How the “Houthi Attacks” Disrupt the European Supply Chain – and Why Mexico Could Be an Interesting Alternative

Houthi-Attacks - Mexico as an interesting alternative

Houthi rebels have targeted cargo ships in the Red Sea, disrupting global supply chains along the key trade route through the Suez Canal. These drone and missile attacks, backed by Iran, are a consequence of the Israel-Hamas conflict in Gaza. While the Houthis initially claimed to be targeting Israeli and Israel-bound ships in support of Hamas, their attacks have impacted a wider range of commercial vessels.

Typically, around 13% of global trade passes through this vital corridor between Asia and Europe, which accounts for billions of dollars of goods and about 30% of the world’s container shipping. However, since the attacks began, trade through the Suez Canal has decreased by 75% as shipping companies are not willing to expose their vessels and crews to such risks, leading them to avoid the Suez Canal route altogether.

Shipping companies avoid Suez Canal

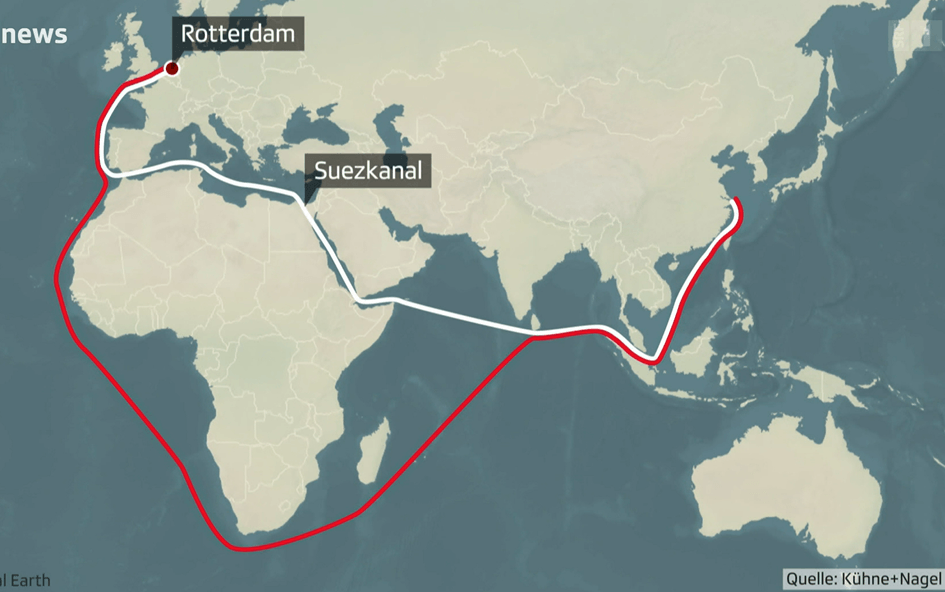

Indeed, several large shipping companies — seven out of the 10 biggest shipping companies, including Maersk, and BP — have made the decision to halt shipping through the corridor Suez Canal (white line) and are opting for the route around Africa (red line) instead. This alternative route could add up to two weeks to delivery times and over $1 million in additional transportation costs, potentially increasing the higher fuel and operational costs and driving up over transportation expenses.

In addition, the rerouting around the Cape of Good Hope is anticipated to delay goods arriving in Europe by 10-12 days beyond the usual 30–45-day transit time Maersk advises for shipments from China to Europe via the Suez route.

End-Consumers costs will increase

Vincent Clerc, CEO of Maersk Lines states; “Since the beginning of the year, shipping costs have more than tripled. Logistics companies are now passing these price increases on to their customers, and new contracts have been negotiated. If we continue to have to reroute via the Cape of Good Hope, it will inevitably drive-up costs, and we will need to pass these on to our customers. Importers will have to pay more, and if the situation doesn't stabilize soon, consumers will also feel the effects."

According to data from the Shanghai Shipping Exchange in April 2024, the Shanghai Containerized Freight Index, which tracks spot freight rate fluctuations from Shanghai to export markets like Europe, reached 2,305.79 on Friday 10th of May — a nearly 19% increase since the end of April and the highest level since late September 2022.

