What is a maquiladora?

Maquiladoras in Mexico

The workforce in Mexico's manufacturing industry, including maquiladoras and export services, experienced significant monthly growth in June 2023, recording a 0.9% increase. This growth marked the highest figure since March 2022, highlighting the resilience of the sector.

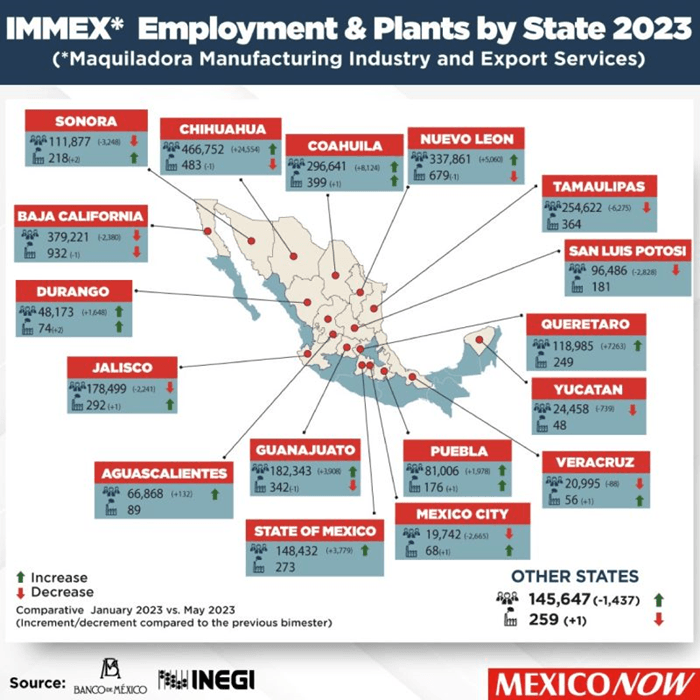

Indeed, the graph below shows the states with the highest manufacturing employment throughout Mexico. Thanks to the closeness to the US border, the states Chihuahua, Baja California and Nuevo Leon have hundreds of thousands of maquiladoras.

The surge in employment in Mexico's export-oriented maquiladora industry can be attributed to two key factors: the resilience of the U.S. economy and the phenomenon of nearshoring. The Instituto Nacional de Estadística y Geografía (Inegi) reported that in June, the number of employees in manufacturing, maquiladoras, and export services reached 3.348 million, the highest number on record and an increase of 109,000 jobs compared to the previous year. This represents a 3.4% annual growth, the highest in five months, and marks 31 consecutive months of expansion.

The History behind a maquiladora

The history of Mexico's manufacturing sector is closely intertwined with the rise of maquiladoras, a unique form of industrial operation. In this article, we will explore what maquiladoras are, their significant role in Mexico's major industries, and their contribution to the growth of manufacturing in Mexico. We will also compare Mexico's manufacturing landscape to that of China and the USA and delve into essential aspects such as Mexico's business culture and import-export requirements.

But, what are Maquiladoras? Maquiladoras, a term originating from the Spanish word "maquilar," which means to mill or grind, have been pivotal in reshaping Mexico's manufacturing landscape. These manufacturing plants, often located near the U.S.-Mexico border, have played a crucial role in boosting Mexico's manufacturing sector and promoting economic development.

Thus a maquiladora is a Mexican manufacturing company that operates under a distinctive arrangement. The are often referred to as a 'maquila”. These companies import raw materials, components, or semi-assembled goods duty-free for various manufacturing processes, including assembly, processing, and finishing. The primary purpose of maquiladoras is to produce goods, usually for exportation.

The history of maquiladoras in Mexico can be divided into several key phases:

- The Bracero Program Era (1942-1964): The Bracero Program, which allowed Mexican laborers to work temporarily in the United States, ended in 1964. This led the Mexican government to seek alternative ways to provide employment for returning laborers, ultimately laying the foundation for the maquiladora industry.

- The Birth of Maquiladoras (1960s): In 1965, Mexico introduced the maquiladora program, encouraging foreign investment by offering tax incentives and relaxed regulations. This marked the birth of the maquiladora industry, initially concentrated along the U.S.-Mexico border.

- Expansion and NAFTA (1990s): With the North American Free Trade Agreement (NAFTA) coming into effect in 1994, maquiladoras experienced significant growth. NAFTA eliminated trade barriers and boosted cross-border trade, leading to the establishment of maquiladoras in various regions of Mexico.

- The New Millennium: In the 2000s, Mexico's maquiladora industry faced challenges, including economic downturns and global competition. However, it continued to evolve, emphasizing higher value-added activities, and diversifying into industries such as aerospace and electronics.

