Is Manufacturing in China Still Trendy?

Is Manufacturing in China Still Trendy? The Changing Landscape of Global Production

For decades, China has held the title of the world's factory. It became a major manufacturing hub in the late 1970s and early 1980s, following significant economic reforms that opened the country's doors to foreign investment. These reforms attracted numerous companies looking to outsource their manufacturing to China. However, recent years have seen a shifting tide in global manufacturing, raising questions about whether China's trendiness as a manufacturing destination is waning.

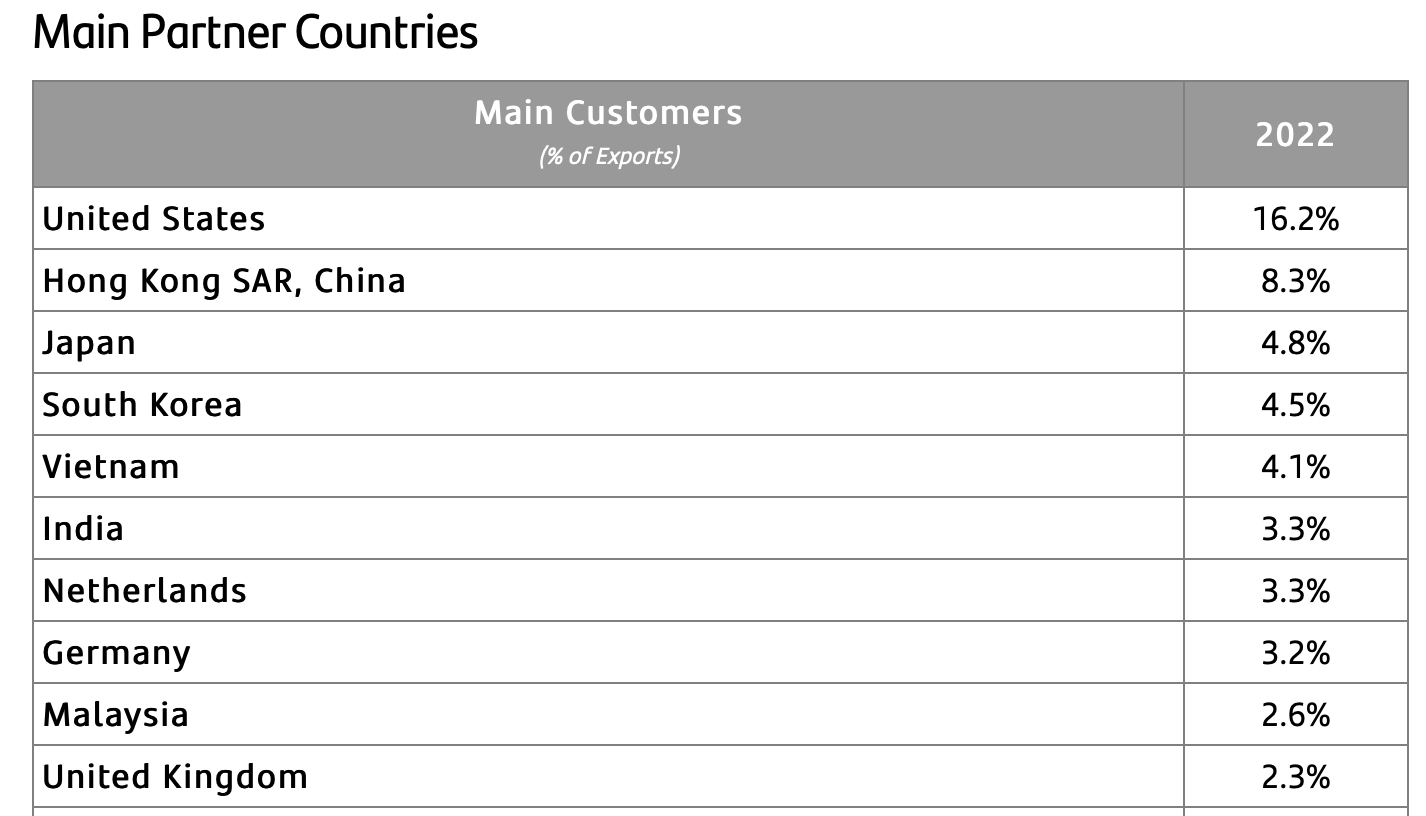

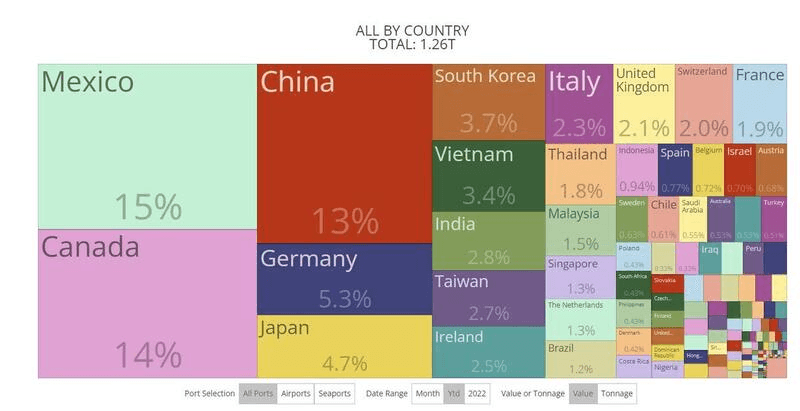

China maintains extensive trade relationships with numerous countries, many of which are its primary trading partners. The graphic below illustrates the distribution of China's exports by percentage in the year 2022.

Historical Reasons for Outsourcing to China

The appeal of China as a manufacturing hub was driven by several factors:

- Low Labor Costs: China boasted a large and relatively young workforce, resulting in significantly lower labor costs compared to developed nations. This cost advantage made China an attractive destination for companies aiming to reduce expenses.

- Government Support: The Chinese government actively supported manufacturing by offering tax incentives, subsidies, and other incentives to attract foreign investments.This created a conducive environment for manufacturing in China.

- Robust Infrastructure: China developed an extensive infrastructure network, including well-maintained roads, efficient ports, and modern airports, making the transportation of goods in and out of the country seamless.

- Technological Advancements: China's robust technology sector positioned the country as a leader in manufacturing. Chinese companies were at the forefront of developing new manufacturing technologies, contributing to China's competitive edge.

As a result, China became a major hub for producing various products, including electronics, clothing, toys, and furniture. However, it's crucial to acknowledge that outsourcing to China has not been without its risks, including quality control issues, intellectual property theft, and political instability. Nevertheless, for many businesses, the benefits of outsourcing to China outweighed these risks.

