Why is there exactly NOW a nearshoring boom in Mexico?

Why are companies nearshoring to Mexico?

In the past 4 years, the world’s supply chain underwent dramatic changes and many companies had to redefine their portfolio strategies. It clearly illustrated just how risky it was to have such a heavy reliance on a weakening supply chain and dependent on one region – mainly on Asia.

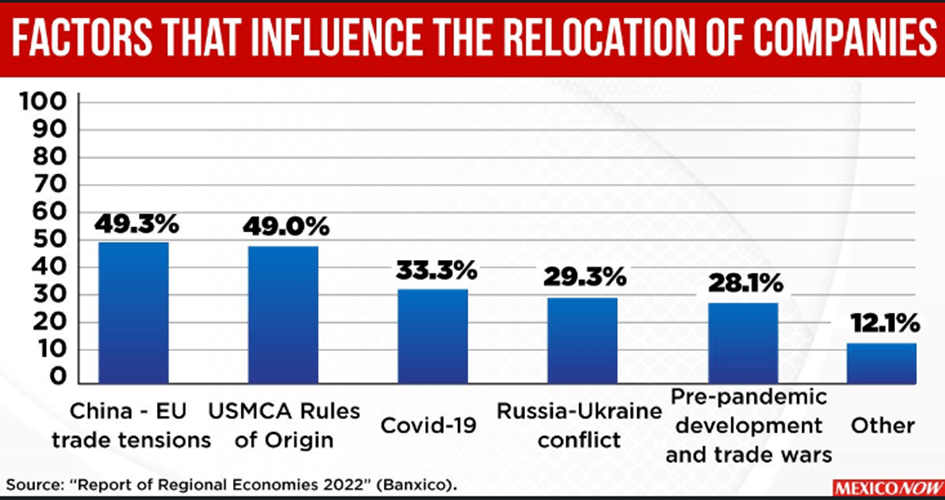

The geopolitical challenges such as the war in Ukraine, the commercial war between the United States and China and of course the Covid-19 pandemic, have prompted companies to relocate or nearshore their operations and move closer to their consumers and buyers. Thus, this trend presents a huge opportunity for Mexico as a popular nearshoring destination for companies selling to the North American market. Geographic proximity, lower labor costs, and the United States-Mexico-Canada trade agreement (USMCA) are facilitating this trend.

As we can see in the graph below, events like the Suez-Canal, Covid-19, or the on-going Ukraine-War were a wake-up call for many companies to overthink their supply chain strategy.

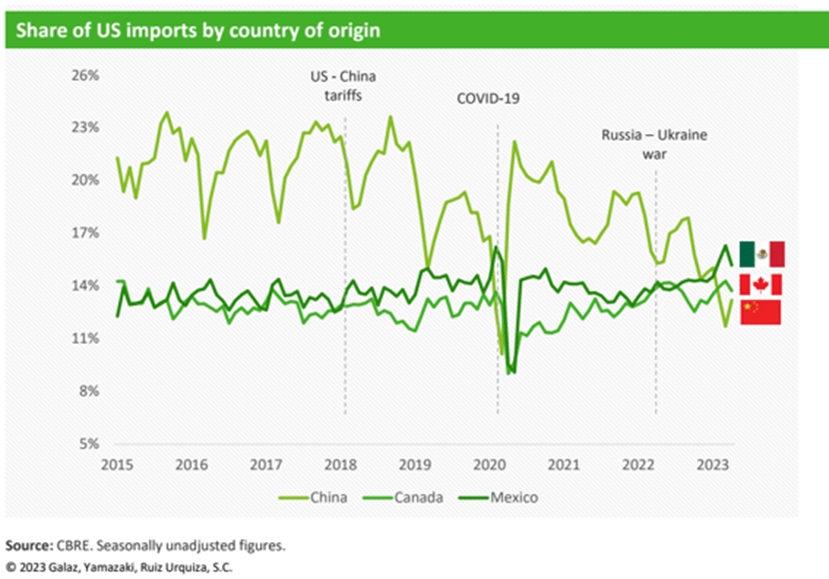

Those are all events which favor Mexico’s nearshoring boom. As you can see in the graph below, Mexico has never had more exports to the United States as China. Indeed, in some times over the last 8 years, China had double as much exports as Mexico to the United States – until 2023. Thanks to the nearshoring activities, Mexico has exported more products to its neighbor country than any other country. This is historic and has never been achieved – and the peak has not arrived yet!