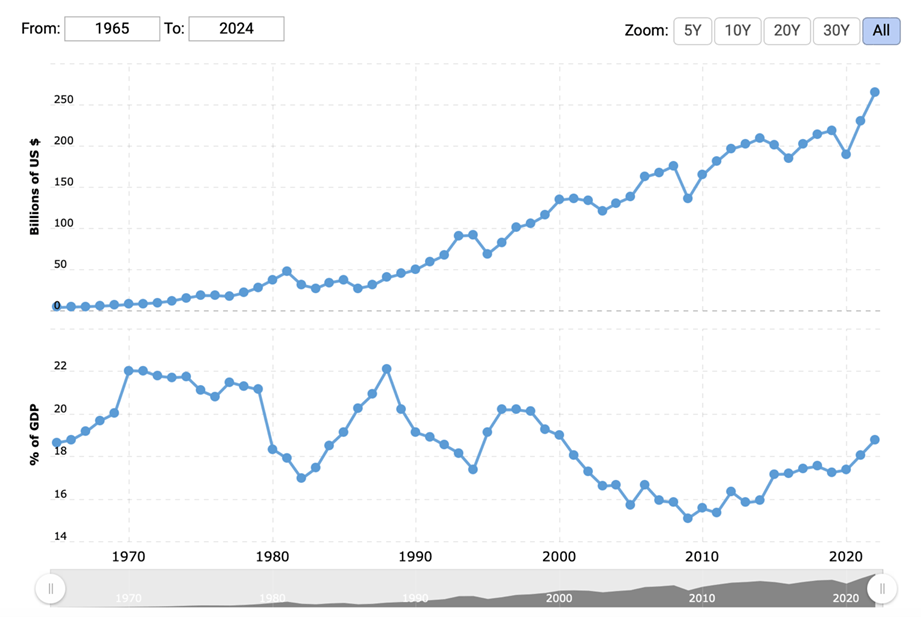

The graph below shows the amount of value manufactured since 1965 in Mexico and how its production and value-added are measured. In summary, Mexican manufacturing experienced a decrease in 2020, followed by increases in 2021 and 2022. The value-added is calculated without considering asset depreciation or depletion of natural resources.

- Mexico manufacturing output for 2022 was$265.67B, a15.48% increasefrom 2021.

- Mexico manufacturing output for 2021 was$230.07B, a21.44% increasefrom 2020.

- Mexico manufacturing output for 2020 was$189.45B, a13.48% declinefrom 2019.

- Mexico manufacturing output for 2019 was$218.96B, a2.1% increasefrom 2018.

The strength of the Mexican economy and the resulting growth in employment can be attributed to the robust U.S. economy and increased private investment driven by the expectations of nearshoring. The U.S. economy's impressive growth rate and the disappearance of signs of slowdown observed six months ago have played a significant role in driving this employment surge.

Industries with most maquiladoras

In the manufacturing sector, most employees are engaged in the production of transportation equipment, with a total of 1.05 million individuals employed in this segment. Other sectors that maquiladoras have helped Mexico increase manufacturing are computer equipment, communication devices, measurement instruments, and other electronic equipment, components, and accessories, employing 404,000 workers.

This growth in manufacturing employment aligns with the hiring intentions of employers, extending not only to the results seen in June but also projected for the entire third quarter of the year. The manufacturing sector ranks third in terms of the highest intentions to increase the workforce. The transportation, logistics, and automotive sector hold the second position with a 47% intention to attract talent, followed by manufacturing with 42%. The Latin American region presents significant growth potential, particularly given the opportunities offered by nearshoring.

Immex benefits push maquiladoras

The total number of establishments participating in the IMMEX program reached 5,194 in June 2023, according to Inegi's records. Notably, border states such as Baja California, Nuevo León, Chihuahua, Coahuila, and Tamaulipas are prominent in hosting these establishments, indicating the concentration of manufacturing activity in these regions.

Furthermore, one positive aspect of the maquiladora industry is the rising real median wages of its workers. As of June, the average wage per person reached 26,688 pesos, representing a 7.2% annual increase, the highest figure in 12 months. These wages surpass the averages seen in other sectors, such as agriculture, construction, and commerce, making the maquiladora sector an attractive choice for job seekers.

The increase in wages within the maquiladora sector can be linked to the provisions of the United States-Mexico-Canada Agreement (USMCA), where one of the key focuses was the improvement of labor conditions, including wages. This upward trajectory in salaries can also be attributed to the intense competition for skilled labor in the northern border region, resulting in companies increasing wages significantly to retain talent and remain competitive.

Mexico's Maquiladoras: A Strategic Partner in America's Manufacturing Resurgence

Maquiladoras have been instrumental in bolstering Mexico's manufacturing sector. They have attracted substantial FDI, particularly from the United States, and have emerged as a cornerstone of the Mexican economy. One of the critical factors contributing to their success is Mexico's strategic proximity to the United States, facilitating efficient logistics and reduced transportation costs.

American companies that previously operated in Asia have made a significant investment shift, pouring a staggering $11 billion into Mexico's burgeoning manufacturing sector. This transformation is attributed to the rising trend of "nearshoring," fueled by international treaties that Mexico has embraced to attract business investments. These developments have been championed by Luis Manuel Hernández González, the President of the National Council of the Maquiladora and Export Manufacturing Industry (Index).