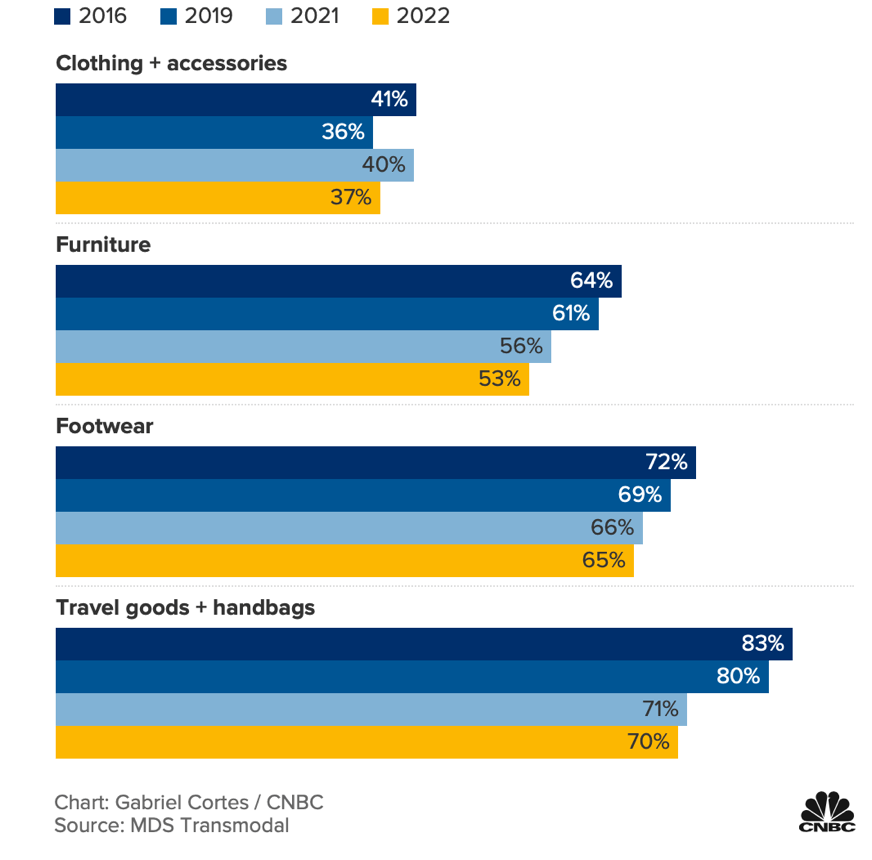

China's share of global exports of consumer goods has fallen since 2016:

Challenges to China's Manufacturing Supremacy

Recent years have witnessed various challenges to China's position as a manufacturing hub. The following factors are contributing to the reevaluation of China as the go-to destination for manufacturing:

- Rising Labor Costs: Labor costs in China have been steadily increasing, diminishing the cost advantage it once had over other nations.

- Trade Wars: Ongoing trade tensions between the United States and China have made companies consider diversifying their manufacturing locations.

- Political and Economic Stability Concerns: Worries about China's political and economic stability have pushed companies to reassess the risks associated with heavy reliance on China.

Several major companies are considering moving some of their manufacturing operations out of China:

- Intel: Intel is exploring the possibility of moving manufacturing out of China to the United States to comply with U.S. government regulations.

- Microsoft: Microsoft is contemplating moving some manufacturing out of China to Europe to mitigate supply chain risks.

- Nike: Nike is evaluating the option of shifting manufacturing from China to Southeast Asia to enhance quality and reduce costs.

- Dell: Dell is in the process of moving manufacturing to Vietnam and Mexico to lower costs and improve efficiency.