The nearshoring boom has started just about two years ago. Why is there exactly NOW a nearshoring boom in Mexico? Beside “the Domino-Effect”, we explain you in this Blog article the other 4 main reasons why companies are forced to diversify their production portfolio and the country Mexico is taking advantage of it.

Benefits of nearshoring to Mexico

Over several years if not even decades, Mexico offers various reasons to international companies to settle down its manufacturing and do nearshoring.

Trade Agreements: Mexico has a network of free trade agreements, including the United States-Mexico-Canada Agreement (USMCA, formerly NAFTA). In addition, Mexico is the second largest economy in Latin America and fifth largest in the Trans-Pacific Partnership (TPP)

Cost-Efficient Supply chain: While transportation from China to the USA by sea often takes two weeks across the Pacific, goods from Mexico's manufacturing facilities are usually only 24 hours or less.

Market Size: Mexico's geographic proximity to the USA, one of the largest consumer markets in the world (350 million), makes it an attractive location for companies looking to produce nearby.

Highly Skilled Workforce: Increasing proportion of well-educated professionals, including those with experience abroad Low average age (28-29 years) of the Mexican population compared to Germany, Austria, and Switzerland (48 years)

Cost advantage due to low personnel costs (up to 30-50% savings compared to production in the USA)

Cultural and Time ZoneSimilarities Mexico's cultural affinity and similar time zones to North America can facilitate communication and collaboration between companies and their nearshore partners. In addition, many Mexican worker are bilingual and speak beside Spanish also English.

Industry Specialization: Some industries such as electronics, automotive, aerospace, and medical devices, have seen significant nearshoring activity in Mexico due to the country's established expertise in these sectors.

The 4 main reasons for the Nearshoring Boom

As we see on the examples above, there are several advantages why company should move to Mexico. However, there are four events which have occurred over the last 4 years and triggered the nearshoring boom. Indeed, the reasons below have brought the long-ignored issue of supply chains to the forefront.

1. USA – China Relation Commercial war

The trade tensions between China and the United States, often referred to as the "trade war," led many companies to reevaluate their supply chain strategies. Indeed, the Tariffs imposed by the United States in 2018 have caused to thousands of businesses to look for alternative markets to reduce costs. And thanks to the USMCA-Agreement and proximity to the United States, Mexico became an attractive option for companies looking to diversify their sourcing.

The trade war was initiated by the former US President Donald Trum who had been determined to revolt against China’s so called protectionism. Indeed, China exported US$557.9 billion worth of goods to the US in 2018, which was approximately four times the amount that US exported to China in the same year. In order to fight against the trade deficit of US$ 375 billion, Trump revolt against the trade practices of China, including Governments direct control over its currency, industrial policy and Chinese firms’ violations of US sanctions on third countries. China itself responded by charging a tariff of 25% on USö16 billion worth of exports from the United States. This was only the start of the commercial war.

Chinese companies take advantage of Nearshoring Boom

In November 2022, over 400 Chinese companies announced that the future of the economy lies in relocation or nearshoring. Due to the trade dispute between the United States and China, Chinese companies do not want to lose the American market. The nearshoring boom has been especially reflected in companies in the automotive and basic metals sectors, which seek to guarantee the availability of supplies during the manufacturing process and facilitate the transfer of finished products to the target market, to be commercialized. Thanks to the proximity to the American market, Nearshoring is the strategy in which a transnational organization establishes its manufacturing, assembly or supply processes in the country or continent where they will be marketed, thus reducing the risk of suffering operational interruptions.

But not only Chinese companies moving to Mexico; Around 50 Mexican companies which had migrated to China are now preparing to return to the country as part of the nearshoring trend. Mexican companies are bringing back their plants to North America because their customers in the United States now require products in a timely manner. Now there is a great opportunity in attracting US companies, which require assistance with soft landing, company establishment, and official standards certification.

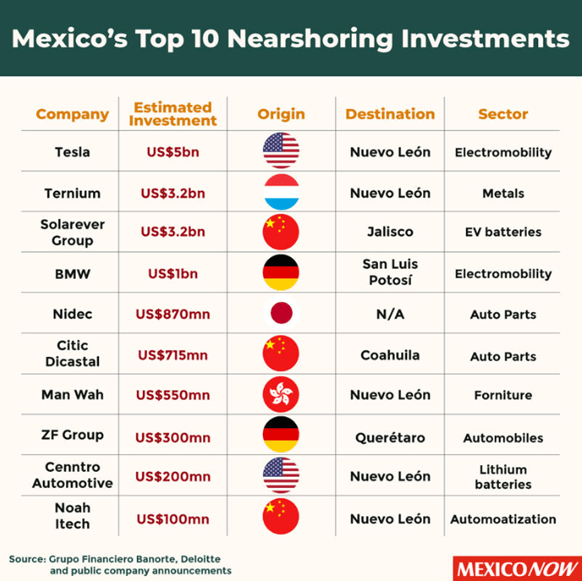

Below, you can find the recent Top 10 nearshoring investments by foreign companies. The graph shows that beside American and Chinese company also other countries like Germany, Netherland, Vietnam, or Hong Kong have made significant investments. The investments are not only from the automotive industry but also furniture, Metal or Electronics.

