What are the Nearshoring-Challenges of the country Mexico?

As we know, numerous global corporations are currently shifting their production to Mexico or expanding their manufacturing capacities in the country. This is fueling a robust demand for capital goods: In the first quarter of 2023, investments in machinery and equipment increased by 17.6 percent compared to the same period last year.

In 2022, FDI totaling 35.3 billion US dollars (US$) flowed into the country. This represents the third-highest level ever recorded, following the years 2013 and 2015. In the medium term, Mexico could potentially attract FDI of up to 60 billion US dollars, according to the consulting firm Deloitte.

The 5 nearshoring challenges of Mexico

These are promising hard facts for the country, however what challenges does Mexico face with all the demands? We have listed some of the top 5 challenges

Rising Labor Costs:

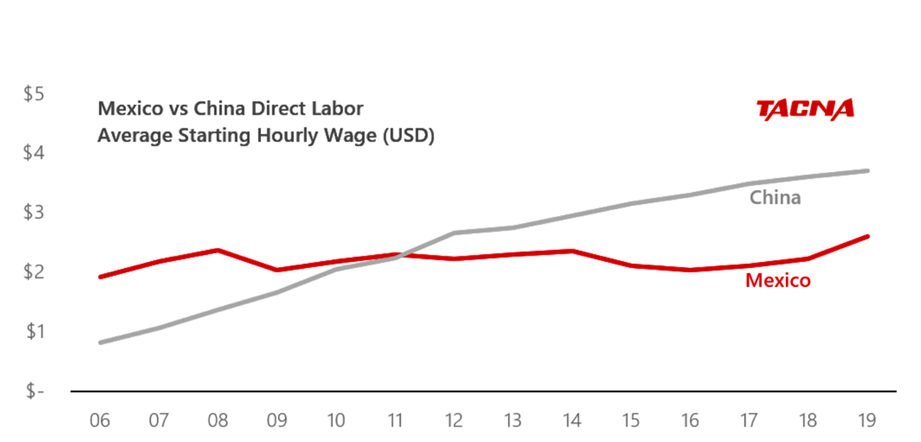

One of the key driving factors for companies looking to shift their manufacturing operations to Mexico has been its competitive labor rates. In contrast to China's increasing labor costs, Mexico offers a more cost-effective option. It can be observed in the following graphic that in recent years, the average wage for a manufacturing worker in China has risen to approximately $3.50 per hour, while in Mexico, it remains around $2.50 per hour.

This wage advantage has enticed major players like Ford and Apple to move their production to Mexico, expecting annual savings in the hundreds of millions of dollars.

However, Mexico must be cautious not to follow the path of China, where rising labor costs became a challenge for the nation's manufacturing sector. As Mexico's quality of life improves and wages increase, the country needs to find a balance between higher wages for its workforce and maintaining cost-effective manufacturing.

Need for Skilled Labor

While Mexico offers competitive labor rates, it must also focus on developing a skilled workforce. The nearshoring industry requires not only plant workers but also engineers, technicians, and logistics experts. To meet the demands of modern manufacturing, Mexico needs to invest in education and training programs that can produce a workforce capable of operating and managing advanced production processes.