Mexico's Rise as a Nearshoring and Manufacturing Hub

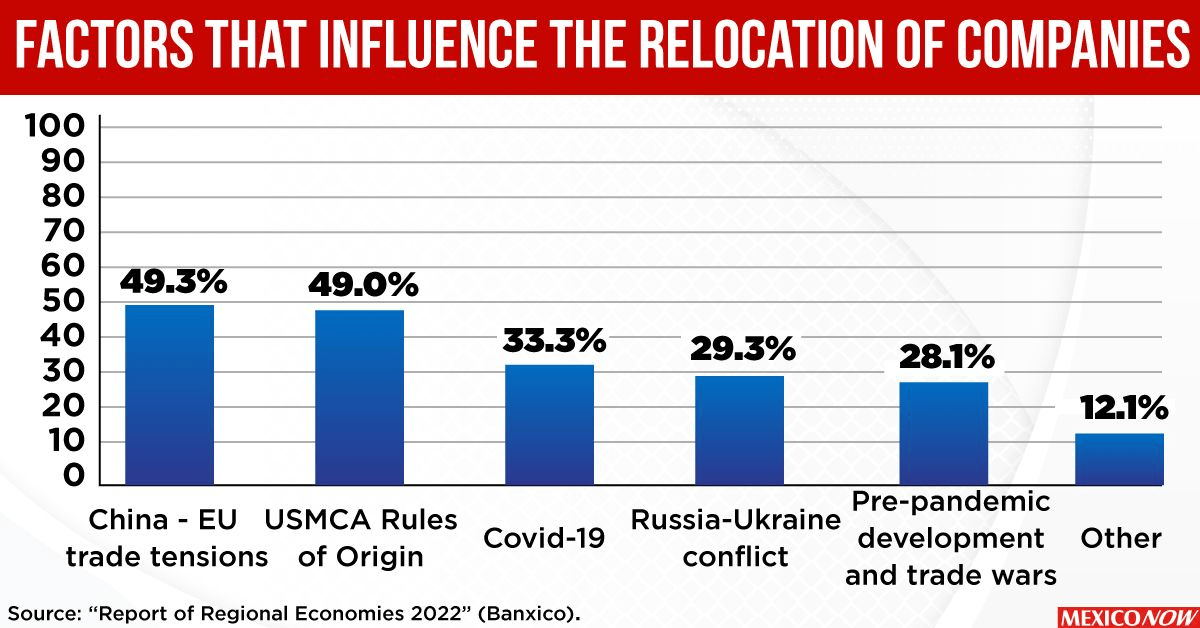

Among the countries emerging as popular alternatives for manufacturing, Mexico stands out as a significant nearshoring destination. In recent years, nearshoring between the United States and Mexico has gained momentum. After the trade war initiated by the Trump administration against China in 2019, companies sought to reduce the risk of supply chain disruption by locating suppliers closer to home.

The Inter-American Development Bank (IDB) estimated that nearshoring in Latin America and the Caribbean could lead to $78 billion in additional goods and services exports annually in the short and medium term, with Mexico expected to contribute significantly.

Indeed, foreign direct investment in Mexico has increased to upgrade the country's role as a supplier to the United States. While this has partially materialized, nearshoring remains below its potential due to various factors.

The Rising Presence of Chinese Companies in Mexico

The surge of nearshoring, a strategic realignment of supply chains, has led to a significant increase in the footprint of Chinese companies in Mexico's industrial properties. According to data from SiiLA Market Analytics, the square meters occupied by these companies in industrial warehouses have quintupled between 2019 and 2023, with the number of tenants from the Asian giant nearly tripling.

SiiLA's real estate data study reveals that these Chinese enterprises are actively seeking strategically located, high-quality properties, currently occupying over 1.8 million square meters spread across various regions of Mexico. Jorge Luis Baca, regional director of Querétaro for the developer American Industries Group, emphasizes that, since the last quarter of 2022, half of all Asian companies are keen on bringing their operations to Mexican territory. This move aims not only to optimize their supply chains with major automakers like Tesla but also to capitalize on the attractive features offered by the country.

Throughout 2023, the developer has finalized ten projects with Asian companies, with negotiations underway for an additional 15. However, Baca notes some challenges in solidifying the influx of investment from the East, particularly concerning the consolidation of infrastructure, including physical structures like land, sea, or air entry points to facilitate goods transportation. Other considerations include the generation and distribution of electricity, natural gas, sources of renewable energy, and water.

As of mid-2022, there were 1,294 Chinese companies operating in Mexico, according to the Ministry of Economy. The Mexican government recently reported that over 400 companies based in China have expressed interest in expanding their production in the country. The upward trend of nearshoring from China to Mexico is on the rise, bringing numerous benefits to the commercial real estate market.

One notable advantage is the growing demand for industrial warehouses, leading to a surge in new inventory construction. This phenomenon has created investment opportunities for developers and increased employment prospects in the construction sector, as highlighted in SiiLA's analysis.

Chinese companies move to the North of Mexico

Given the proximity to the United States, the most crucial consumer market for Chinese companies, border cities emerge as highly attractive for nearshoring. SiiLA reports that 62% of the total square meters occupied by tenants of this kind are concentrated in three markets: Monterrey, Saltillo, and Tijuana. These cities collectively host over 1.1 million square meters of Class A and B industrial properties occupied by Chinese companies.