A 'tsunami' is coming with nearshoring thanks to the commercial war

The accelerated growth of nearshoring involves implementing business, legal, and fiscal strategies to gain both economic and logistical advantages. Companies can now have their production close to customers, save on labor costs and expenses, and have better products.

Nearshoring — the trend of transnational industries setting up production lines in countries close to their main markets to reduce costs — is also a significant opportunity for the growth of the Mexican economy, at least for the next decade. Mexico has a greater trade openness, a much more diversified economic structure, and a much more prepared workforce than China.

Nearshoring, driven in large part by the Treaty between Mexico, the United States, and Canada (USMCA), benefits the country by increasing foreign investments' arrival, as well as the market players' competitiveness, improving response times, and reducing significant risks by consolidating distribution chains.

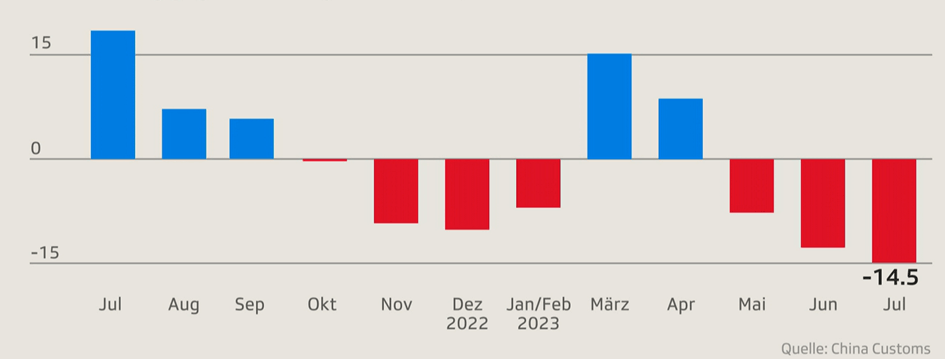

China's export business is weakening

Beside the dynamic relationship between China and the United States which involucrate escalating tensions and trade disputes, imposed tariffs have introduced uncertainties into cross-border commerce.

In the graph below, we can see that the exports from China to other countries decline the seventh time this year already vs. previous year.

Change of exports versus the same month of a year before, in %

2. Covid-19 Pandemic

The second reason for the nearshoring boom is the Covid 19 pandemic. Over decades, all international companies moved their production facilities to China – its cheap, has the second largest market and good trade relations with the United States. Prior to the pandemic in 2019, another episode underscoring supply chain fragility; the blockage of the Suez Canal by the Ever-Given vessel in March 2021 sent shockwaves through international trade. The incident created a bottleneck of vessels, translating to delayed shipments and a domino effect across global supply chains, especially in Europe. Costs of one ship blockage: 55 billion dollars within days.

Then the COVID-19 pandemic unmasked vulnerabilities in worldwide supply chains. The implementation of lockdowns, quarantines, and movement restrictions reverberated across industries, impacting production, transportation, and workforce availability. The rapid spread of the pandemic led to closing of borders globally, which in turn impacted the availability of goods and delivery times during a time when the demand for various products increased. It made Europe aware how dependent they are on the Asia suppliers.