Mexico – not only Nearshoring- but also Offshoring destination for the European Market

The Huthi Attacks and other recent global supply chain challenges underscore the numerous advantages of settle down its manufacturing plants in Mexico – and not only producing its products for the Nearshoring destination United States but also for Europe.

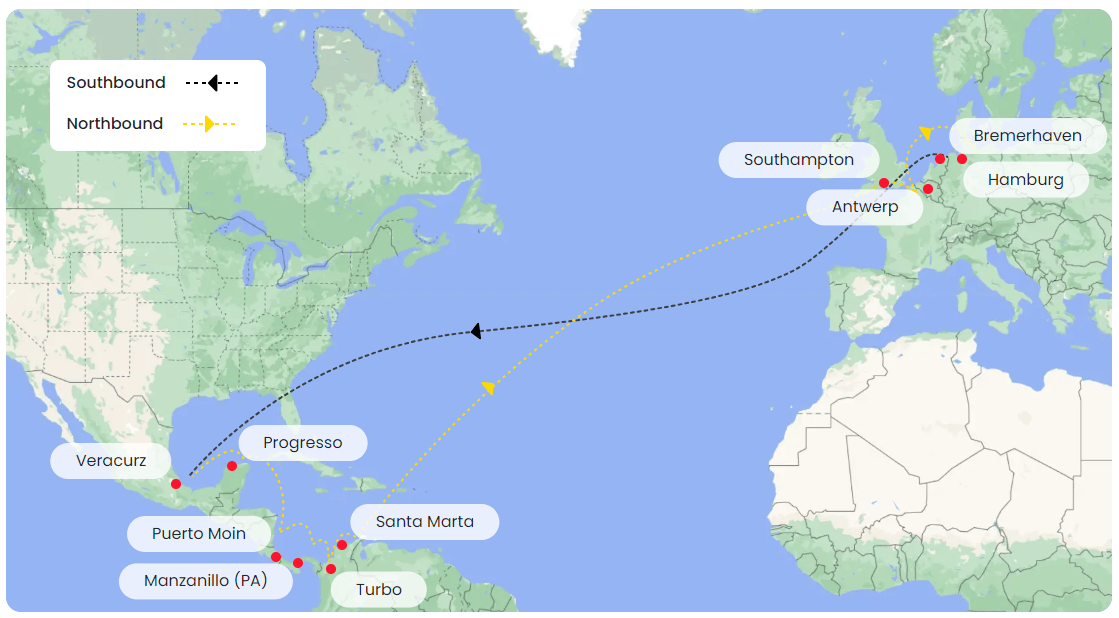

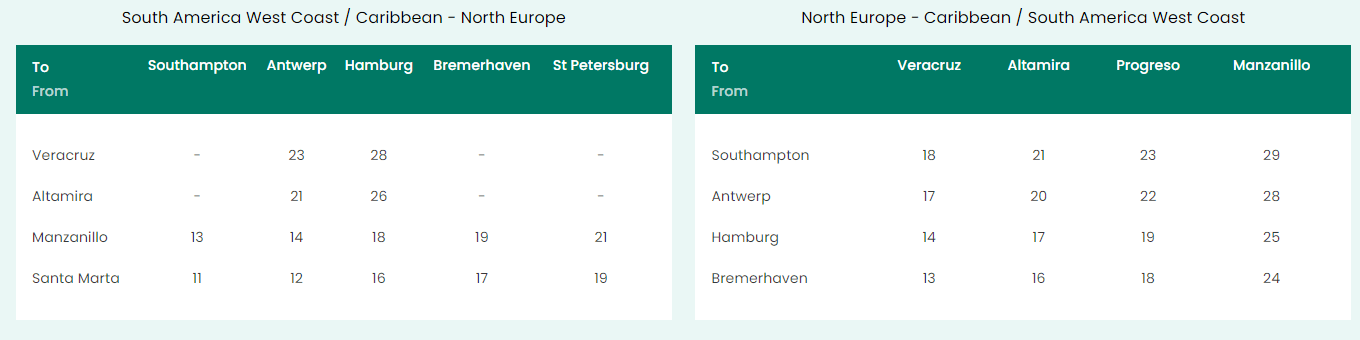

Indeed, Mexico boasts excellent sea freight connectivity to Europe and Asia and save thanks to its geopolitical positioning and its strategic well located ports Manzanillo and Veracruz a lot of money. With the cost-effectiveness weekly routes between to the main ports in Europe, Mexico will play a vital player in the future for production companies, transporting large volumes, as sea freight remains the most economical mode compared to air.

