Industrial Parks in Mexico

What Are Industrial Parks in Mexico?

Industrial parks in Mexico are master-planned developments designed for manufacturing, logistics, and industrial operations. They provide pre-approved zoning, urbanized land, centralized infrastructure, utilities, and professional park management.

For foreign and domestic companies, industrial parks reduce regulatory complexity, shorten setup timelines, and lower operational risk—making them a core pillar of Mexico’s nearshoring strategy.

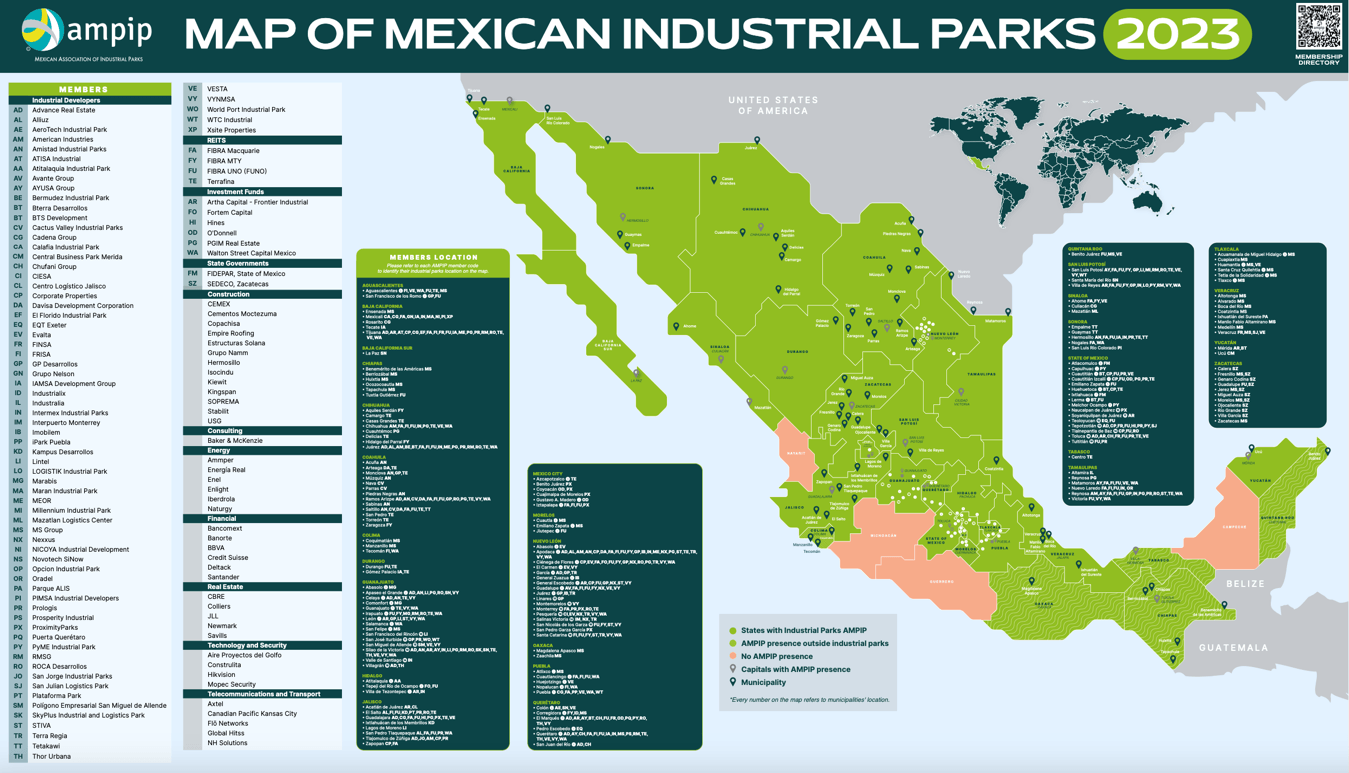

AMPIP: The Reference Point for Industrial Parks in Mexico

The Mexican Association of Private Industrial Parks (AMPIP) is the leading industry organization representing professionally developed and managed industrial parks in Mexico.