Regional Disparities

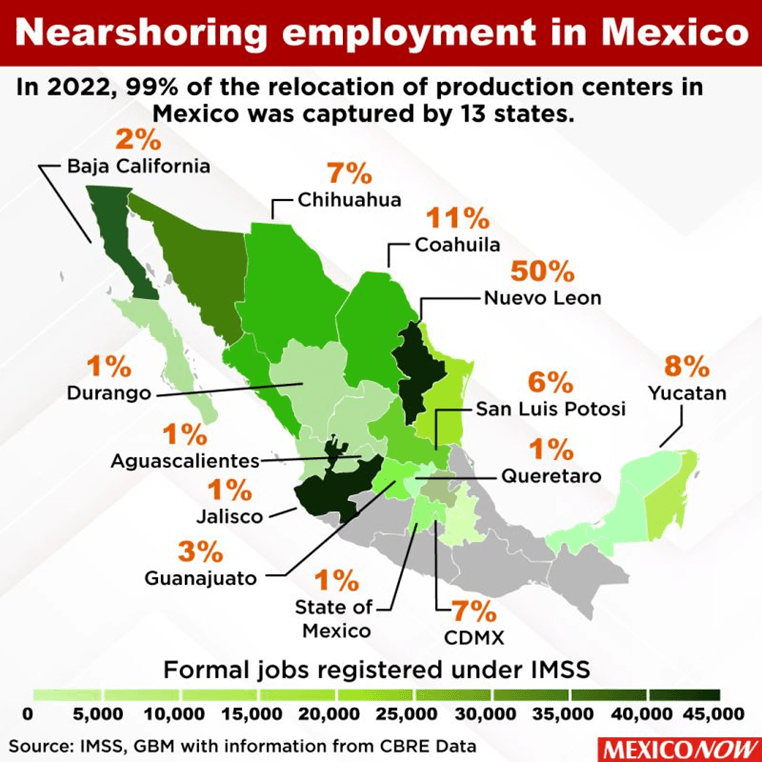

Mexico's nearshoring success is not uniform across the country. Certain regions, such as Nuevo León, Sinaloa, Aguascalientes, and Coahuila, stand out as favorable destinations due to their skilled labor force, better working conditions, and developed infrastructure. In contrast, states like Guerrero and Oaxaca face challenges in attracting investment due to a lack of skilled labor, inadequate transportation infrastructure, and limited educational institutions geared toward the needs of the nearshoring industry.

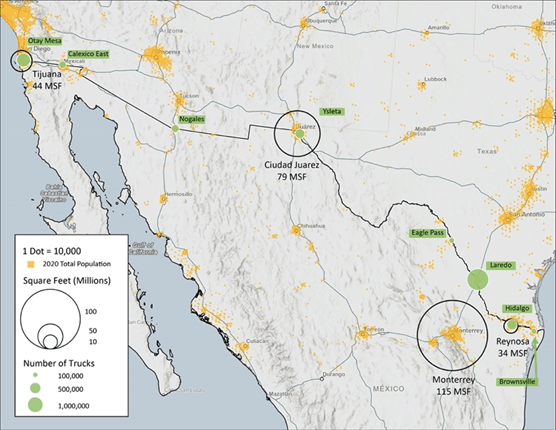

The following image shows the percentage of concentration of production centers in states like Nuevo León, Coahuila, and Chihuahua.

Mexico's ascent as a nearshoring hub is not without its labor-related challenges. While the country offers competitive labor costs and abundant sunlight for renewable energy, it must navigate rising labor expenses, invest in workforce development, and address regional disparities.

Infrastructure

Mexico's role as a nearshoring destination is gaining prominence, driven by various factors, including the growth of e-commerce and the need for cost-effective manufacturing solutions. However, Mexico faces significant infrastructure challenges that need to be addressed to fully capitalize on its nearshoring potential.

Industrial Building Deficit

Mexico currently faces a deficit of 11 million square meters of industrial warehouses, and the demand for such spaces for nearshoring is expected to reach 2.5 million square meters in the current year. To attract investment and accommodate the growth of new industries, addressing this warehouse deficit is crucial. Moreover, infrastructure deficiencies in areas such as electricity, water, transportation, and information technology are hindering the country's development. Without adequate infrastructure, Mexico cannot fully leverage its geographic advantages.