Nearshoring reduces supply chain costs

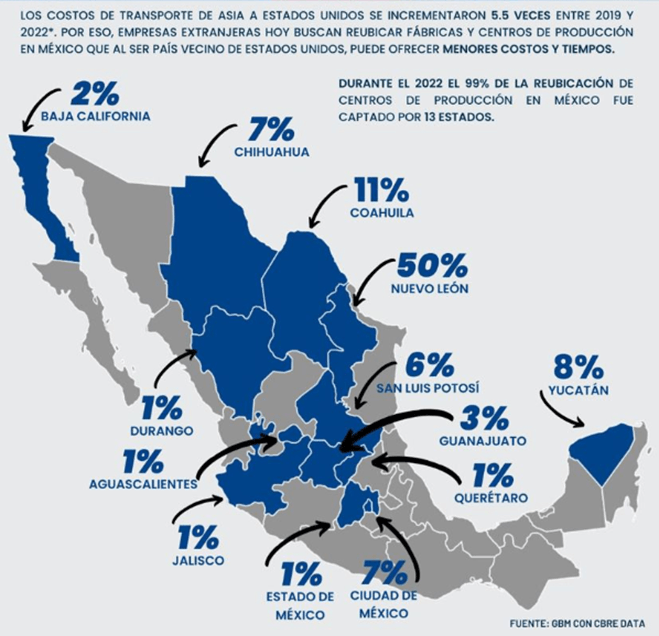

The transportation costs from Asia to the United States increased 5.5 times between 2019 and 2022. As a result, foreign companies are currently seeking to relocate their factories and production centers to Mexico. Being a neighboring country to the United States, Mexico can provide reduced costs and shorter lead times.

Nearshoring boom in the north of Mexico

As we can see on the graph below, especially the North of Mexico took advantage of the relocation of international companies. Throughout 2022, 99% of the production center relocations to Mexico were concentrated in 13 specific states, in which Nuevo Leon is leader ahead of Coahuila and Chihuahua. To mentioned is that there is also a huge nearshoring boom in Yucatan, the south of Mexico.

3. Russia-Ukraine War

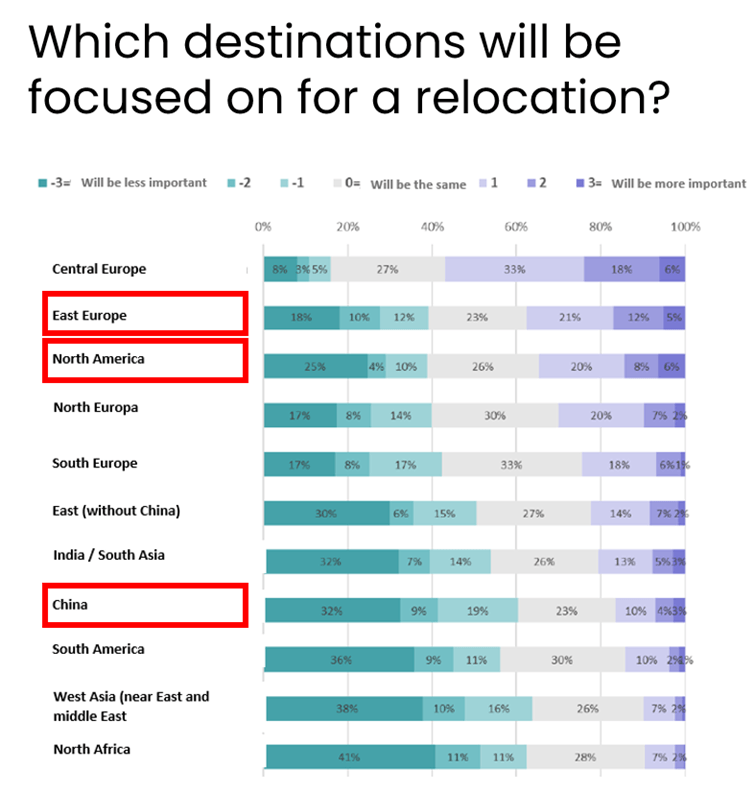

In midst of the pandemic, many European companies tended to nearshore their productions to the East of Europe. A Swiss survey (see below) with over 600 companies revealed in 2021 (before the Ukraine War), that East Europe (38%) and North America (34%) are more attractive than Asia (17%). However, the outbreak of the war in Ukraine limited companies the supply of raw materials as well as manufacturing mass productions in the East. In addition, the exponentially increased electricity costs forced businesses worldwide to diversify its portfolio. Indeed, as the conflict disrupts trade routes and escalates geopolitical tensions, businesses face a cloud of uncertainty over the stability of their sourcing networks. Those heavily reliant on goods or materials from Ukraine are at risk of encountering delays, shortages, and heightened vulnerabilities due to potential disruptions.