Approximately 70% of the capital injected by U.S. corporations into Mexico is directed towards expanding existing factories and plants, with the remaining 30% being allocated to new ventures. Hernández González points out that these companies are not owned by Asian entrepreneurs but are, in fact, U.S. firms that had previously set up operations in Asia. However, faced with chip shortages, container issues, and the ongoing COVID-19 pandemic, they are now moving their value chains closer to Mexico.

The allure of Mexico's value chain is its comparative stability in the post-pandemic era. Consequently, companies are increasingly eager to be nearer to their customers. This strategy, known as "nearshoring," aims to capitalize on the advantages that Mexico offers, just as the United States and Canada do. These corporations are gearing up for full-scale production once the chip supply chain stabilizes.

Presently, companies that have shifted operations from Asia to Mexico are not only reviewing their product lines but also embarking on the construction of new plants, factories, and storage facilities. This process is expected to take a couple of years before full-scale operations can commence.

According to the President of the National Council of the Maquiladora and Export Manufacturing Industry, the expanded operations will primarily focus on producing household goods, appliances, electronics, and medical equipment. New entrants into the Mexican market typically belong to the same industrial sector, as the country's manufacturing expertise makes it an attractive destination for further investments.

The maquiladora industry is a vital component of the trade relationship between Mexico and the United States, contributing over 62% of total trade and generating more than 3.2 million direct jobs. All these operations comply with Mexican laws and regulations.

The inception of the North American Free Trade Agreement (NAFTA) in 1994 marked a significant turning point. Mexico's proximity, skilled labor force, and favorable conditions for manufacturing along its northern border became increasingly evident. This led to a substantial increase in integration, rising from 10% to 70% under NAFTA. This shift allowed companies to qualify for tariff exemptions when they integrated their supply chains more closely within Mexico.

Despite the change in U.S. leadership from Donald Trump to Joe Biden, the trade war with China persists. Biden has retained the tariffs imposed by his predecessor on Chinese products, signaling a commitment to building and protecting domestic manufacturing. This protectionist approach has provided a unique advantage to the maquiladora industry and its operations in Mexico.

While concerns about a potential economic recession in the United States loom, most of the products manufactured in Mexico have already been pre-ordered and paid for. The industry's ethos revolves around building to meet existing orders rather than speculative market forces.

In conclusion, as uncertainties continue to shape global trade dynamics, Mexico's manufacturing sector is well-poised to benefit from the strategic shift of American maquiladoras. This investment trend showcases the importance of Mexico as a manufacturing hub and underscores the resilience and adaptability of the maquiladora industry in the face of evolving economic landscapes.

Challenges of applying the maquiladora program

Even though the maquiladora program has been established over several decades, there are also various challenges as if you are not compliant with the local rules, you cannot take advantage of the benefits and you may pay even penalties. Indeed, two main drawbacks of becoming a maquiladora are the bureaucratical paperwork you are obliged to deliver to the government as well as the complexity of the Import & Export rules and regulations. In the latter case, you need a dedicated person who knows how to handle all the documentation at the border.

Conclusion

Maquiladoras have been instrumental in Mexico's economic development and the expansion of its manufacturing sector. From aerospace to furniture manufacturing, Mexico offers an attractive destination for companies looking to diversify their operations. Its strategic location, competitive advantages, and evolving business culture make it an appealing choice for businesses seeking to expand their manufacturing footprint. As Mexico continues to strengthen its position in the global manufacturing landscape, comprehending the intricacies of doing business within the country will remain a critical success factor.

Do you want to take advantage of the maquiladora program?

Thanks to the nearshoring boom in Mexico, it also boost the maquiladoras. Indeed, for the 3 -5 years, a foreign direct investment will take place of over 60 billion USD yearly. However you must be careful to apply it properly, we are glad to support you and giving more insights of the program.

Bibiliography

Hernández, E. (2022). Maquiladoras de EU mueven sus fábricas de Asia a México atraídas por el ‘nearshoring’.Retrieved from Forbes Mexico: https://www.forbes.com.mx/maquiladoras-de-eu-mueven-sus-fabricas-de-asia-a-mexico-atraidas-por-el-nearshoring/

Index. (2023). Historia de la Manufactura en México.Retrieved from https://index.org.mx/historia/#:~:text=En%20México%20la%20Industria%20Maquiladora,Estados%20Unidos%2C%20países%20altamente%20industrializados.

MacroTrends. (2023). Mexico Manufacturing Output 1965-2023. Retrieved from https://www.macrotrends.net/countries/MEX/mexico/manufacturing-output

Novela, G. O., Lagarda, A. M., & López, E. J. (2020). La industria manufacturera en México: una historia de producción sin distribución.Retrieved fromCEPAL: https://repositorio.cepal.org/server/api/core/bitstreams/efcb54ba-7784-4f89-8ee1-a3e9f94d6db4/content

Tetakawi. (2023). The History of the Maquiladora Program in Mexico. Retrieved from https://insights.tetakawi.com/the-history-of-the-maquiladora

Tijuana EDC. (2023). Manufactura aeroespacial en Mexico.Retrieved from https://es.tijuanaedc.org/manufactura-aeroespacial-en-mexico/