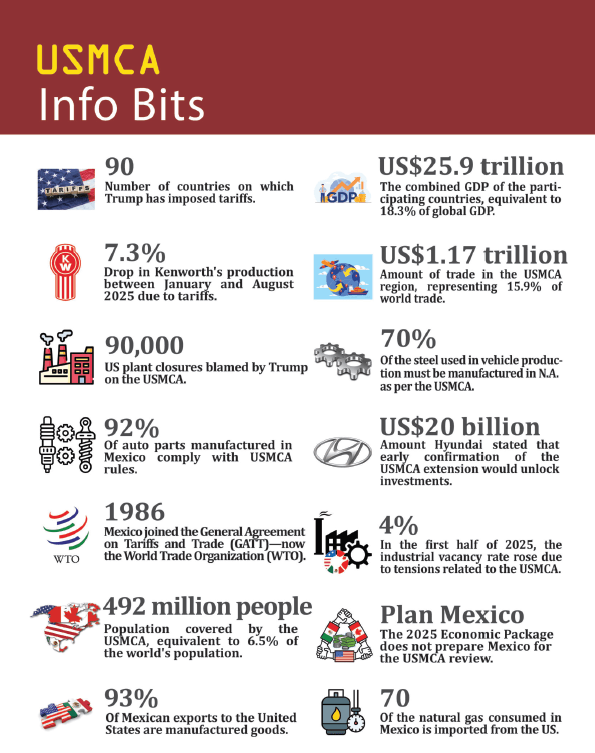

The USMCA Review in 2026: Why It Changes the Risk Equation

The USMCA review in July 2026 introduces a layer of uncertainty that manufacturers cannot ignore. While Mexico and Canada currently face lower effective tariffs than other trade partners, the review may reshape:

- Rules of origin (especially automotive & auto parts)

- Enforcement of labor and environmental provisions

- Energy-policy disputes involving state-owned enterprises

For manufacturers, this reinforces a key insight:

Being inside North America matters—but compliance and location strategy matter even more.

Violence, Institutions, and Operating Risk

Security remains one of Mexico’s most persistent structural challenges. Companies allocate between 2 % and 10 % of annual budgets to protect facilities, supply chains, and personnel.

At the same time, proposed judicial reforms and the weakening of autonomous regulators have increased perceived political risk—particularly among foreign investors evaluating long-term manufacturing footprints.

Nearshoring decisions in 2026 are therefore less about cost arbitrage and more about risk-adjusted execution.

Nearshoring 2.0: Opportunity Still Exists—With Limits

Despite these pressures, Mexico remains one of the few countries globally capable of absorbing large-scale manufacturing relocation:

- U.S. reshoring remains cost-prohibitive for many industries

- China risk is structurally embedded in global supply chains

- Mexico offers scale, proximity, and experience

Nearshoring 2.0 is likely to unfold over the next 1–3 years, but growth will be constrained by:

- Energy availability

- Water access

- Skilled labor supply

- Legal certainty

Mexico will not capture all relocating supply chains—but it can capture the most strategic ones.

Conclusion: Mexico’s Window Is Narrow—but Still Open

Mexico enters 2026 facing slower growth, elevated risk, and a pivotal trade review. Yet the fundamentals that made nearshoring viable remain intact.

The outcome will depend on execution, not hype.

Manufacturers that move early, structure operations correctly, and select locations aligned with infrastructure and compliance realities will continue to benefit from nearshoring in Mexico.

Those that wait for certainty may find the best opportunities already taken.

FAQ

Is nearshoring in Mexico slowing down?Nearshoring is normalizing after rapid growth. Demand remains strong but more selective.

Why is the USMCA review in 2026 so important?It may reshape rules of origin, compliance enforcement, and sector-specific trade conditions.

Does violence significantly impact manufacturing decisions?Yes. Security costs directly affect operating expenses and location attractiveness.

Is Mexico still competitive versus the U.S. and China?Yes—especially for North American supply chains—but execution risk must be managed carefully.