U.S. Auto Tariffs Reshape North America’s Industry — Mexico Stands Firm

The U.S. auto tariffs introduced in 2025 are forcing a deep transformation across the global automotive supply chain, with Mexico’s auto industry taking center stage. A 25% tariff on imported light vehicles, new restrictions on auto parts, and sweeping duties on aluminum and steel are now the new norm. Yet amid uncertainty, Mexico’s auto exports, nearshoring advantages, and trade relationships under USMCA continue to provide strategic value.

Mexico Navigates a Shifting Trade Environment

Since April, Mexico’s auto manufacturing sector has faced new challenges. The U.S. administration implemented a 25% tariff on non-USMCA-compliant vehicles, and a 10% base tariff on other imports. A second wave in May affected auto parts, particularly those not produced in Mexico or Canada, with the exception of compliant content.

According to the National Auto Parts Industry Association (INA), over 92% of components built in Mexico already comply with USMCA rules, which gives the country an upper hand. However, this status is not permanent. By 2026, tariff credits on imported parts will shrink from 15% to 10%, eventually expiring.

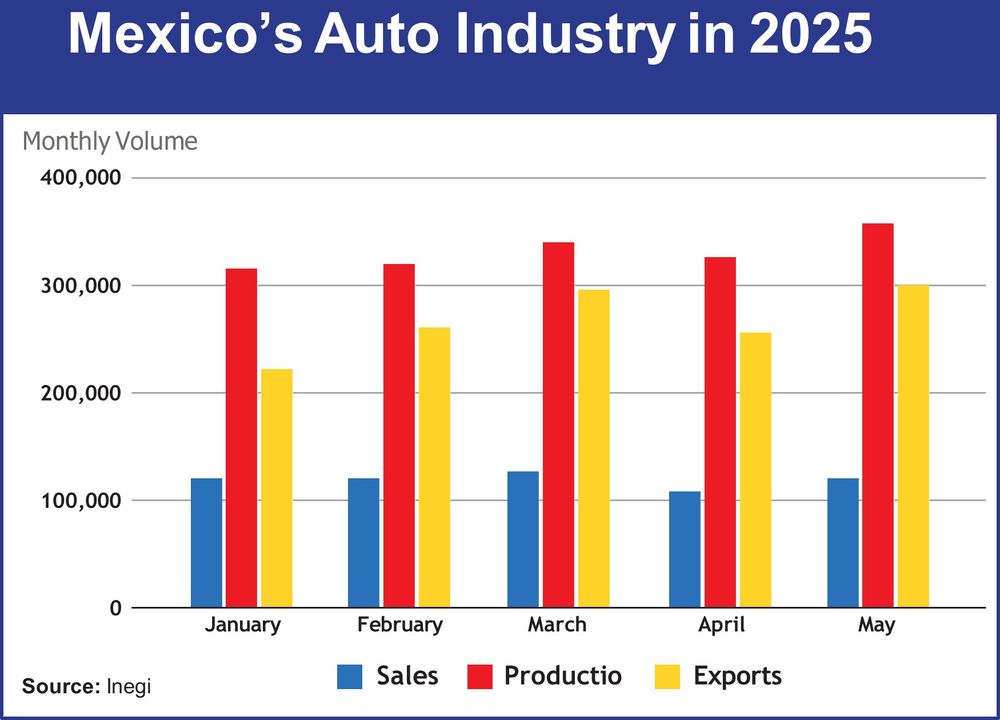

Mexico’s Auto Industry in Numbers (Jan–May 2025)

📊 Production:

March saw a 12.1% YoY increase with 338,669 light vehicles

Cumulative Q1 production: 973,485 units, second-highest ever

Total Jan–May production: 1.65M units, only a 0.45% decrease YoY

📦 Exports:

Jan–May exports: 1.33M units, down 6.3%

April and May exports fell 7.3% and 2.88% respectively

80% of exports went to the U.S., but volumes declined due to tariff shock

🚗 Domestic Sales:

Jan–May: 473,323 light vehicles, 0.9% higher than 2024

Despite Easter season dips, domestic sales remain the second-highest on record

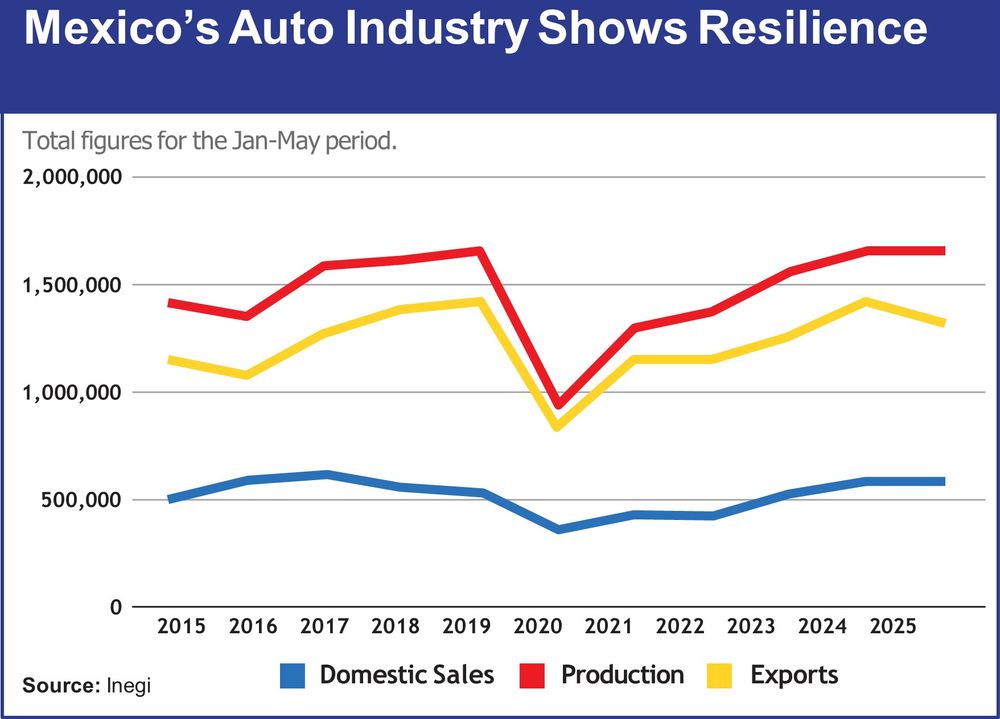

These results highlight the resilience of Mexico’s auto industry, even as external trade dynamics shift.

U.S. Sales Spike Before Tariffs Hit

U.S. consumers rushed to dealerships in March and April to buy duty-free vehicles.

March: 1.61M light vehicles sold, +11% YoY

April: 1.49M units sold

May: 1.5M units sold, but momentum is slowing

Analysts from Cox Automotive and S&P Global Mobility agree that the market hit its last growth window in May. From June onward, vehicle sales are expected to decline as inventory becomes tariff-priced.

Strategic Opportunities Still Exist

Despite uncertainty, there is room for strategy. Nearshoring in Mexico continues to attract OEMs looking for tariff-safe, cost-effective production. The Interoceanic Corridor, skilled labor, and Mexico’s manufacturing infrastructure make it a regional leader.

However, analysts warn that tariffs on non-compliant vehicles from Canada and Mexico (25%) will remain through 2025, dropping to 12% in 2026. Non-USMCA countries will face 25% until 2027, possibly falling to 15% afterward.

As Guido Vildozo from S&P Global Mobility puts it:

“It’s definitely challenging, but the opportunities are real. Every decision now must be based on cost, pricing, and margin analysis.”

Conclusion: Mexico Remains a Stronghold in a Reordered Auto Market

The 2025 U.S. auto tariffs have rewritten trade playbooks. But amid complexity, Mexico’s auto industry remains structurally sound. Its compliance with USMCA, rising domestic sales, and growing role in U.S. exports keep it vital to the future of North American auto manufacturing.