It's noteworthy that these cities also house the country's four busiest border crossings, providing a stable trade alternative. Consequently, the expectation is for Chinese investment in these markets to continue growing in the coming years.

Challenges in Mexico's Nearshoring Journey

Mexico's nearshoring journey faces challenges:

- Business Environment: Mexico's business environment is not as friendly, with the government showing resistance to sustainable energy investments and inadequate infrastructure development.

- Labor Costs and Skill Gap: Labor costs in Mexico are rising, and the country faces a shortage of high-tech workers, making it less competitive for certain industries.

- Local Investment: The country needs more local and foreign investment to boost its overall industry.

Despite these challenges, individual trailblazers like automaker Tesla and manufacturers like BMW are making investments to bolster Mexico's industrial capabilities.

The situation in the Nuevo León region of Mexico is drawing increasing attention due to a surge of Chinese companies establishing factories there. For years, Chinese companies mainly manufactured their products within China, but this is changing because of multiple global factors. Companies like Man Wah, a Chinese furniture maker, are setting up factories in Mexico to serve the American market. The primary drivers behind this shift are proximity to the U.S., lower labor costs compared to the United States, and Mexico's participation in a free trade zone with the U.S. and Canada.

Cheaper labor force in Mexico than USA

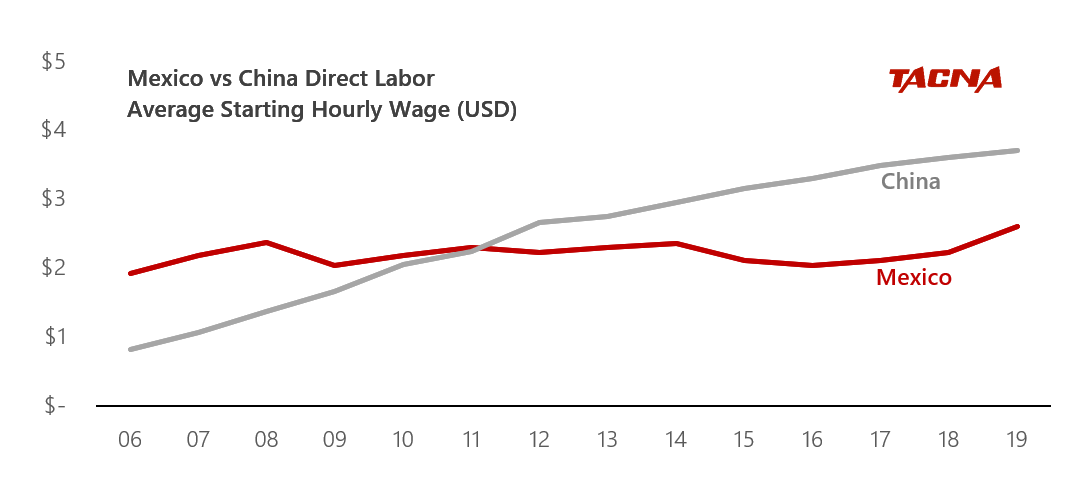

This graphic shows that Mexico has a cheaper labor force compared to China in relation of the US dollar.

In assessing the comparative advantages between Mexico and China, several key factors come into play. Mexico offers proximity, with a flight duration of just a few hours, while China is situated halfway around the world, resulting in substantial time zone differences. Language and numbers in Mexico use the same characters, easing communication, whereas China employs different characters, posing language barriers. Worker productivity is generally higher in Mexico but faces seasonal tight periods, while China's labor market has a concentration of engineering talent but is challenged by a low birth rate and high labor costs. When it comes to shipping transit times to the U.S., Mexico offers a significant advantage with less than a day, while in China, only small quantities can be shipped by air within two days at a high cost per pound. Mexico demonstrates a better record in protecting intellectual property, with courts that respect and enforce these rights, while China has encountered issues with counterfeits and intellectual property enforcement. Additionally, Mexico's social responsibility is reflected in relatively strict environmental laws, a 48-hour workweek, and a livable wage, fostering tight-knit family circles among employees. China, on the other hand, has less strict environmental laws, commonly involves 12-hour workdays, and workers live in factory dormitories. Availability of qualified workers remains generally plentiful in both countries, with Mexico benefiting from a high birth rate, ensuring a long-term supply of labor, and China having a concentration of engineering talent but facing a long-term labor challenge due to low birth rates and high labor costs.

