Mexico Secures $78.2 Billion in Investment Across 346 Projects

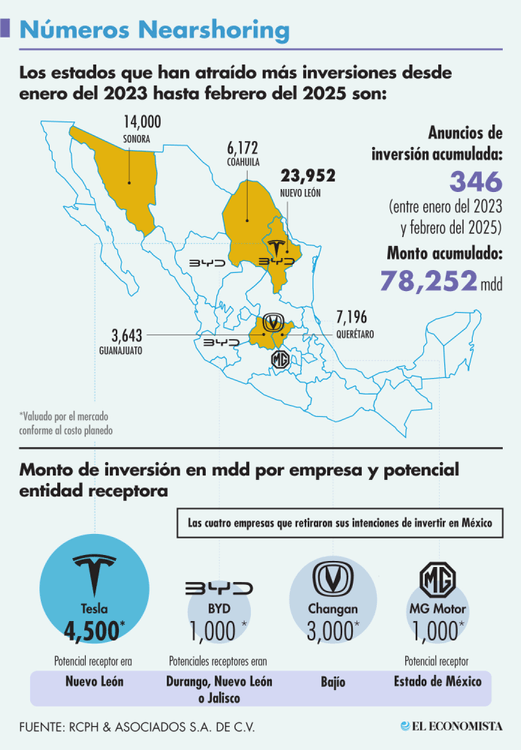

Between January 2023 and February 2025, Mexico attracted 346 investment announcements totaling $78.2 billion USD, according to consulting firm RCPH & Asociados. These announcements underscore the momentum behind nearshoring in Mexico, driven by its strategic location and strong trade ties with the U.S. and Canada under the USMCA.

Despite positive figures, $10 billion USD in investment promises were withdrawn by four mobility sector firms—Tesla, BYD, Changan, and NT Motor—due to rising trade tensions between the U.S. and China. Still, analysts anticipate a rebound as Mexico continues to benefit from nearshoring 2.0 and preferential tariff treatment by the U.S.

Sector Breakdown of Mexico’s Nearshoring Investment

The recent wave of foreign direct investment in Mexico has been concentrated in several key sectors:

Automotive sector: $27.4 billion (35%)

Energy sector: $19.7 billion (25%)

Real estate sector: $10.5 billion (13%)

Technology sector: $5.8 billion (7%)

While February 2024 marked a peak with $6.27 billion in investment announcements, activity has since cooled, reaching only 19 announcements worth $3 billion in early 2025. According to Luis Felipe Alcántara of RCPH, the slowdown reflects investor caution amid U.S. protectionist policies under President Trump’s administration.

Key Projects That Sustain Investment Momentum

Despite some withdrawals, multiple companies continue to support foreign direct investment in Mexico, reinforcing its position as a top nearshoring destination:

Mota Engil (Portugal): $3B USD for a fertilizer plant in Veracruz.

Toyota: $1.45B USD for upgrades in Baja California and Guanajuato plants, including hybrid pick-up production.

Schneider Electric: $1.3B MXN for a new intellectual manufacturing hub in San Pedro Garza García.

Bosch: $5.2B MXN plant in Salinas Victoria, Nuevo León, employing 1,500 workers.

Traxión: 22% investment increase in logistics capacity, mainly in northern and Bajío regions.

Siemens: $2B MXN to expand facilities in Nuevo León, Chihuahua, and Querétaro.

Fibra Nova: Ongoing BTS (build-to-suit) projects in Ciudad Juárez totaling 53,000 m² of industrial space.

Evergo: 10 EV charging stations across central Mexico with $52M MXN investment.

Citic Dicastal (China): $600M USD across two aluminum wheel plants in Coahuila.

Solarever Group (China): $1B USD battery plant for EVs in Jalisco.

NIDEC (Japan): $23M USD expansion in Reynosa, Tamaulipas.

Makino (Japan): $20M USD innovation center in Querétaro, expected to generate 200 jobs.

Nearshoring Outlook: A Second Wave Ahead?

Despite temporary headwinds, nearshoring in Mexico continues to evolve. As foreign direct investment in Mexico regains momentum, Mexico is well-positioned to capitalize on shifting global trade patterns, especially if trade negotiations under the USMCA remain favorable.

“The loss of a few investments is outweighed by the projects that remain,” said Luis Felipe Alcántara. “If political clarity improves, we could see the emergence of a ‘nearshoring 2.0’ trend.”

Conclusion

Mexico’s impressive haul of 346 investment projects worth $78.2 billion USD confirms its rising profile in the global manufacturing and supply chain landscape. While geopolitical uncertainty has slowed the pace in early 2025, robust sectoral diversification and infrastructure commitments ensure that nearshoring in Mexico remains on track.