Survey by Kalaidos University 2022, before Ukraine War to 600 Swiss companies

Electricity costs force companies to do nearshoring

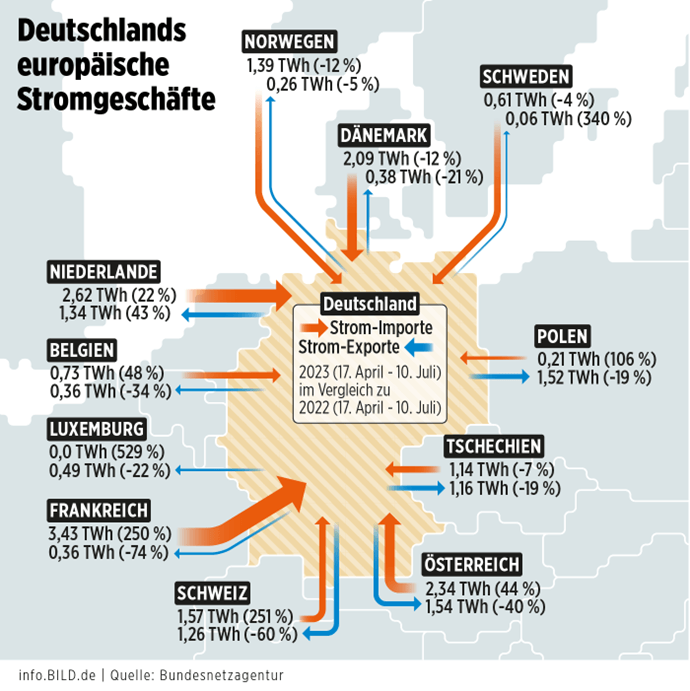

Germany is importing more electricity than ever before. According to the Federal Network Agency, it was 5,783.4 gigawatt-hours in July – an all-time record. NEVER BEFORE has Germany purchased so much electricity from abroad.

Indeed, many European countries are very dependent on the Russian gas as they cannot produce yet sufficient sustainable, clean electricity.

As we can extract from the graph below, the export balance for Germany in Jul 2023, in terms of electricity trading with its EU neighbors, was 469 million euros (cause: more imports than exports). The export price was only 38.60 euros per megawatt-hour (MWh), while the import price was 97.20 euros. This means: Germany is paying almost 60 euros more per MWh for imported electricity compared to what our EU neighbors pay for their electricity.

4. “The Domino effect”

Many large companies such as Tesla, Solarever Group, Nideg, Honeywell, etc., have announced in the last months to expand their production to Mexico – and if you are a supplier of one of the mentioned companies, you must move as well to guarantee a cost-efficient supply chain. In the automotive industry, we can also talk of a “Tesla-Nearshoring-Effect”; Electronic cars are booming and many suppliers from Tier 1 do not want to lose them as a client – and the same counts for Tier 2, 3 and raw materials producer.

“Tesla effect” examples of nearshoring

Example 1: Kuntai Company, is a leader in the automotive sector from Tier 1 and engaged in the design, development, production and sales of soft interiors for vehicles. They are a leading Tesla supplier and to strengthen their position, Kuntai plans to establish its presence in Durango with an investment of US$30 million, creating 300 new jobs. This again will require actions from their suppliers (Tier 2, Tier 3, and so on), as if they are not producing already in Mexico, they must take strategical decisions whether it will not make sense to build up a production space as well and invest into Mexico. This domino-effect phenomenon does not only exist in the automotive sector, but also in any other kind of industries such as Electronic, Aerospace or Appliances.

Example 2: The company Indorama Ventures Mobility Scottsboro is a manufacturer of airbag fabric for Tesla and Ford Motor Company vehicles and will invest 600 million Mexican pesos in Puebla. The Thai company specialized in sustainable chemical industry, operates 124 productive plants in the petrochemical sector and will be strengthening its presence in the Mexican market with this investment in Puebla.

As global economies diversify supply chains away from China, certain emerging market countries will stand to benefit disproportionately. The biggest will keep getting bigger, and those with scale will be able to command a fair return on their investment. Beside Mexico, other beneficiaries will be India, Vietnam, and Indonesia.

Tesla Nearshoring encourages other companies

Now, we can clearly see that especially the large companies do the first move to Mexico. However, it is indispensable that many hundreds other mid and small sized organizations will also do take advantage of the nearshoring boom. Once Nuevo Leon announced that Tesla will start operating in Mexico and invest over $5 Billion USD into their production plants, it had a positive sign worldwide and encourage also other companies to do nearshoring in Mexico.

Do you want to take advantage of the Nearshoring boom?

To sum up, nearshoring to Mexico allows companies to reduce supply chain risks and ensure smoother operations in times of crisis. In a globalized w in global world with a lot of competition, it is indispensable to have a diversified production portfolio and not being heavily reliant on a single country like China. Lockdowns, travel restrictions, and disruptions to manufacturing highlighted the need for more resilient and agile supply chain solutions.

Fact is that this year over 60’billion USD will be invested by foreign companies thanks to the nearshoring boom. Are you considering nearshoring in your supply chain strategy?

Talk to us!