The ongoing labor tensions in China, compounded by the challenges posed by trade wars and the pandemic, have forced Chinese companies to explore alternative locations for their manufacturing operations. Mexico offers an attractive solution, especially for companies looking to meet the demands of the American market. The move to Mexico is not only a pragmatic response to these challenges but also a shift away from China-centric manufacturing.

This transformation could have multiple implications. For American consumers, it could alleviate product shortages and supply chain disruptions. Some products might see slightly higher prices, but overall, the cost savings from reduced transportation may compensate for it. Importantly, regionalized manufacturing, with Mexican factories serving the U.S. market, has the potential to stimulate job opportunities in the U.S., benefiting American manufacturers and the broader economy.

The growing interdependence of supply chains in the U.S., Mexico, and Canada means that products made in Mexico still contribute to the U.S. economy, fostering job creation and supporting American manufacturers. Beyond economic advantages, a stronger Mexican economy could also reduce the flow of migrants across the U.S. border, potentially alleviating immigration-related tensions.

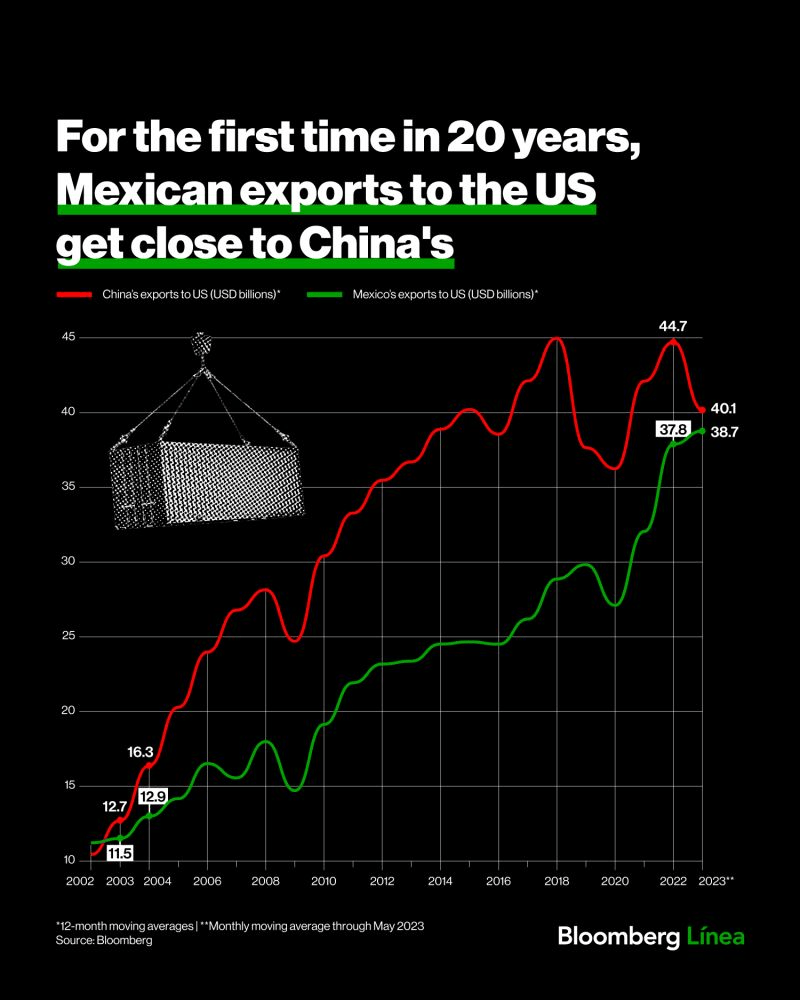

According to the data presented in the graphic, a significant transformation in U.S. import patterns is evident. As of May this year, the United States imports more from Mexico and Canada than from China, marking a substantial decrease in China's share of U.S. imports. Just five years ago, China contributed to over 20% of all U.S. imports, but in the latest U.S. Census Bureau data, China's share has dwindled to 13.35%. In contrast, Mexico now accounts for 16% of U.S. imports, and Canada for 15%. This shift signifies the end of China's 14-year streak as the primary source of U.S. imports.

The primary factors influencing this change are the Trump Administration's implementation of tariffs on a wide range of U.S. imports from China and the global pandemic, which underscored the risks associated with overreliance on a single source for both raw materials and finished goods.

Global Challenges

As the Russia-Ukraine conflict continues to dominate international headlines, its repercussions are felt far beyond the borders of the two warring nations. China, a major global player in both the economic and geopolitical arenas, finds itself navigating a complex web of interests and challenges in its economic relations with Russia and Ukraine.

Economic Interdependence with Russia and Ukraine

China's economic relationships with Russia and Ukraine are significant. Russia has been China's largest trading partner for 12 consecutive years, with bilateral trade reaching $146.9 billion in 2021. While this represents only about a tenth of China's combined trade with the US and EU, the importance of Russia to China's strategic interests cannot be understated.

