Water and Energy Bottlenecks: The Hidden Risk to Nearshoring Investment in Mexico

Why are water scarcity and electricity constraints becoming decisive bottlenecks for industrial investment and nearshoring in Mexico?

Introduction: Nearshoring Meets Physical Limits

Mexico’s nearshoring momentum remains structurally strong — but it is increasingly constrained by realities that cannot be ignored. Beyond geopolitics, tariffs, or labor availability, water and electricity availability have become critical gating factors for industrial investment in Mexico.

For manufacturers evaluating production expansion, the question is no longer if Mexico is competitive — but whether utilities can support scale, automation, and long-term reliability. In 2025 and beyond, water stress and grid saturation are shaping location decisions just as much as labor cost or proximity to the U.S.

Water Scarcity: A Structural Constraint for Industrial Expansion

Mexico entered a prolonged water stress phase well before nearshoring accelerated. By 2024–2025, drought cycles, aging infrastructure, and fragmented water governance converged into a nationwide challenge.

Northern industrial hubs were hit first and hardest.

Nuevo León as a Warning Signal

In 2022, Nuevo León suffered its worst drought in three decades. Major reservoirs such as Cerro Prieto and La Boca dropped below 5% capacity. Industrial and urban demand exceeded available supply by more than 20%, triggering emergency rationing.

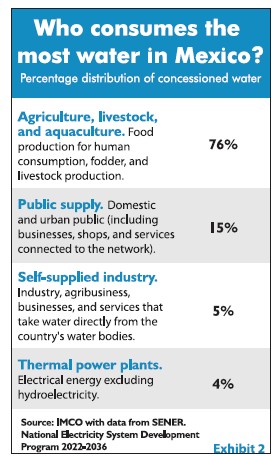

According to state planning data, only 25% of water consumption is residential, while 75% flows to agriculture and industry — exposing a structural allocation imbalance that becomes critical as manufacturing scales.

Large industrial users continue to hold long-term concessions, while population growth and industrial density intensify competition for limited water resources.

This data underlines a key risk for nearshoring projects: industrial water access is not guaranteed simply because demand exists.

Electricity: Grid Saturation Is Slowing Industrial Projects

Water is only half the equation. Electricity availability and transmission capacity are increasingly decisive for industrial site selection in Mexico.

Querétaro: When Demand Outruns the Grid

In Querétaro alone, at least 12 industrial projects have been delayed or halted due to insufficient power availability. The issue is not generation alone — but transmission and substation capacity.

Mexico’s grid has suffered from underinvestment following the suspension of competitive power auctions and regulatory uncertainty in the energy sector.

According to industry representatives, companies are ready to invest — but CFE lacks sufficient transmission capacity to connect new industrial loads in multiple regions.

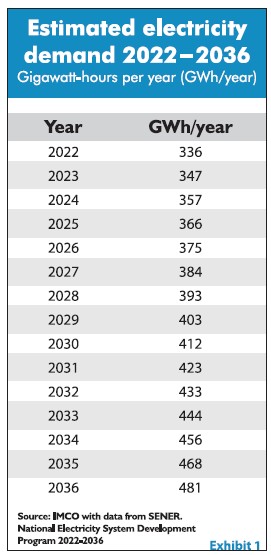

The data shows electricity demand increasing steadily through 2036, reinforcing the urgency of grid expansion for nearshoring-driven manufacturing growth.

The Water–Energy Nexus: A Compounding Risk

Water and energy constraints reinforce each other.

- Hydroelectric output drops during droughts

- Data centers and semiconductor plants consume both water and electricity at scale

- Cooling systems increase water stress while adding grid load

- Northern Mexico already shows signs of infrastructure saturation, particularly in corridors experiencing heavy nearshoring inflows.

According to the World Economic Forum, over 45% of Mexico’s aquifers are overexploited, while precipitation levels in industrial regions remain structurally low.

Government Plans vs. Execution Reality

Mexico has announced ambitious infrastructure plans:

- Water investments: MXN 186.5 billion over five years (aqueducts, desalination, irrigation modernization)

- Electricity investments: Over USD 22 billion planned between 2025–2030

- Transmission upgrades: 275 new transmission lines and 524 substations announced

While directionally positive, execution remains the key risk. Regulatory uncertainty, limited private participation, and long permitting timelines continue to slow implementation.

For investors, this creates a timing mismatch: nearshoring demand is accelerating faster than utility infrastructure can respond.

What This Means for Industrial Investors

For companies evaluating manufacturing expansion in Mexico, water and energy are no longer background considerations — they are strategic risk variables.

Successful projects increasingly require:

- Early utility feasibility assessments

- Location selection aligned with confirmed grid capacity

- Water availability verification beyond nominal concessions

- Contingency planning for energy and water redundancy

Nearshoring remains attractive — but only where infrastructure supports execution.

Conclusion: Nearshoring Needs Infrastructure, Not Just Momentum

Mexico stands at a decisive juncture. The country remains one of the few globally competitive nearshoring destinations for the U.S. market — yet water scarcity and electricity constraints threaten to cap its industrial upside.

The winners of the next nearshoring phase will not be those who move fastest, but those who align location, utilities, and long-term scalability from day one.

For Mexico, solving the water-energy bottleneck is not optional — it is the difference between sustained industrial leadership and missed opportunity.

FAQ

Why are water and energy becoming critical risks for nearshoring in Mexico?

Because industrial demand is growing faster than infrastructure expansion. In several regions, water availability and grid capacity are already limiting new manufacturing projects.

Which regions are most affected by water scarcity?

Northern and central industrial hubs such as Nuevo León and Querétaro, where population growth, manufacturing density, and climate stress collide.

Is electricity generation or transmission the bigger problem?

Transmission. While generation capacity exists, grid congestion and lack of substations prevent companies from securing reliable power connections.

Can these bottlenecks delay or stop industrial projects?

Yes. Multiple projects in Mexico have been postponed or canceled due to uncertain power or water access, even when land and labor were available.

How should companies mitigate water and energy risks?

By integrating utility feasibility checks early in site selection, securing written confirmations from providers, and prioritizing locations with proven infrastructure capacity.

Do these challenges undermine Mexico’s nearshoring potential?

No — but they raise execution risk. Nearshoring remains attractive, yet only projects aligned with infrastructure realities will scale successfully.