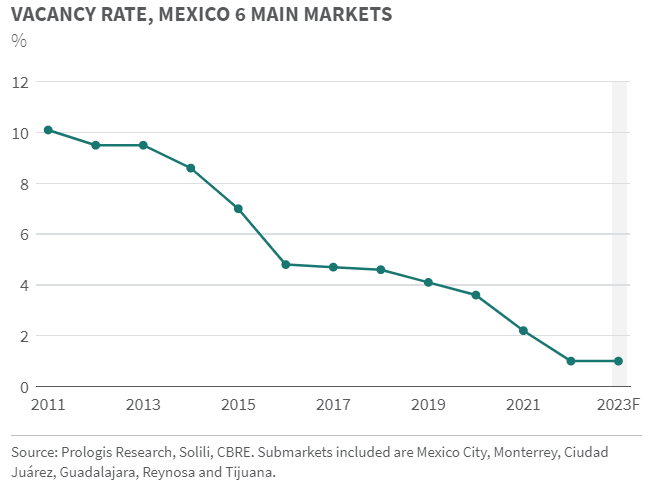

Demand for industrial space are at all time high

Prologis Research' Aricle demonstrate the extremely limited availability of space, at 1.1% as of Q1 2023, in contrast to the 6% average during the expansionary period of 2013-2019, is driving future demand. Currently, 60% of the space under construction is already pre-leased, a significant increase from the 36% pre-leasing rate observed in 2019. Alongside the challenges associated with bringing new supply to the market, this low-vacancy environment resulted in the highest recorded rent growth in the past decade, reaching 16% in 2022. Prologis anticipate that double-digit rent growth will persist into 2023.

Developing new Industrial Parks and Industrial Buildings to Attract Investment

To attract industrial clients and foster the adoption of new technologies, Mexico needs to develop lands with suitable infrastructure. Many industrial parks struggle to meet the energy and water requirements of certain industries, impeding their growth. A robust and comprehensive infrastructure development plan is essential to ensure that the country can accommodate the needs of nearshoring businesses.

High Demand for Logistics Spaces

The rise of e-commerce in Mexico, particularly since the onset of the Covid-19 pandemic, has led to the creation of 2,100 companies specializing in warehousing and deliveries. This surge in demand for logistics spaces and warehouses is expected to continue. Large retail companies are also increasingly focusing on expanding their online sales, further driving the need for logistics facilities. However, developers face the challenge of finding suitable locations with optimal infrastructure for constructing these projects.

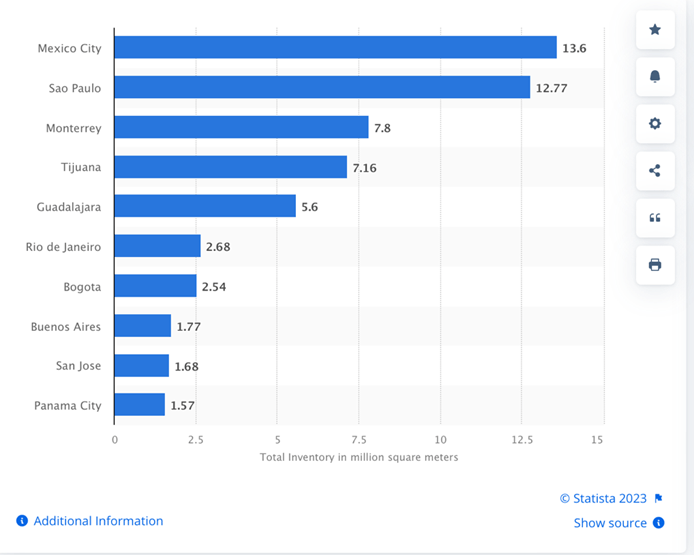

The graphic shows a comparison of the volume of industrial and logistic real estate space between important LATAM cities, we can observe that Mexican cities appear on the top 5.

Growth of E-commerce Sector

Large retail companies are increasingly focused on boosting their online sales, which is expected to further increase the demand for logistics spaces in the e-commerce sector.

Indeed, the e-commerce sector is playing an increasingly important role in the demand for industrial spaces in Mexico and its nearshoring boom. With the exponential growth of online sales and the emergence of new companies dedicated to logistics and deliveries, there is a need for adequate logistics infrastructure to meet this ever-expanding demand.

