Foreign Direct Investment in Mexico 2025: Navigating Uncertainty and the Role of Plan Mexico

In 2025, foreign direct investment in Mexico faces a challenging yet transformative landscape. Amid geopolitical tensions, protectionist U.S. policies, and the unfolding Plan Mexico, investors are increasingly cautious. While Mexico remains a key nearshoring destination, the investment climate is evolving due to new tariff policies and uncertainty around the USMCA (T-MEC) agreement.

A Shift in Investor Sentiment

Investor confidence in foreign direct investment in Mexico has declined. According to BBVA economist Carlos Serrano Herrera, the uncertainty surrounding U.S. trade tariffs, judicial reform, and domestic politics has led to a cautious approach. Investors are waiting for "clear signals" before opening their portfolios.

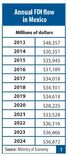

In 2024, FDI reached $36.87 billion, yet new investments dropped by 39%, accounting for only 8.6% of total FDI. Most capital came from profit reinvestment and intercompany accounts, indicating companies are expanding existing operations rather than launching new projects.

Plan Mexico: Strategic Vision or Ambiguous Policy?

Plan Mexico has been introduced as a guiding vision for economic transformation. However, its direction remains vague, which complicates long-term investment decisions. The interplay between Plan Mexico and foreign investment will determine how global companies allocate resources.

To improve investor sentiment, Mexico must clarify its policy trajectory. Legal certainty, political stability, and structural reforms will be key to converting potential interest in Mexico into actual FDI inflows.

USMCA: A Double-Edged Sword

Under the USMCA agreement, Mexico initially benefited from tariff exemptions, particularly in automotive manufacturing. However, with recent U.S. tariff hikes on steel and aluminum (up to 50%), these exemptions may not be permanent. The country must actively defend its position and ensure Mexico USMCA investment opportunities are preserved.

During May 2025, Mexico's automotive industry saw a 2.8% decline in exports. Tariff uncertainties have caused companies like Stellantis and Audi to reduce output, while those with stronger USMCA compliance, like Toyota and Honda, showed resilience.

FDI Trends in Mexico 2025: A Sectoral Breakdown

The majority of foreign direct investment in Mexico in 2024 went to:

Manufacturing industries: US$19.4 billion

Financial services: US$5.49 billion

Trade and transport: ~US$4.8 billion combined

Technology and innovation sectors, including semiconductors and clean energy, are emerging priorities under Mexico nearshoring strategy 2025.

Kearney Confidence Index: A Warning Sign

Mexico dropped from 21st to 25th place in the Kearney FDI Confidence Index. Despite this, it remains among the top emerging markets alongside Brazil, India, and China. The main deterrents are regulatory complexity, policy ambiguity, and declining judicial independence.

How to Invest in Mexico: Recommendations for 2025

To attract and sustain foreign direct investment in Mexico, the government should:

Provide long-term certainty about USMCA exemptions

Accelerate the implementation of Plan Mexico with clear milestones

Promote best sectors for investment in Mexico, like tech and green energy

Streamline regulatory and legal frameworks

Conclusion: Turning Interest into Investment

The outlook for FDI trends in Mexico 2025 is one of cautious optimism. While figures remain strong, the composition signals a shift toward internal growth over new entrants. For Plan Mexico and foreign investment to align successfully, the government must act decisively.

Only through clarity and reform can Mexico nearshoring strategy 2025 deliver its promise. Otherwise, the country risks losing its edge in global investment flows.