Mexico’s Mid-2025 Trade and FDI Outlook: Resilient Growth Amid Global Uncertainty

As the first half of 2025 wraps up, Mexico continues to defy global headwinds. Trade disruptions, rising protectionism, and shifting tariffs haven’t derailed the country’s upward momentum. Instead, Mexico has emerged as a resilient and increasingly strategic player in global manufacturing and nearshoring.

This article offers a fresh look at Mexico’s economic landscape through mid-2025—highlighting trade performance, investment trends, and the broader implications for businesses operating across North America.

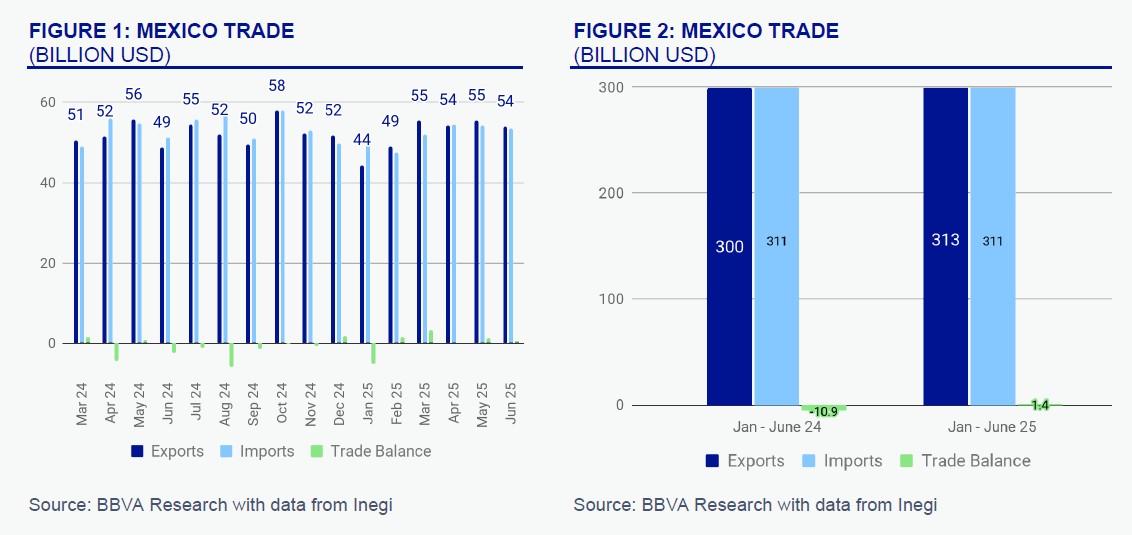

Trade Surplus and Export Stability: A Sign of Strength

Between January and June 2025, Mexico posted a trade surplus of USD 1.4 billion. Exports reached USD 313 billion, growing by 4.3% compared to the same period in 2024, while imports grew modestly by just 0.2%, totaling USD 311 billion. Monthly export figures have stayed steady, averaging between USD 50 and 56 billion—a sign of a resilient export economy despite external volatility.

Manufactured goods continued to dominate, making up nearly 90% of total exports. However, the agriculture and livestock sector has overtaken oil as Mexico’s second-largest export category, with a 3.9% share. This shift reflects a broader rebalancing of the country’s export mix—one that signals reduced dependency on energy and growing competitiveness in agri-food sectors.

Mexico’s Trade Landscape: Dominance of U.S., but China’s Role Grows

The U.S. remains Mexico’s primary trading partner, absorbing over 83% of its exports in 1H 2025. However, Mexico’s supply chain is becoming more diversified. China accounted for 20.1% of Mexico’s imports, reflecting a rising dependence on Chinese intermediate goods. This evolving trade structure emphasizes Mexico’s role as a bridge in the U.S.-Asia value chain—complementing, rather than competing with, American industry.