As an example of this phenomenon, we have Mercado Libre, a global e-commerce giant and one of the main e-commerce platforms in Mexico. The company has experienced significant growth and has invested in building a strong logistics network. In the last four years, the company has multiplied its business volume in the country by six times and has established 90 warehouses and service points in Mexico, ranging in size from 2,000 to 100,000 square meters.

Connectivity and Innovation

To remain attractive to foreign investment in various industrial sectors, Mexico must focus on improving connectivity in its logistics infrastructure. This includes expanding port capacity, enhancing road and rail networks, transitioning to cleaner energy sources, and advancing telecommunications, including the expansion of 5G connectivity. Additionally, fostering innovation in technology and manufacturing can provide Mexico with a competitive edge, particularly in high-tech industries such as microprocessors.

It is shown on the map the logistic market square footage, number of annual cargo land border crossings and the population in 2020 in northern Mexico. The country’s proximity with the US is an advantage, Mexico needs to improve its connectivity.

Efficient Supply Chain Management

Efficient supply chain management is a critical challenge in the context of nearshoring, especially in the construction sector. Outsourcing services to providers in different geographic regions require a seamless and reliable logistics and transportation system. Mexico benefits from its strategic location near the United States, a major source of companies with extensive supply chains. Furthermore, the US-Mexico-Canada Agreement (T-MEC) offers competitive advantages for nearshoring. The expansion of freight railroads can significantly benefit the construction sector by improving sustainability and cargo capacity.

Energy

One of the primary challenges facing Mexico's nearshoring strategy is ensuring a reliable energy supply. The director of Sustainable Economy at the Mexican Institute for Competitiveness (IMCO), Jesús Carrillo, highlights that Mexico's energy supply, including electricity and water, poses significant challenges. The national power grid's saturation, particularly in the northern and central regions of the country, is a widespread issue that needs to be addressed. Indeed, limitations of Mexico’s federal transmission grid have forced real estate developers to build alternative infrastructure, leading to delays for companies with larger electricity requirements.

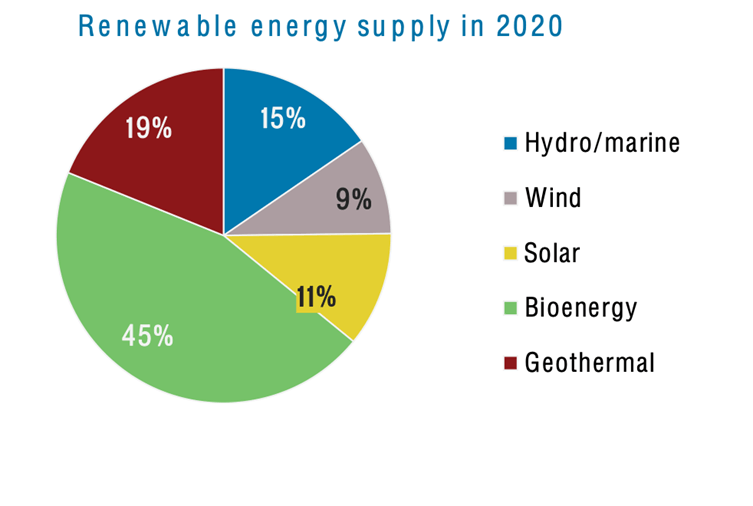

To support the growing demand, there is a pressing need to develop additional energy transmission infrastructure and build clean and renewable energy generation facilities. Specialized technology companies and those focused on electromobility will require more energy, potentially leading to an annual demand growth higher than the traditional 3-4%.