China heavily relies on Russia for energy imports. In 2021, China imported 79.64 million tons of oil from Russia, accounting for 16% of its total oil imports. Furthermore, Russia is the second-largest supplier of natural gas to China, playing a vital role in China's energy security.

However, China's economic ties with Ukraine are not to be overlooked either. Ukraine is China's largest trading partner in the region, with a trade volume of $19.3 billion in 2021. Additionally, China's strategic interests in Ukraine extend beyond trade. Ukraine is an essential transit hub for the Eurasian Land Bridge, a network of railways connecting Europe and Asia that is mainly supported by China. Chinese investments and projects in Ukraine, particularly in infrastructure, agriculture, energy, and telecommunications, have been significant, further cementing the economic connection.

The Suez Canal Incident and Its Effects

The incident involving the blockage of the Suez Canal by a container ship in March 2021 demonstrated the vulnerability of global supply chains. China, as the world's manufacturing hub, was significantly impacted by this disruption, as it relies on the timely delivery of goods through this vital waterway. The Suez Canal blockage disrupted the flow of goods, leading to supply chain delays, increased costs, and heightened concerns about supply chain resilience.

COVID-19

Moreover, the COVID-19 pandemic has unleashed a myriad of economic challenges on China. Supply chain disruptions, lockdown measures, and a shift in consumer behavior have posed considerable challenges to China's economy. As the world's largest exporter, China's economic recovery has been closely tied to the global response to the pandemic. The virus's spread and the resultant restrictions have been a persistent concern for China's economic stability.

The Rise of India as a Manufacturing Hub

India is making strides to expand its manufacturing output. The Indian government has reduced taxes and regulations, invested in infrastructure, and eased foreign investment for businesses. As a result, India's economy has shown remarkable growth, with a 2022 GDP increase of 8.7%, the fastest among major economies.

India aims to become a $5 trillion economy by 2025, and the government has initiated various measures to boost manufacturing. Apple, for instance, has been at the forefront of moving manufacturing from China to India, capitalizing on the incentives offered by the Indian government.

Apple's decision to shift some manufacturing to India is underpinned by several factors, including tax benefits, a skilled workforce, and the growing Indian market for its products. This trend is expected to continue, with Apple planning to manufacture the iPhone 14 in India.

The Future of Manufacturing: Nearshoring and Homeshoring

As the trend of nearshoring and homeshoring gains momentum, boards and companies are closely examining their supply chains. Identifying single-sourced items and reducing reliance on China are key strategies to mitigate risks and enhance profitability.