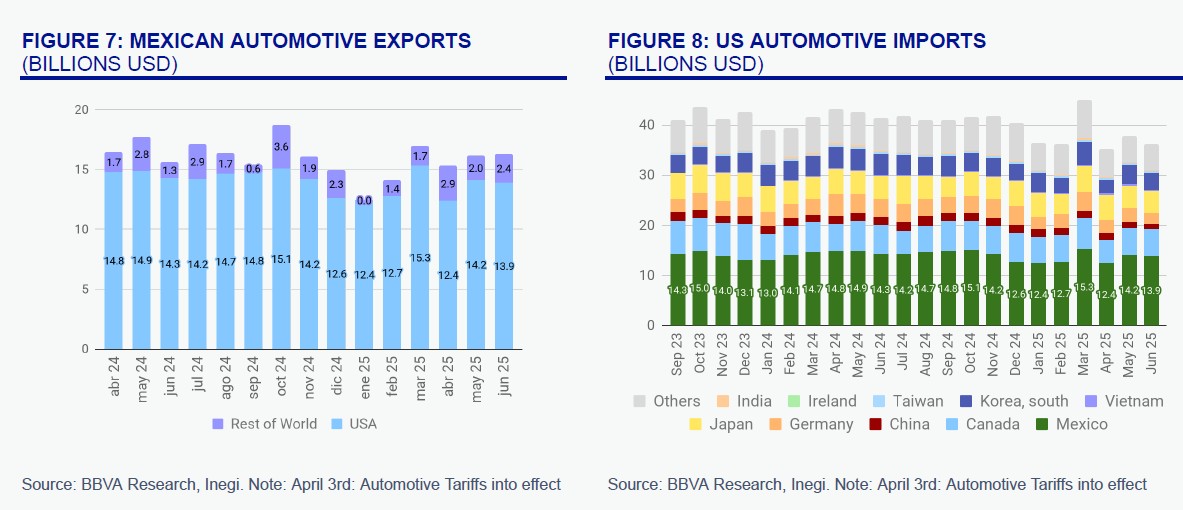

Tariffs and Trade Policy: Navigating Complexity with Strategy

Tariff conditions remain fluid, but Mexico has maintained relatively low trade barriers compared to other nations. As of June 2025, the average effective U.S. tariff on Mexican exports stood at 8.28%, even amid multiple new levies and policy changes. The rate reflects a mix of:

50% duties on steel and aluminum products (Section 232)

25% on automobiles—partially offset due to 18.3% U.S. content deductions

0% effective tariffs on auto parts that meet USMCA origin rules

Automotive exports to the U.S. fell by 5.6% YoY, but growth in exports to other countries (+9.6%) helped soften the blow. Importantly, over 82% of Mexico’s exports to the U.S. entered duty-free in 1H 2025—thanks in part to broader use of Chapter 99 exemptions, which bypass many sector-specific tariffs.