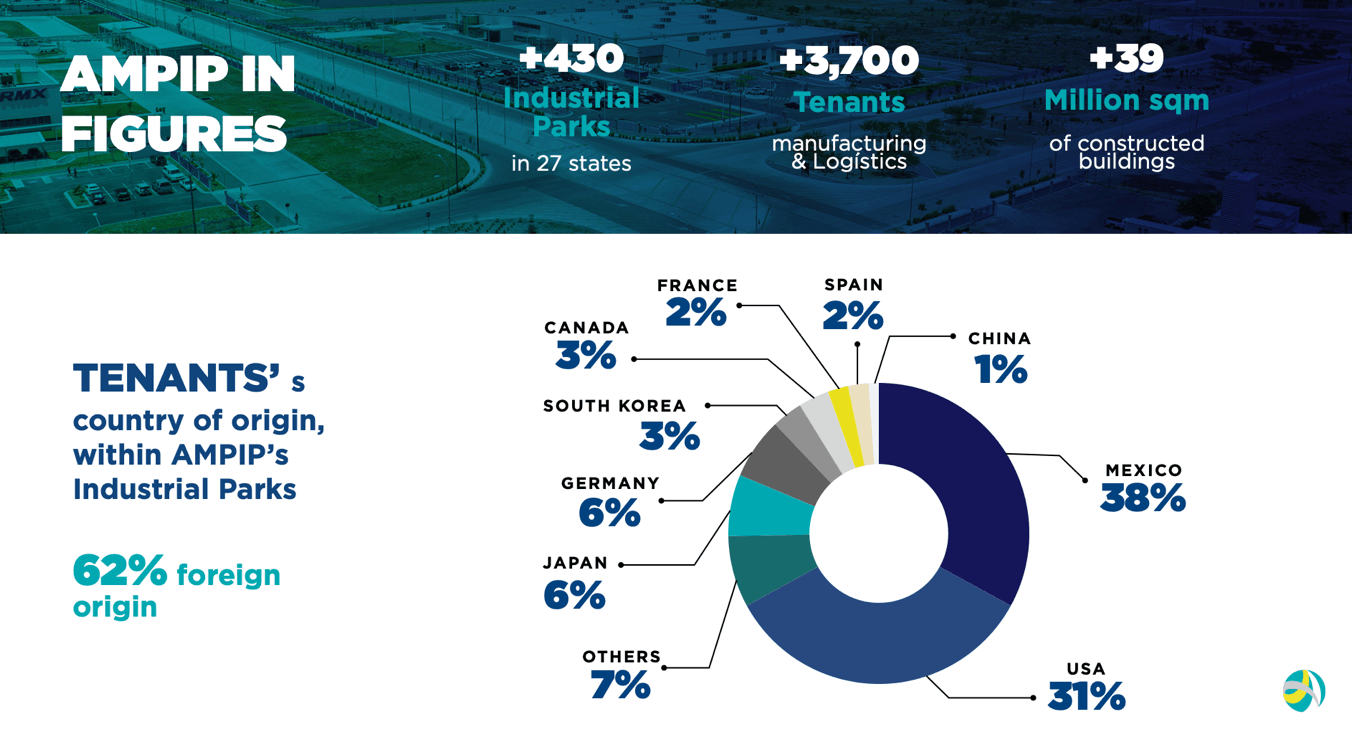

According to AMPIP data:

- 430+ industrial parks

- Presence in 27 Mexican states

- 3,700+ tenant companies

- 39+ million sqm of constructed industrial space

- 62% of tenants are foreign companies

AMPIP does not represent every industrial park in Mexico, but its members typically follow higher standards in infrastructure, security, sustainability, and governance. For investors and manufacturers, AMPIP affiliation serves as a quality and reliability indicator, not a legal requirement.

Why Industrial Parks Are Critical for Nearshoring

The nearshoring shift has dramatically increased demand for industrial parks in Mexico. Companies relocating production from Asia prefer industrial parks because they offer:

- Faster operational startup

- Pre-approved land use

- Easier permitting processes

- Integrated utilities

- Better security and risk control

By 2023, national industrial vacancy rates dropped close to 2% in prime markets, and in cities like Monterrey, long-term leases of 10 years or more became common.

Where Are Most Industrial Parks Located?

Industrial parks are concentrated in regions with strong logistics, labor availability, and export connectivity:

Top States by Industrial Park Presence

- Nuevo León – ~80 industrial parks (Monterrey metro area)

- Estado de México – ~47 industrial developments

- Guanajuato – ~44 industrial parks

- Coahuila – ~34 industrial complexes

- Chihuahua – ~32 industrial facilities

- Jalisco – ~25 industrial parks

The most active regions are:

- Northern Mexico (41%)

- Bajío–Occidente (30%)

- Mexico City & Metropolitan Area (17%)

Types and Development Stages of Industrial Parks

Industrial parks in Mexico vary by development stage and purpose:

Development Stages

Land acquisition – land secured, pre-development phase

Permitting – zoning, environmental, and utility approvals

Infrastructure development – roads, utilities, internal services

Occupancy – first tenants installed

Purpose Classification

- Manufacturing-focused

- Logistics-focused

- Mixed-use (manufacturing + logistics)

- Dedicated or specialized parks

Most parks today are mixed-use, offering flexibility for evolving supply chains.

Industrial Building Classes (NAIOP Standard)

Industrial buildings inside parks are commonly classified using NAIOP standards:

Class A

- Newest facilities

- High ceilings, modern HVAC, strong power capacity

- Best for advanced manufacturing and logistics

Class B

- Older but functional

- Suitable for casting, machining, and industrial processes

- Can be upgraded toward Class A

Class C

- Older structures

- Limited infrastructure

- Price-driven, often used for basic operations

Utilities and Infrastructure Inside Industrial Parks

Most industrial parks provide:

- Electricity (medium/high voltage)

- Water and wastewater systems

- Natural gas (region-dependent)

- Telecommunications and fiber optics

- Fire-protection systems

⚠️ Important:Utility availability—especially electrical capacity—is not guaranteed and must always be verified during site selection.