China may have been the world's primary manufacturing country for years, but the shifting landscape of global manufacturing is creating new opportunities and challenges. By diversifying manufacturing locations, businesses can de-risk their operations and prepare for the evolving manufacturing landscape.

In conclusion, while China's dominance in global manufacturing is facing challenges, it's not the end of the road for this manufacturing giant. The manufacturing world is evolving, and China is adapting to the changes. The global trend seems to be less about entirely moving away from China but rather about diversification and strategic adjustments in the manufacturing landscape.

The vulnerabilities exposed by the pandemic and trade wars have prompted multinational companies, not just Chinese ones, to prioritize keeping production closer to their primary markets. China will continue to play a substantial role in manufacturing, but it will not be the sole global factory it once was.

Atkins, B. (2023). Manufacturing Moving Out Of China For Friendlier Shores. Retrieved from Forbes: https://www.forbes.com/sites/betsyatkins/2023/08/07/manufacturing-moving-out-of-china-for-friendlier-shores/?sh=56967f363541

Eloot, K., Huang, A., & Lehnich, M. (2013). A new era for manufacturing in China. Retrieved from McKinsey&Company: https://www.mckinsey.com/capabilities/operations/our-insights/a-new-era-for-manufacturing-in-china

Goodman, P. S. (2023). Why "Made in China" Is Becoming "Made in Mexico". (S. Tavernise, Interviewer)

Huld, A., & Zhou, Q. (2022). Reshoring from China to Mexico – How Prevalent is it Really? Retrieved from China Briefing: https://www.china-briefing.com/news/reshoring-from-china-to-mexico-how-prevalent-is-it-really/

India Today Business Desk. (2023). Explained: How China is slowly losing its position as the world’s factory. Retrieved from INDIA TODAY: https://www.indiatoday.in/business/story/china-manufacturing-hub-worlds-factory-losing-position-2394842-2023-06-19

Jiang, Y. (2022). The economic meaning of the Russia-Ukraine war for China. Retrieved from DIIS: https://www.diis.dk/en/research/the-economic-meaning-of-the-russia-ukraine-war-china#:~:text=The%20impact%20of%20the%20war%20on%20China%27s%20economy&text=In%20terms%20of%20total%20trade,with%20about%202.3%25%20with%20Russia.

Roberts, K. (2023). After 14 Years On Top, China Now Ranks Third For U.S. Imports. Retrieved from Forbes: https://www.forbes.com/sites/kenroberts/2023/07/11/after-14-years-on-top-china-now-ranks-third-for-us-imports/?sh=aea6b197a412

Santander. (2023). Chinese foreign trade in figures. Retrieved from https://santandertrade.com/en/portal/analyse-markets/china/foreign-trade-in-figures#classification_by_country

Song, Y., Hao, X., Hu, Y., & Lu, Z. (2021). The Impact of the COVID-19 Pandemic on China's Manufacturing Sector: A Global Value Chain Perspective. Retrieved from Frontiers: https://www.frontiersin.org/articles/10.3389/fpubh.2021.683821/full

TACNA. (2023). Advantages Of Manufacturing In Mexico vs China. Retrieved from https://tacna.net/manufacturing-in-mexico/difference-vs-china/

Tan, S.-L. (2021). Suez Canal blockage: China to see minor raw material disruptions, but accident further exposes ‘risks’ of global supply chains. Retrieved from South China Morning Post: https://www.scmp.com/economy/china-economy/article/3127506/suez-canal-blockage-china-see-minor-raw-material-disruptions#

Zhu, W. (2023). Chinese companies are moving supply chains out of China to manage risks, with India, Malaysia and Indonesia benefiting. Retrieved from LinkedIn: https://www.linkedin.com/pulse/chinese-companies-moving-supply-chains-out-china-manage-william-zhu/?trackingId=iPs3xIr%2FT1mtWIv8m3xKNA%3D%3D