15 days from Mexico to Europe by Sea-Freight

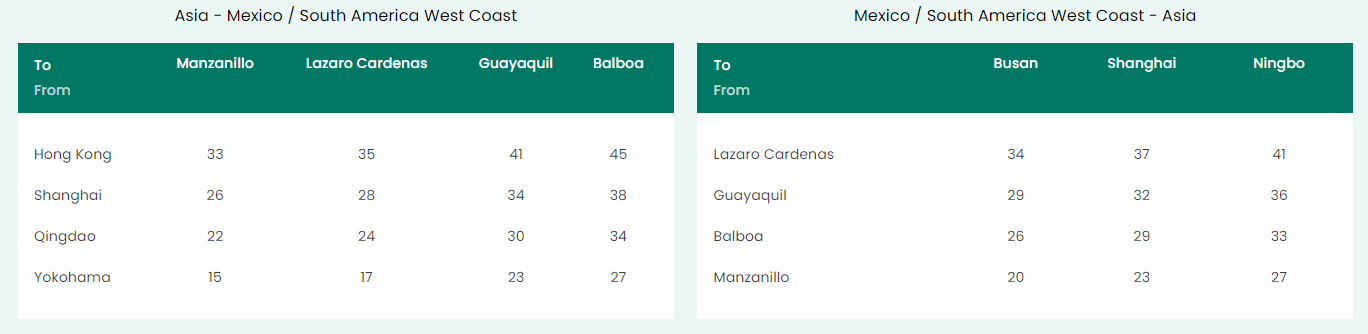

There are typically 10 – 20 shipments per month to Germany, with an average transit time of approximately 15 days. For shipments to Asia, there are 20 – 30 shipments to Hong Kong, which typically take between 23 and 30 days to reach their destination.

Enhanced infrastructure at Mexican ports like Veracruz (for European Market) and Manzanillo (for Asia Market) has further increased the efficiency and dependability of sea freight services. These ports have undergone substantial investments, boosting handling capacities and reducing turnaround times, which are essential for maintaining competitive transit times to Europe.

Veracruz – largest port in Mexico

The port of Veracruz is Mexico's oldest port and the largest commercial hub on the Gulf of Mexico. It operates 18 berths and offers over 600,000 m² of storage space. This comprehensive setup allows the port to manage a wide range of cargo, including containers, agricultural bulks, mineral bulks, general cargo, liquid bulks, and automobiles. Indeed, the port is often regarded as the gateway for the country's automobile industry as it features two dedicated facilities specifically for handling over 700,000 vehicles annually, making it the largest vehicle-handling port in the continent (NALVPS, 2017).

Key Highlights:

-Operates 18 berths and has over 600,000 m² of storage space.

- Receives more than 2,500 ships each year from major global shipping lines.

-Largest vehicle-handling port in the continent, processing over 700,000 vehicles annually.

-Container loading occurs daily, with capacities reaching up to 4,400 containers and peaking at approximately 8,000 containers during high-demand periods.

-Handled over 26.5 million tons of cargo in 2018 (excluding December) (API Veracruz, 2018).

-Connects with major ports in Europe, the United States, Latin America, and Asia (via the Panama Canal).

-Designated as one of Mexico’s two “super ports” due to its leading role in vehicle handling, agricultural bulks, and container shipping.