Security in Mexican Industrial Parks

Security is a decisive factor for foreign manufacturers. Modern industrial parks typically include:

- Controlled access and perimeter fencing

- CCTV and surveillance systems

- On-site security personnel

- Emergency response protocols

Key risks include:

- Cargo theft

- Unauthorized access

- Operational disruptions

Many parks apply risk-assessment methodologies and layered security models, combining physical protection with technology and procedures.

Sustainability and ESG in Industrial Parks

Sustainability has become a core requirement for multinational tenants and investors.

AMPIP-affiliated parks increasingly adopt:

- Energy-efficient building design

- Water recycling systems

- Solar and alternative energy solutions

- ESG reporting and monitoring

Common certifications include:

- LEED

- EDGE

- GRI

- GRESB

Nearly 70% of AMPIP member parks actively track sustainability metrics.

Foreign Investment and Tenant Profile

Industrial parks host a strongly international tenant base:

- 38% Mexican companies

- 31% U.S. companies

- 6% German

- 6% Japanese

- 3% Canadian / South Korean

Chinese companies have become a major growth driver, with a significant share of new demand linked to nearshoring and tariff-avoidance strategies.

Outlook: Industrial Parks in Mexico 2024–2026

According to AMPIP, 50+ new industrial parks are in development stages, with openings expected through 2025–2026. Growth is driven by:

- Nearshoring

- USMCA trade stability

- Logistics and e-commerce expansion

- Automotive and high-tech manufacturing

- Industrial parks will remain central to Mexico’s role in global supply chains.

Conclusion

Industrial parks are the backbone of Mexico’s manufacturing and logistics ecosystem. They offer speed, structure, security, and scalability—critical for companies expanding into Mexico.

However, not all industrial parks are equal. Location, utilities, security standards, sustainability practices, and management quality vary significantly. Careful site selection and professional guidance are essential to avoid costly mistakes.

FAQ

What is AMPIP?

AMPIP is the Mexican Association of Private Industrial Parks, representing professionally developed and managed industrial parks across Mexico.

Are all industrial parks in Mexico AMPIP members?

No. AMPIP represents a large share of high-quality parks, but not all industrial parks in Mexico are members.

Why do foreign companies prefer industrial parks?

Because they reduce permitting risk, offer ready infrastructure, improve security, and accelerate time-to-market.

Are utilities guaranteed in industrial parks?

No. Electrical and water capacity must always be verified before signing any agreement.

How does nearshoring affect industrial parks in Mexico?

Nearshoring has sharply increased demand, reduced vacancy rates, and accelerated new park development nationwide.

Sources

Chen, J. (2022). Industrial Areas: Overview, Significance, Special Considerations. Retrieved from https://www.investopedia.com/terms/i/industrial-park.asp

Acosta, M. G. (2023). How many industrial parks exists in Mexico? Retrieved from LinkedIn: https://www.linkedin.com/posts/mgaytan1_cushwakemx-strategicconsulting-industrialbroker-activity-7123350257765134336-cWo-/

Advance Real Estate. (2022). ¿CÓMO TENER UN PARQUE INDUSTRIAL SEGURO? Retrieved from https://advance-realestate.com/adblog/como-tener-un-parque-industrial-seguro/

Animal Político. (2022). La importancia de la sostenibilidad para el desarrollo de los parques industriales.Retrieved from https://www.animalpolitico.com/hablemos-de/sustentabilidad/importancia-sostenibilidad-parques-industriales

Gurrola, K. S. (2023). INDUSTRIAL PARKS IN MEXICO History and Best Practices Based on Certifications. Retrieved from https://www.airealestate.com.mx/en/blog/industrial-parks-mexico-history-best-practices-based-certifications/

Industrial Plot. (2021). What are the Different Classes of Industrial Buildings? Retrieved from https://industrialplot.com/what-are-the-different-classes-of-industrial-buildings/

Juárez, C. (2023). Parques industriales en México: ¿en dónde se encuentran?Retrieved from https://thelogisticsworld.com/logistica-y-distribucion/parques-industriales-en-mexico-en-donde-se-encuentran/

Martínez, C. (2023). Parques industriales en México: clasificación, etapas de desarrollo y demanda frente al nearshoring.Retrieved from https://thelogisticsworld.com/logistica-y-distribucion/parques-industriales-en-mexico-clasificacion-etapas-de-desarrollo-y-demanda-frente-al-nearshoring/

Ramos, M. (2023). SEGURIDAD EN PARQUES INDUSTRIALES.Retrieved from https://www.seguridadenamerica.com.mx/33912/seguridad-en-parques-industriales-1

Rangel, J. (2022). Sustentabilidad, tendencia para la construcción de parques industriales.Retrieved from https://inmobiliare.com/sustentabilidad-tendencia-para-la-construccion-de-parques-industriales/