Mexico’s Foreign Direct Investment in 2024: Record Numbers, Real Signals

Executive Summary: Mexico’s FDI Signal for Decision-Makers

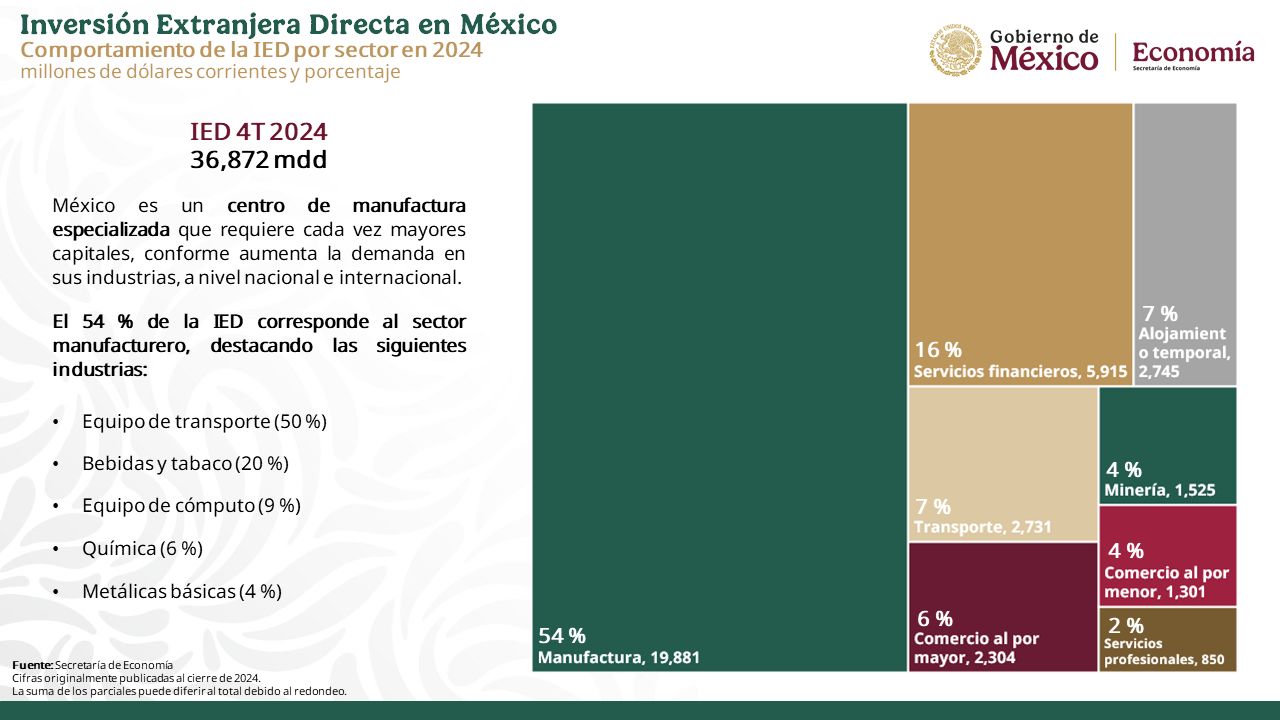

Mexico attracted a record USD 36.87 billion in Foreign Direct Investment in 2024, confirming its role as a core nearshoring destination for North America.However, over 80% of inflows came from reinvested earnings, while new investment dropped to its lowest level in three decades.

For executives, the signal is clear:Mexico remains strategically relevant, but future growth depends on execution certainty, regulatory clarity, and infrastructure readiness rather than headline numbers alone.

Mexico’s Foreign Direct Investment Reaches a Record — But with a Structural Shift

Mexico closed 2024 with USD 36.87 billion in FDI, the highest preliminary figure ever reported by the Ministry of Economy. At first glance, the number reinforces the narrative of Mexico as a prime nearshoring destination.

Yet beneath the headline lies a structural shift that investors cannot ignore.

Unlike the 2013 peak — driven by one-off M&A transactions — 2024’s inflows were dominated by reinvested profits, not greenfield expansion. This indicates confidence by existing players, but hesitation from new entrants.

Who Is Investing — And What That Signals

The United States remains Mexico’s anchor investor, accounting for 45% of total FDI, followed by Japan, Germany, and Canada. These flows are closely aligned with manufacturing supply chains serving the U.S. market.

What matters strategically is not just who invests — but why.Most inflows reflect capacity expansion, automation, and supply-chain consolidation, not speculative entry.

Manufacturing Remains the Core FDI Engine

Manufacturing absorbed 54% of total FDI, far outweighing services, transport, or hospitality. Automotive, electronics, and industrial equipment dominate, reinforcing Mexico’s position as a production platform — not merely a sales market.

This concentration confirms that nearshoring is structural, not cyclical — but also capital-intensive and sensitive to execution risk.

Where Capital Is Landing — And Why Geography Matters

FDI remains highly concentrated. Mexico City alone captured 39%, followed by industrial hubs such as Nuevo León, Baja California, Chihuahua, and Guanajuato.

This clustering reflects access to skilled labor, logistics corridors, and existing industrial ecosystems — but it also intensifies competition for energy, water, and talent.

The Critical Signal: New Investment Is Slowing

Despite record totals, new FDI collapsed by 34%, falling to USD 3.17 billion — the lowest level since 1993.

The slowdown accelerated in Q4 2024 amid renewed U.S. trade uncertainty. This does not invalidate nearshoring — but it raises the bar for execution.

Outlook: What This Means for Executives

Mexico’s FDI data sends a dual signal:

Yes, Mexico remains strategically indispensable for North American manufacturing.

No, capital will not flow automatically without clarity on permits, energy access, and regulatory predictability.

Future winners will be companies that move early, structure correctly, and localize intelligently.

FAQ – Mexico Foreign Direct Investment 2024

Why did Mexico reach record FDI in 2024?

Mainly due to reinvested profits by existing multinational manufacturers expanding capacity and upgrading operations.

Why is new foreign direct investment declining?

Uncertainty around trade policy, energy availability, and permitting timelines has delayed greenfield decisions.

Which sector benefits most from FDI in Mexico?

Manufacturing leads with 54%, especially automotive, electronics, and industrial production.

Is nearshoring in Mexico slowing down?

No — it is maturing. Capital is becoming more selective and execution-focused.

What should investors watch in 2025?

Energy infrastructure, regulatory stability, and the outcome of U.S.–Mexico trade discussions.