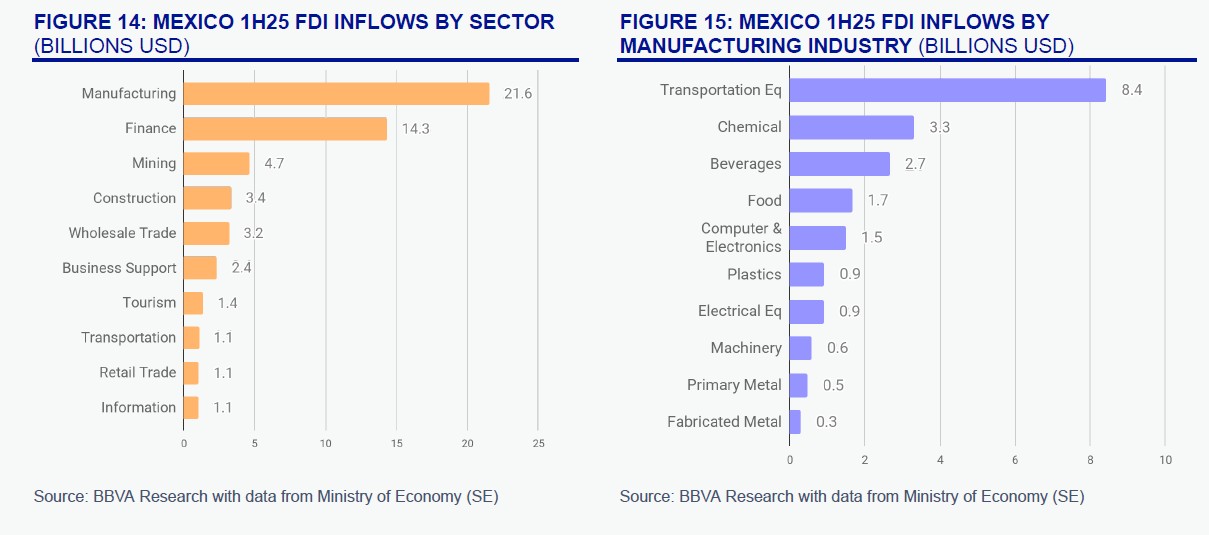

FDI Trends: Nearshoring Momentum Powers Investment Boom

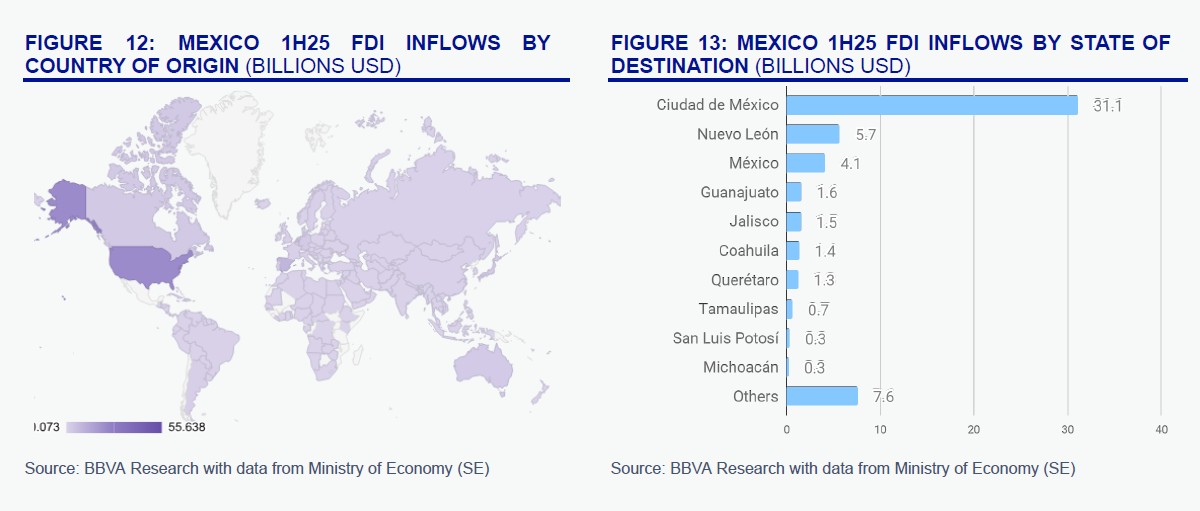

Mexico attracted USD 55.6 billion in foreign direct investment in the first half of 2025—an 8.2% increase over 1H 2024. Manufacturing led the way, drawing in nearly 39% of total FDI. Financial services followed with 25.8%, while the rest was spread across sectors such as logistics, data infrastructure, and renewable energy.

Reinvested earnings made up the bulk of FDI (81.9%), showing strong confidence from existing investors. Meanwhile, equity capital doubled year-over-year—often signaling the start of new projects driven by nearshoring trends.

Top FDI source countries include:

United States (USD 23 billion, 41.3%)

Spain (16.5%)

Japan (3.9%)

South Korea (1.7%)

Geographically, investment remains concentrated in Mexico City (55.9%), followed by Nuevo León (10.3%), State of Mexico (7.4%), and Guanajuato (2.8%).

Key Sectors on the Rise

FDI flows are powering growth in several strategic sectors:

Automotive & EV: Investments in electric vehicles and battery production are accelerating.

Aerospace: Northern and Bajío states are emerging as global aerospace hubs.

ICT and Data: Data centers and cloud infrastructure are expanding, especially around Guadalajara and Monterrey.

Logistics & Warehousing: E-commerce growth is boosting demand for logistics assets near industrial corridors.

Positioning for the Future: Strategic Edge in a Fragmented Trade World

Mexico is navigating U.S. tariff uncertainty with relative success. If broader USMCA usage increases and cooperation on issues like migration continues, Mexico’s average effective tariff could drop to as low as 4.0%. This would make Mexico one of the most accessible markets for U.S.-bound exports—far ahead of China, which faces rates of up to 32.6%.

This cost advantage, combined with proximity to the U.S., makes Mexico highly attractive for firms looking to realign supply chains and lower geopolitical risk.

Policy Support and Infrastructure: Mexico’s Long-Term Bet

The Mexican government has introduced key policies to sustain nearshoring momentum:

Nearshoring Decree: Tax benefits for manufacturers in strategic sectors like semiconductors and EVs.

Polos de Bienestar: Development zones in underutilized regions to promote regional production hubs.

IMMEX 4.0: A digital modernization of customs and compliance processes for export-oriented firms.

Combined, these initiatives are designed to boost Mexico’s global competitiveness and support its goal of becoming a top-tier manufacturing destination.

Conclusion: From Resilience to Opportunity

Mexico’s economic performance in 1H 2025 shows that it's not just surviving a tough global environment—it’s finding ways to thrive. With a stable trade surplus, rising FDI, and a strategic edge in North American supply chains, the country is becoming a magnet for long-term investment.

If tariff barriers ease and USMCA participation expands, Mexico may very well become the most competitive export platform in the Western Hemisphere.