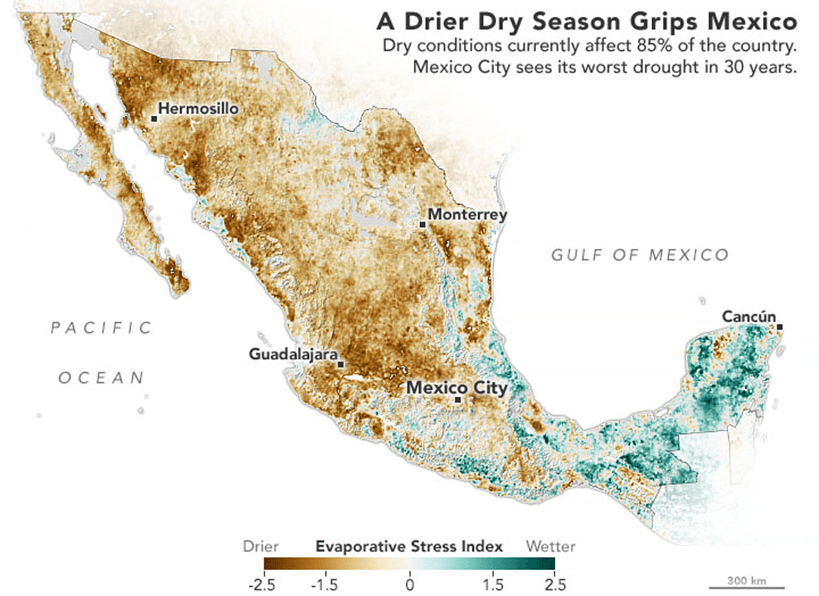

In addition to energy, access to an adequate water supply is vital for industries. Mexico's susceptibility to prolonged droughts in some regions can influence investment decisions, making water infrastructure development crucial.

Regulatory Clarity and Support for Renewables

The success of nearshoring also depends on regulatory clarity and support for renewable energy sources. Mexico must promote the generation of clean and renewable energy through effective public policies. Encouraging the private sector to invest in renewable energy infrastructure is essential to meet increasing demand and sustainability goals.

Collaboration with the Private Sector

Mexico's energy challenges are partly attributed to inadequate planning. To seize the nearshoring opportunity, there's a call for greater collaboration between the government and the private sector. Allowing the private sector to play a more significant role in energy infrastructure planning can help identify critical investment areas.

Embracing Renewable Energy

Mexico's transition to clean and renewable energy is essential to meet decarbonization and sustainability objectives. The country has substantial untapped renewable energy potential, but investment and development are needed to fully utilize these resources. Mexico's commitment to clean energy, as outlined in international agreements, underscores the importance of this transition.

Security

Organized crime remains a significant security threat in Mexico, primarily driven by major drug cartels such as the Sinaloa Cartel, los Zetas, the Gulf Cartel, and others. These cartels have diversified into non-narcotics-related criminal activities, posing a long-term threat to multinational businesses operating in Mexico.

Cartel-related violence, including conflicts between rival cartels, confrontations with government authorities, and diversification into non-narcotics crimes, continues to drive insecurity in Mexico. This violence can directly impact business operations.

Security Concerns for Businesses

Businesses operating in Mexico should be aware of specific security concerns, including extortion, supply chain theft, kidnapping (physical and virtual), human smuggling, resource theft (e.g., petroleum), auto theft, assassination for hire, money laundering, and piracy of products and software.

Corruption and extortion pose significant risks to businesses. Understanding how to counter these threats through proactive measures is essential for safeguarding operations.

Protecting the supply chain is critical, particularly given Mexico's unique cargo theft patterns and vulnerabilities. Businesses need to assess the desirability of their products to thieves and adapt their security measures accordingly.

Implications for Nearshoring

Nearshoring in Mexico presents an ideal opportunity for businesses, but it comes with risks. Understanding and addressing these security challenges is crucial for the success of nearshoring operations. Businesses must consider their vulnerability to theft and violence, as well as develop comprehensive security strategies.

The Mexican government's efforts to combat insecurity have been insufficient. The private sector emphasizes the need for a more effective and comprehensive national security strategy, including police force reform and improved law enforcement.

While nearshoring in Mexico offers economic benefits, it is essential for businesses to acknowledge and address the persistent security threats. Understanding the security landscape, assessing specific risks, and implementing proactive security measures are vital steps in ensuring the safety and success of nearshoring operations. Collaborative efforts between the private sector and the government are also crucial to combating organized crime and creating a more secure environment for businesses.