Sea Routes Mexico - Europe

Sea routes Mexico - Asia

Interoceanic Corridor – connecting Asia and Europe through Mexico

Another alternative of instead shipping the goods through the Suez Canal or Cap of Good Hope is the new constructed and recently launched Interoceanic Corridor. Indeed, the Interoceanic Corridor is an ambitious infrastructure project in Mexico designed to connect the Pacific and Atlantic Oceans through a multi-modal logistics platform. The corridor is what technicians call a dry canal, a corridor with 309 km railways infrastructure for freight trains and a road with a highway in certain sections as well as two ports, with a focus on enhancing the economy of southern regions, particularly Veracruz and Oaxaca. It is anticipated to facilitate the transport of over 1.4m containers annually, reducing transit time across the country to less than six hours from port to port.

Interoceanic Coridor; Efficient Supply Chain

One of the key features that make the corridor significant in global supply chain is its potential to serve a critical link between the east-west and north-south trade routes. The corridor has the capacity to streamline trade flows between Asia, Europe and the Americas. This strategic advantage is particularly relevant in the context of growing trade volumes and the increasing demand for reliable and cost-effective logistics solutions. With all the global challenges, it became evident that the manufacturing and logistics ecosystem was ill-prepared to adjust to the sudden jump in the demand for consumer goods.

By 2050, it is expected that the corridor alone will contribute 1.6% to the national GDP; moreover, the establishment of industrial complexes along the corridor could mobilize over $50bn in investment and generate more than 500,000 direct jobs. Various incentives such as value-added tax exemptions and tariff reductions should boost and contribute future foreign investment.

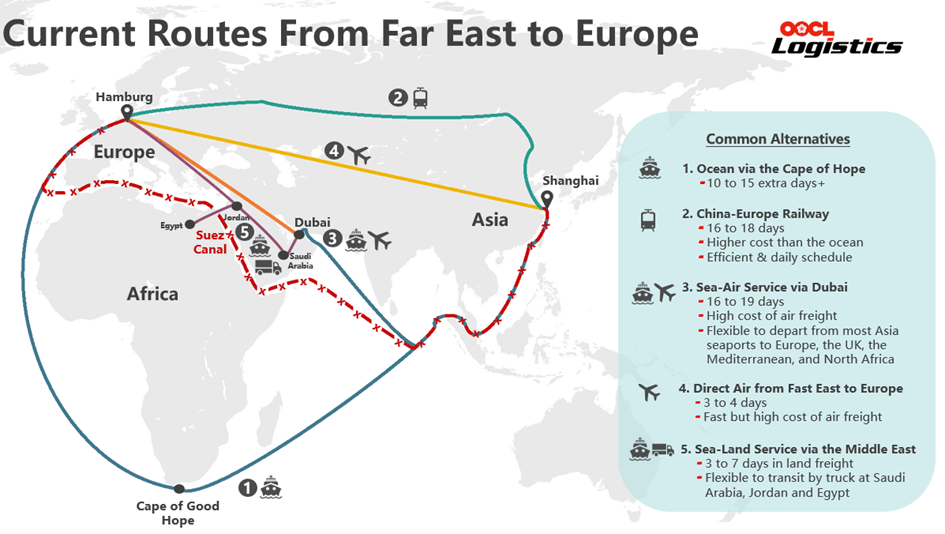

What other routes from Far East to Europe exist?

Coming back to Far East; What are the other transport options beside sea freight? We give you an overview of some potential alternative routes – which may be faster and reliable – but significantly more expensive.

Rail Freight – Northern and Western Corridors: Rail freight has gained appeal due to recent maritime shipping delays. It offers a faster alternative to sea freight with a transit time of about 16-18 days, significantly quicker than the 30-45 days typically required for ocean freight. Rail freight is one-third the duration of sea freight and one-sixth the cost of air freight. High-frequency rail services connect 217 cities in China with major European countries via the New Silk Road. In 2023, 16,145 freight trains transported 1.75 million containers between China and Europe, reflecting increased volume despite some capacity challenges and higher costs compared to sea transport. Notably, the Northern Corridor crosses from China into Russia, while the Western Corridor passes through Kazakhstan and Belarus. Major services, such as those by Davies Turner and DHL Forwarding, have transit times ranging from 13 to 20 days, depending on the route.

Intermodal – Middle Corridor: The Middle Corridor offers an alternative route, avoiding Russia due to the Ukraine conflict. This corridor involves transporting goods from China through Kazakhstan, crossing the Caspian Sea into Azerbaijan, and reaching the EU via Georgia and Turkey. Transit times on this route are longer, ranging from 50-60 days, due to inefficiencies like poor port operations and infrastructure issues. However, with investments and improvements, this corridor could become a viable option in the future.

Air Freight: For urgent shipments, air freight is a fast option, taking around 3-4 days from Asia to Europe. However, it is considerably more expensive than other modes, with costs about 3-4 times higher than sea and rail transport. Despite a forecasted increase in demand, the sector has not yet seen significant growth. The global average air cargo spot rate recently peaked at $2.60 per kg but is still lower compared to previous years.

Sea-Air Combination: Combining sea and air freight offers a middle ground, reducing costs compared to pure air freight while speeding up transit times compared to sea freight. This multimodal approach involves shipping goods by sea to a hub like Dubai and then transporting them by air to Europe. This method is gaining traction for its flexibility and resilience, though it remains less popular due to higher costs and added complexity in handling and customs.

Sea-Land Transportation in the Middle East: As an alternative to the Red Sea route, combining ocean freight with inland transportation in the Middle East is being explored. Goods are transported by sea to a port in the UAE and then moved by truck to destinations in Saudi Arabia, Jordan, and Egypt. This method can shorten transit times compared to rerouting via the Cape of Good Hope and offers flexibility in land routes.

Is there an end in solving the Houthi conflict?

From Sudan to Somalia, the Horn of Africa is experiencing a period of significant upheaval. In Sudan, the conflict has dangerously escalated over the past week, raising concerns that the Rapid Support Forces might advance further east towards the Port of Sudan. Meanwhile, Ethiopia's prime minister has been openly advocating for direct access to the Red Sea for his landlocked nation. Eritrea, which boasts the longest coastline along the Red Sea, has only recently rejoined the Intergovernmental Authority on Development (IGAD) and maintains limited communication with Western countries.

The newly formed multinational naval task force includes the United States and allies like the United Kingdom, Bahrain, Canada, France, Italy, the Netherlands, Norway, Seychelles, and Spain. However, notable regional powers such as Saudi Arabia, Egypt, and several East African nations are not part of the task force. China's exclusion is also significant, given its naval presence in Djibouti and its strategic interest in the Red Sea as part of its Belt and Road Initiative. Effective communication with other nations will be essential to ensure that this increased military presence is not seen as an escalation.

The U.S. Institute of Peace’s Senior Study Group on Peace and Security in the Red Sea Arena has emphasized the growing involvement of Gulf nations in securing access to ports along the Red Sea. This interest has intensified since 2020, with Russia also expanding its focus, seeking agreements first with Sudan's Omar al-Bashir regime and later with the civilian government before the 2021 coup and the 2023 civil war.

In response, the United States has taken action by intercepting Houthi drones and establishing a 10-nation naval task force to safeguard vessels navigating this crucial trade route.

Summary

While patience may be required, the situation in the Red Sea is unlikely to improve quickly, meaning that the higher transportation costs will eventually impact consumer prices. However, it is important to consider that transportation costs make up only a small portion of the total cost of imported goods, so the price increases should remain manageable for the moment. Despite the current disruptions, the effects on individual consumers are likely to be bearable.

However, analyzing your supply chain is crucial to remain competitive and ensure reliable transportation. Producing your products in Mexico can be a strategic move as it offers greater efficiency, reduced costs, and enhanced safety compared to other locations such as Asia. Additionally, manufacturing in Mexico provides the advantage of accessing multiple markets, including the United States and Europe, making it a highly attractive option for companies looking to optimize their operations and reducing costs.

Links

https://www.usip.org/publications/2023/12/houthi-attacks-red-sea-disrupt-global-supply-chains

https://trans.info/en/asia-europe-freight-options-red-sea-375852

The Report; Redefining trade; Prolstmo & Mexico's Interoceanic Corridor