The success of Mexico's nearshoring industry hinges on its ability to strike a balance between higher wages for its labor force and maintaining cost-effectiveness through automation, infrastructure development, and access to cheap energy. By addressing these challenges, Mexico can secure its position as a top-tier global manufacturing hub for years to come.

Do you need help to overcome those nearshoring challenges?

Are you ready to embrace the advantages of nearshoring in Mexico while mitigating the associated challenges? Contact us today to discover how we can help you find the ideal suppliers, distributors, and logistics centers to make your nearshoring venture a resounding success. Let's unlock the full potential of nearshoring in Mexico together.

Central Interactiva. (2023). Retos y desafíos del nearshoring en el panorama actual de la construcción en México. Retrieved from https://www.expocihachub.com/nota/ingenieria-y-construccion/retos-y-desafios-del-nearshoring-en-mexico#:~:text=Uno%20de%20los%20desafíos%20más,específicas%20puede%20ser%20un%20desafío.

Entrelíneas. (2023). SUMINISTRO DE ENERGÍA, AGUA Y PERSONAL, RETOS EN LOS ESTADOS ANTE NEARSHORING.Retrieved from https://entrelineas.com.mx/mexico/suministro-de-energia-agua-y-personal-retos-en-los-estados-ante-nearshoring/

Escobar, S. (2023). E-commerce impulsa ocupación de espacios logísticos, pero no hay infraestructura suficiente para atender la demanda.Retrieved from https://www.eleconomista.com.mx/econohabitat/E-commerce-impulsa-ocupacion-de-espacios-logisticos-pero-no-hay-infraestructura-suficiente-para-atender-la-demanda-20230526-0003.html

Espejo, S. (2023). Nearshoring an opportunity for Mexico, but energy to power it could be a challenge. Retrieved from https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/081723-nearshoring-an-opportunity-for-mexico-but-energy-to-power-it-could-be-a-challenge?_its=JTdCJTIydmlkJTIyJTNBJTIyMTEwOGQ0YWYtNzNkYy00MmJkLTlhYTYtYzE5ZTZjYWVjNDI4

Estrella, V. (2023). Déficit industrial y de mano de obra, entre los retos de los estados ante el nearshoring.Retrieved from https://www.eleconomista.com.mx/estados/Deficit-industrial-y-de-mano-de-obra-entre-los-retos-de-los-estados-ante-el-nearshoring-20230718-0066.html

Forbes. (2023). Los retos de la sociedad ante el nearshoring.Retrieved from https://www.forbes.com.mx/los-retos-de-la-sociedad-ante-el-nearshoring/

Goslin, C. (2023). THE SECURITY RISKS OF NEAR-SHORING TO MEXICO. Retrieved from https://cclshouston.com/blog/36-the-security-risks-of-near-shoring-to-mexico

Greenberger-Bright, J. (2023). What Moving China Production to Mexico Means for Energy Sector. Retrieved from Mexico Business News: https://mexicobusiness.news/energy/news/what-moving-china-production-mexico-means-energy-sector

Noguez, R. (2023). México necesita sí o sí energías renovables para captar inversiones del nearshoring: Moody’s.Retrieved fromhttps://www.forbes.com.mx/mexico-necesita-si-o-si-energias-renovables-para-captar-inversiones-del-nearshoring-moodys/

Porras, E. (2023). Tres retos para materializar la oportunidad del nearshoring en México.Retrieved from EGADE IDEAS: https://egade.tec.mx/es/egade-ideas/opinion/tres-retos-para-materializar-la-oportunidad-del-nearshoring-en-mexico

PROLOGIS. (2023). IMPACTS OF NEARSHORING ON DEMAND FOR MEXICAN LOGISTICS REAL ESTATE. Retrieved from https://www.prologis.com/news-research/global-insights/impacts-nearshoring-demand-mexican-logistics-real-estate?utm_source=organic_social&utm_medium=linkedin&utm_campaign=research